Townsville is emerging as the standout among Australia’s regional markets, illustrating a new phase where lifestyle appeal and economic depth combine to drive long-term performance.

According to Ray White Group Senior Data Analyst Atom Go Tian, this blend of affordability, coastal living and diversified employment marks the direction regional Australia is now heading.

Townsville’s median price of $653,000 positions it well below the levels reached in pandemic-fuelled hotspots, yet its growth sits in the top tier nationally.

Mr Tian points to the city’s mix of defence investment, mining services and tropical coastal amenity as a sign of what will define the next decade of regional expansion: places that offer more than lifestyle alone.

This emerging trend follows three clear phases over the past ten years. The first was the satellite-city surge between 2015 and 2019, when buyers priced out of Sydney and Melbourne pushed strong gains in surrounding centres.

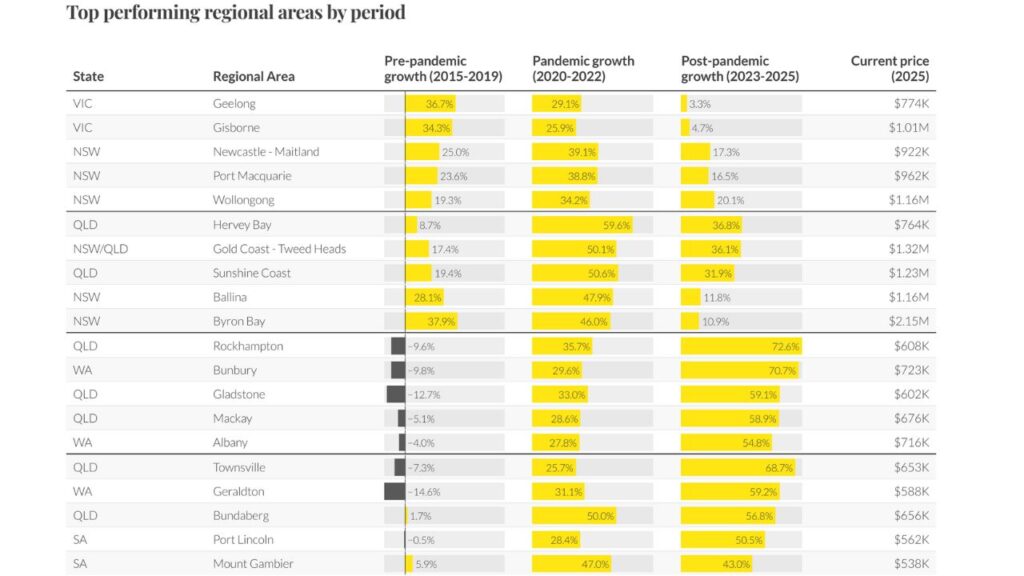

Geelong and Gisborne lifted 37 per cent and 34 per cent, while Newcastle, Port Macquarie and Wollongong rose between 19 and 25 per cent. These areas averaged 27 per cent growth, well above the national figure of 14 per cent.

The second stage arrived during the pandemic, when remote work sent buyers flooding into coastal towns.

Hervey Bay rose 60 per cent, the Sunshine Coast and Gold Coast–Tweed Heads both gained 50 per cent, and Ballina and Byron Bay increased 48 per cent and 46 per cent.

Regional Australia outpaced capital cities during this period, growing 42 per cent compared to 28 per cent.

By 2023, conditions shifted again as commodity-linked regions took the lead. Rockhampton recorded the strongest rise in the country at 73 per cent.

Bunbury followed with 71 per cent, while Mackay and Gladstone both climbed 59 per cent. Townsville posted 69 per cent, supported by mining services and defence activity, while WA’s Albany and Geraldton grew above 55 per cent.

The new phase, now gathering pace, belongs to markets that sit at the intersection of the coastal lifestyle boom and the industrial resurgence.

Alongside Townsville, and Mr Tian highlights Bundaberg ($656,000), Port Lincoln ($562,000), Geraldton ($588,000) and Mount Gambier ($538,000) as examples of sub-$700,000 communities achieving strong results while maintaining robust local economies.

These cities are outperforming lifestyle-only markets that surged early in the pandemic. Byron Bay, now at $2.15 million, has eased to 11 per cent growth, while the Sunshine Coast – at $1.23 million – has slowed to 32 per cent.

By contrast, the emerging convergence group is recording gains between 43 and 69 per cent.

Mr Tian says the pattern is unmistakable.

“The lesson from the last decade is clear: sustainable regional growth requires either extreme affordability, genuine employment drivers or, increasingly, both.”