More than 60 per cent of Australian households are made up of just one or two people, yet the majority of the nation’s housing stock is designed for families, according to new analysis from Cotality.

The research, led by Cotality Australia Head of Research Eliza Owen, highlights a clear imbalance between who lives in Australian homes and the types of homes being built.

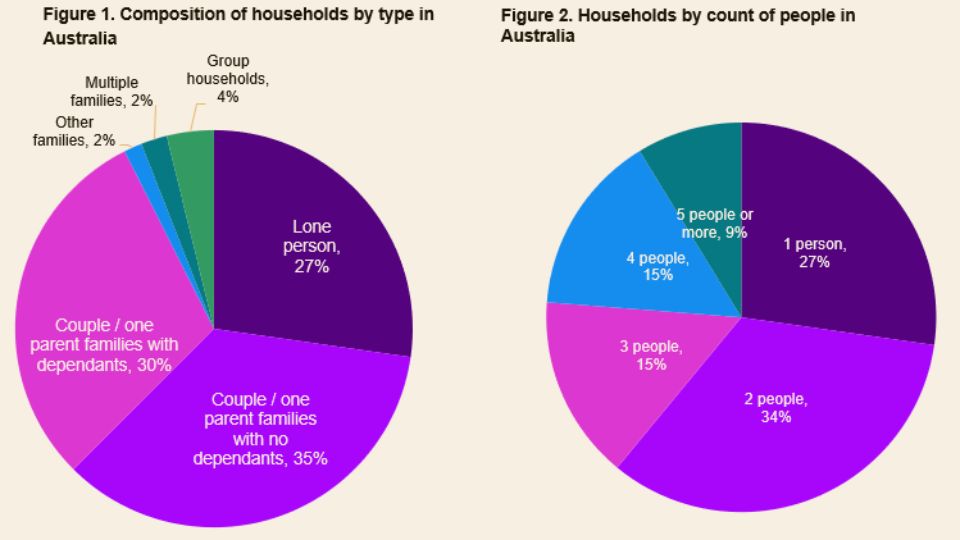

While families remain a vital part of the housing system, only around 30 per cent of households include dependants.

By contrast, 31 per cent are couples without children and 27 per cent are people living alone. Together, this means 61 per cent of households are made up of just one or two people.

Despite this, three-bedroom dwellings dominate the national housing stock, accounting for 42 per cent of homes.

One-bedroom and studio apartments together represent just 6 per cent — far short of demand from the 27 per cent of households who live alone.

The mismatch is visible across all states and territories, with larger housing consistently outweighing smaller dwellings.

Ms Owen notes that demand for bigger homes has been partly fuelled by lifestyle changes, including home offices, space for hobbies, and in-home care.

Many couples without dependants may also hold on to larger homes while planning for children.

New houses have generally grown in size over time, reflecting both changing lifestyle expectations and development on city fringes where residents prefer more in-home amenities.

Market forces are also at play. Cotality data shows four-bedroom dwellings recorded the highest five-year annualised capital growth nationally (8.7 per cent), compared with just 3.7 per cent for 0–1 bedroom dwellings.

Higher returns are encouraging buyers and investors to favour larger houses over smaller stock.

On the policy side, the report suggests that tax reform could help rebalance the market.

Options floated include abolishing stamp duty and replacing it with a broad-based land tax, which would make moving house easier but increase holding costs for larger landowners.

Reforming pension asset tests to include the value of the family home could also incentivise older Australians to downsize.

While politically difficult, these measures could push demand towards smaller, better-located dwellings and help align supply with real household needs.