National

-

The Threat of Fraud Is The Real Fraud

In a recent industry survey conducted by InfoTrack, 40 per cent of real estate agent respondents reported concerns about fraudulent activity when using electronic and digital signature technology. The hyper-vigilance that seems to dissuade agents from digitising contracts doesn’t seem to apply to the same degree of scrutiny to good old-fashioned fraud. The survey indicated that only 2.17 per cent…

Read More » -

Finalists announced for Annual REA Excellence Awards (AREAs)

The AREAs celebrate success and achievements across the real estate and media industries in the categories of Innovation, Service and Marketing and Community and will be held in Melbourne on November 16. For the first time, the competition will include a Gold AREA – Agency of the Year award, which will recognise agencies who work hard to set themselves apart…

Read More » -

New Home Sales Continue to Ease from Record Highs

“July’s result was driven by a 15.7 per cent decline in multi-unit sales and a more measured reduction in detached house sales. The large drop in multi-unit sales this month is in contrast to strong sales volumes late in 2016 and early 2017,” outlined Mr Reardon. The HIA New Home Sales report – a monthly survey of the largest volume…

Read More » -

Coast swells with RE/MAX agents

Eighteen regions now make up RE/MAX Asia Pacific, with delegates also coming from countries such as Canada, United States, United Kingdom, Poland, Argentina, South Africa and Italy. Many arrived early to partake in meetings or the charity golf day at Royal Pines on Tuesday and Wednesday. Indigenous dancers from Australia and New Zealand signal the start of the formal program…

Read More » -

Banks shut the door on new interest-only borrowing

APRA’s June Quarterly ADI Property Exposures data released today shows a 7.0 per cent drop in interest-only terms for new lending from the previous quarter. The drop comes despite a 10.6 per cent rise in new lending in all categories since March 2017. RateCity.com.au Money Editor Sally Tindall said today’s APRA data showed banks had responded to the regulator’s demand…

Read More » -

Corelogic launches new generation Hedonic Index

CoreLogic, has launched its new-generation Hedonic Home Value Index using updated methodologies and processes to provide insights into housing market conditions across the regions of Australia. The upgraded Index, which will continue to be published on the first business day of each month, combines a property’s key attributes, such as land area, number of bedrooms, bathrooms and car spaces, with…

Read More » -

View.com.au partners with Independent Media Publishers

The partnership with Independent Media Publishers (IMP) follows a decision by realestateview.com.au to rebrand as view.com.au and launch Property 360, a property price estimate tool of over 10 million properties offering consumers the ability to track the value of their home and calculate property price estimates. View.com.au says the commercial cross-promotional arrangement with IMP will provide the portal with increased…

Read More » -

Auction volumes at their highest levels in 12 weeks

National auction clearance results for the week ending 27/08/2017 courtesy of CoreLogic Over the corresponding week last year, the clearance rate was 74.5 percent and 2,153 auctions were held. It is expected as more results are collected that the final auction clearance rate will revise lower to remain within the high 60 percent range, where clearance rates have been tracking since early…

Read More » -

How to respond to queries from clients faster and more cost effectively

Launching the new PM Assist service at ARPM 2017, Aimee Engelmann, CEO of outsourcing company Beepo, said one of the key factors of the growing pressure comes back to people and resources, with the allocation of workloads and the growing amount of administration within the sector. “A leading brand recently blind surveyed their offices and found that over 200 of…

Read More » -

Snug.com launches BondCover to free up rental bonds

Rental community platform startup Snug.com is launching its first feature, BondCover, a surety bond designed to transform the rental market by freeing up $4 billion worth of rental bonds. “With 2.5 million renters across Australia, it’s time to recognise good renting,” says Justin Butterworth, Founder of Snug. “The current cash bond system is completely outdated, and the resulting liquidity and…

Read More » -

CoreLogic Property Pulse 24 August: Housing turnover remains low

Housing turnover remains low despite strong selling conditions in Sydney and Melbourne, according to latest CoreLogic data. CoreLogic data confirms over the 12 months to May 2017 only 4.8 per cent of all houses nationally actually sold, highlighting just how little stock sells in a given 12-month period. Across house sales over the past 12 months, Tasmania recorded the highest…

Read More » -

Bouris invests in virtual estate agent Property Now

Mr Bouris and his ASX-listed investment and mortgage broking firm Yellow Brick Road have taken a 5 per cent stake in PropertyNow, joining BRW rich-lister Jeremy Same as shareholders in the privately-held company. PropertyNow founder and director Andrew Blachut said three years of courting Mr Bouris paid off when he bought into PropertyNow earlier in this month. “The business is…

Read More » -

Danielle Mariu of Port Hedland, WA wins Josh Phegan’s Changed Agent Award for 2017

The Josh Phegan team held their annual Blue-print conference in Sydney at the stunning IVY in George Street on Tuesday the 15th and Wednesday the 16th of August 2017. At the event, four incredible finalists from across Australia were invited to share their story of triumphs from humble beginnings in the annual Changed Agent Awards proudly supported by Agent Box.…

Read More » -

InspectSafe: Streamlining the inspection process

InspectSafe is the latest inspection management solution transforming the way residential property inspections are managed across Australia and New Zealand. It is an inspection app that provides essential personal safety features for property managers, whilst delivering peak efficiency and the real-time outcomes which property owners expect from professional management. InspectSafe captures key information from all trust systems and covers all…

Read More » -

realestate.com.au study reveals Australians not so neighbourly

The study surveyed Aussies’ regard, or lack of, for their neighbours. More than 15 per cent admitted they go out of their way to avoid speaking to a neighbour, while one in five revealed they’d previously had a dispute with someone living in their street. realestate.com.au Executive General Manager of Residential, Andrew Rechtman, said the findings showed that for the…

Read More » -

REA Group appoints Val Brown as Executive General Manager – Consumer Experience

REA Group has appointed Val Brown to the role of Executive General Manager of Consumer Experience. She will be part of the company’s Executive Leadership Team, reporting to REA Group Chief Executive Officer, Tracey Fellows. Ms Brown is responsible for driving the Group’s consumer product strategy for realestate.com.au and Flatmates.com.au. With a specific focus on personalisation, her product, design and…

Read More » -

Bankwest housing density report shows NSW only state to see growth in medium density housing approvals

New South Wales was the only state in Australia to experience growth in medium density approvals in the 12 months to March 2017. That is one of the key findings of the Bankwest Housing Density report which analysed approvals in medium density and low density housing over both the long and the short term. The report also found that NSW…

Read More » -

Ex-CEO of LJ Hooker Joins LocalAgentFinder

LocalAgentFinder is a leading comparison platform that enables property owners to compare local real estate agents or property managers for their sale or leasing requirements. The business, led by Matt McCann, the former CEO of iSelect, is continuing to explore its strategic options including an Initial Public Offering (IPO) as part of its growth strategy. Mr Harrod is the current…

Read More » -

R&W Colours Up for Starlight Foundation

They took part under the red banner of Richardson & Wrench, wearing purple and yellow wigs for the Starlight Children’s Foundation. And, at the end of the 5km Color Run fundraiser around Centennial Park, the 120 R&W runners, smeared top to toe in bright paint, had collected more than $10,000 to make the lives of seriously ill children just a…

Read More » -

Whitsunday’s Island for sale

Drop the suitcases, wash away the cares of the world, sink into relaxation and become immersed in a tropical paradise … there’s absolutely nothing more to be done. That’s the message from the owner of Victor Island, in the blissful Whitsundays, who has placed the cherished property on the market for $3.5 million. Paul Sullivan and wife Megan bought the…

Read More » -

Preliminary clearance rate increases to 71.7 percent, while auction volumes remain steady

National auction clearance results for the week ending 20/08/2017 courtesy of CoreLogic Volumes continue to track higher than what was seen over the corresponding July-August period last year. Across the two largest markets, Melbourne’s preliminary clearance rate rose this week (77.7 percent), after last week’s final results saw a weakening in the rate of clearance, falling below 70 percent for the first…

Read More » -

Elders digital strategy drives consumer holiday competiton

Elders Real Estate has announced a national competition to drive customer engagement, brand awareness, and importantly, generate local leads for agents. The competition will run until the end of October and provide potential clients with the opportunity to win a $15,000 holiday experience, through registering and receiving a sales or rental appraisal. Elders Real Estate National Marketing Manager, Belinda Connor…

Read More » -

realestate.com.au unlocks homes of the future

Future Homes, created by Neighbourhood Films for realestate.com.au, showcases the convergence of changes across architecture, technologies, population and socio-cultural trends. From the tiny house movement to the latest in smart homes, realestate.com.au Creative and Video Manager Monique Knoblanche said the video series was an exploration into the progressive change taking place in the way we live in our homes. “We…

Read More » -

Raine & Horne takes community approach with Local Hero campaign

“Our Local Hero campaign is a community-focused promotion that will support those sporting clubs achieving great things in their local communities,” said Angus Raine, Executive Chairman Raine & Horne. “Grassroots sports are the lifeblood of many Australian communities, yet they are often forced to operate on the smell of any oily rag. “We believe they deserve some financial support through…

Read More » -

Real Estate Bookings Launches REBconnect

The Real Estate Bookings platform captures buyer and tenant enquiries from a range of online channels. The platform integrates with Facebook, Instagram, property websites and real estate portals. This data can now be used to directly remarket listings to in-the-market buyers via social media. Combining this with other data sources, such as CoreLogic, Acxiom and Quantium, means every property advertisement…

Read More » -

CoreLogic Property Pulse: housing stock under $400k declines

New research by CoreLogic shows properties in the $400,000 price bracket have declined. The research shows that across Australia, 31.2% of houses and 37.3% of units sold transacted for less than $400,000. By comparison, a year ago the proportions were recorded at 32.8% for houses and 38.6% for units. A decade ago, 62.4% of all house sales and 68.9% of…

Read More » -

Australasia’s best auctioneers vie for ultimate gavel in SA

Australia’s best auctioneers will compete for the title of champion in Adelaide which will host the 2017 Australasian Auctioneering Championships from 6-7 September 2017, hosted by the Real Estate Institute of South Australia. The annual competition showcases Australia and New Zealand’s best auctioneers who are ready to take up the challenge with a frenzy of calling, bidding and selling. “The…

Read More » -

Stockdale & Leggo Wins Gold Stevie Award in 2017 International Business Awards

Stockdale & Leggo was named the winner of a Gold Stevie® Award in the Real Estate category in The 14th Annual International Business Awards. The International Business Awards are the world’s premier business awards program. All individuals and organisations worldwide – public and private, for-profit and non-profit, large and small – are eligible to submit nominations. The 2017 IBAs received entries…

Read More » -

Belle Property Celebrates the Best of 2016-2017 at Annual Awards

Belle Property Dee Why swept the awards evening and were crowned the number one office for gross commission earned and number two for number of transactions. Agent Nick Duchatel was ranked the number one agent (GCI), Lauren Bridges was awarded BDM of the Year (transactions) and agent Jo Morrison received the Excellence Award for most improved over a two-year period.…

Read More » -

REA Group goes live with a design uplift for new homes

REA Group has gone live with a design uplift to the new homes section of their website. With half of property seekers on realestate.com.au considering off-the-plan property, REA’s Joseph Lyons said the section of the site (https://www.realestate.com.au/new-land-estates/) plays a critical role in meeting the needs of consumers across Australia, and also offshore investors. Mr Lyons, REA Group Executive General Manager – Developer…

Read More » -

Fairfax confirms Domain will begin trading in Mid-November

Fairfax Media expects Domain to begin trading in mid-November after it separately lists the real estate classifieds and services business, the AFR reports. Fairfax released details of the spin-off following the release of their full year results, which saw the publisher report a net profit of $84 million. Fairfax also reported a six per cent reduction in operating costs, thanks…

Read More » -

LJ Hooker and Facebook team up in game-changing digital strategy

The announcement forms part of LJ Hooker’s $1 million investment in the Spring launch of its integrated digital and social media platform, LJ Hooker Boost developed by the group’s innovation centre, LJX-Lab. LJ Hooker Boost is a custom-built, automated Facebook and Instagram advertising platform, powered by strategic partner Tiger Pistol, which will amplify the profile of agents, listings and generate…

Read More » -

Recent Slump in Investor Mortgage Demand Slowed in June 2017

In June 2017 there was $33.3 billion worth of housing finance commitments which was 0.8% higher than the previous month and 2.9% higher than June 2016. In June 2017 there was $20.7 billion in housing finance commitments to owner occupiers with a further $12.5 billion to investors. The total value of owner occupier housing finance commitments was 0.3% higher over…

Read More » -

Auction volumes highest they’ve been for 6 weeks with a low 70’s clearance rate.

National auction clearance results for the week ending 13/08/2017 courtesy of CoreLogic This was the largest number of auctions held since the last week of June 2017 and approximately one third higher compared with the same week a year ago. However, as more results are collected it is expected that the final auction clearance rate will be revised lower to remain within…

Read More » -

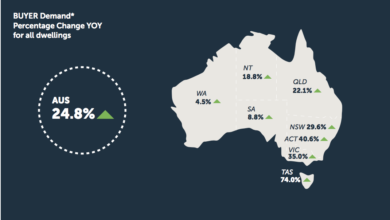

Demand for Australian property hits a new peak, REA Demand Index

According to the REA Property Demand Index, after a choppy few months, demand surged again in July with even the struggling WA market starting to hit its stride. Only one section of the Australian market, NSW apartments, saw a slight drop in demand. Chief Economist Nerida Consibee said, “Given that the state has been seeing decades of housing undersupply, this…

Read More »