Crypto is not a dirty word. But, back in 2017 when I first started talking about it, it may as well have been.

It was this black hole that nobody knew too much about and deeply associated with weird money-making schemes and cybercrime.

But back then, speaking to a group of agents and leaders at one of our events, I put it to them that blockchain might instead be the key to creating transparency in what could be a new era of trust.

I’m pretty sure a few people in the room thought I was mad, but the prediction has come to be – there are a number of blockchain applications that have become mainstream.

For example, at Elite Agent, we’ve been using a blockchain-enabled system called Accredible to issue digital CPD certificates – they cannot be tampered with like a PDF and every change made is verifiable on a public ledger.

In 2019, the REIQ introduced blockchain-based digital tenancy agreements.

These days, we’re in the same kind of mindset about Non Fungible Tokens (NFTs) as we were about the blockchain back then.

“It’s crazy that people pay all that money for a jpg or a gif…” I hear you say.

I agree.

But NFTs are not just about selling cat memes, gifs or Gary Vee’s latest doodle, but I’ll get to that in a moment.

How about back in November 2019 when we had an avatar on the cover from eXp World?

I remember back then thinking we were taking a bit of a risk reporting on a virtual brokerage in a virtual world, and once again, people would look at me and think I’d gone a bit bonkers.

But once again, we were just a little bit ahead of our time, because I’ve just been looking at a sneak peek of Ryan Serhant’s Metaverse as I write this, and it actually doesn’t look that different.

And as you’ll read in the Autumn 2022 issue of our magazine, over in Canada GDA Capital is now positioning itself as the first virtual real estate company.

Last week I got an email from Zuckerberg himself (along with his millions of other subscribers) talking about how Meta is planning on leveraging the Metaverse and new ways of using VR from a work perspective.

This conceptually doesn’t surprise me at all, as with a global pandemic, even we couldn’t have predicted the scale of the shift to online collaboration.

And this is logically the next step.

For those of you who happen to be thinking the idea of Web 3.0 won’t impact you or your business, or it’s too far into the future, that’s ok.

Stop reading now and reassure yourself this stuff is a really long way off and won’t impact the real estate industry too much.

Granted, it might not be today or tomorrow, but do any of you guys remember when I told you that story in an editor’s note years ago about how in the ‘90s I sold the crazy concept of email to the managing partner of the accounting firm I was working at?

At that point in time, most of the other partners were pretty comfortable with typed memos being delivered to pigeon holes.

Fast forward to the mid-2000s, social media came onto everyone’s radar.

There were some people that thought it was a fad, and I guess there are some people that still do.

The explosion in social media has been nothing short of remarkable over the past nearly 20 years.

And right now, we’re on the cusp of another big revolution in the digital space.

But this next revolution will be about trust.

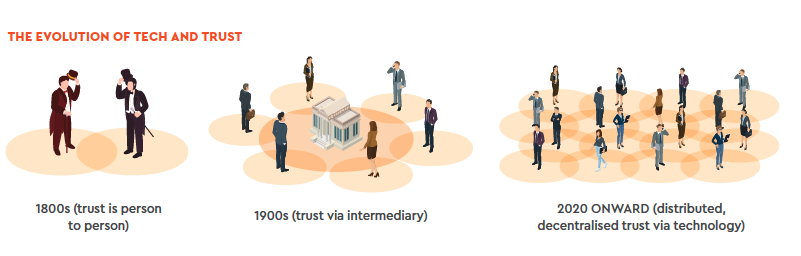

And, before we go forward, let’s rewind to the 1800s – think The Gilded Age, which is streaming on Paramount+ right now.

Trust happened between a tight-knit community – person to person.

“Never the new,” warns Agnes Van Rhijn who comes from old money and does not trust the newfound wealth of the railroad tycoons.

If someone put a well-heeled foot out of place in that society they would get a bad reputation quicker than a dodgy Google review from the competition down the road.

Despite the lack of internet at that time, friendships and reputations took a long time to create but less time to break.

Rachel Botsman, who has done a heck of a lot of thinking on the topic, says the disruption of this 1:1 system came in the mid-nineteenth century with the Industrial Revolution.

The local banker who knew everyone was replaced by growing entities that didn’t really know people as individuals.

Trust was placed into intermediaries of authority; things like legal contracts, governments, approvals, frameworks and insurances.

But how much trust do we really place in those institutions today?

Over the last couple of years, we’ve had a Banking Royal Commission, a Commission into Aged Care, ICAC pursuing a sitting Premier, Facebook cancelling media in the news feed, elections being tampered with and the list goes on.

Mainstream brands are not exempt from being questioned on their trustworthiness either – the Volkswagen scandal of 2015 immediately comes to mind.

Is institutional trust really a solution in this digital age?

Many folks believe this century will be defined by trust being distributed, transparent, inclusive and accountable, versus the closed, centralised, opaque world we live in today.

This means that thing called the blockchain is heading towards having a very big moment.

The Economist, back in 2015, described the blockchain as “the great chain of being sure about things,” because it allowed people who didn’t know or trust each other to build a dependable ledger.

In much the same way the internet blew open the doors to everyone in the information age, many folks say the blockchain will revolutionise the idea of trust on a global scale.

Harvard Business Review got quite excited about the blockchain in 2017 and wrote, “With blockchain, we can imagine a world in which contracts are embedded in digital code and stored in transparent, shared databases, where they are protected from deletion, tampering, and revision”.

“In this world, every agreement, every process, every task, and every payment would have a digital record and signature that could be identified, validated, stored, and shared.

“Intermediaries like lawyers, brokers, and bankers might no longer be necessary.

“Individuals, organisations, machines, and algorithms would freely transact and interact with one another with little friction.”

This is one of the reasons that Web 3.0 could be the beginning of the end of the intermediary as trust becomes decentralised through technology.

How does this affect real estate? Well, my own thinking hasn’t changed too much since an article I wrote back in 2017 on the topic.

Consumers deal with a lot of intermediaries throughout the house purchasing process, mostly due to hard to access information sources and an inability to record their own documentation.

The blockchain can securely store and verify data such as the current legal owners of a property, the deed information and the repair history of the home (property managers, how cool would that be?).

Neither consumers nor agents would need to visit multiple physical offices to get all the information necessary to complete the home purchase process.

Would anyone miss the additional outgoings such as title-related costs, insurance, and legal fees, building inspection documentation and more that would all be publicly available?

Probably not, is my guess.

Plus, the transaction would take days (or less) to settle, not months.

Deposits could be easily transacted any time of the day or night.

Proof of funds, whether they be crypto or not, could happen in an instant.

And yes, there are people working on this stuff now.

Lantmäteriet – the land titles office of Sweden has been testing the technology for a couple of years now and are expecting a huge reduction in fraud as well as forecast savings and efficiencies into the millions of dollars.

At the same time, the US, India and China are all working on smart contracts for similar purposes.

What about property management?

Well, this is where things get super interesting.

We’re already seeing evidence our old friend “Trust Accounting” doesn’t appear to be ageing well when stacked up against Web 3.0 thinking.

If rental payments occurred via some kind of blockchain application we are no longer a payment intermediary; because remember blockchain is not related to a bank or a centralised government or institution, it’s a trusted system in and of itself.

This changes all of our jobs once and for all from being rent collectors to being trusted advisors and asset managers (which has been happening for some time now anyway).

And let’s not forget that centralised repair history of the home would probably be pretty handy for a PM, for an owner, for a tenant, for a tradie…. The list goes on.

A non-fungible what-now?

You probably have all heard the phrase NFT by now which stands for Non-Fungible Token, and it’s a key building block of Web 3.0.

Could you sell a house as an NFT?

Yes, in the future, if the house can be tokenised, I believe you could.

Could you sell part of a house as an NFT?

Probably, it’s a big yes to that too.

Let’s say an artist created a feature wall or a mural, or a specific type of fireplace or light fixture which was unique

to the house.

Every time that house gets sold, the owner of that piece of art (if it were tokenised) might continue to get some form of royalty for that work on every re-sale.

Because, part of the idea of NFTs is to enable individuals (creators) to be properly compensated for their time, data or creations.

If we think about how the next 10 years might play out in the world of ERC-721 which describes how to build Non- Fungible Tokens on ERC-20 (the standard for smart contracts on Ethereum) we are definitely at the beginning of a new era that focuses on the collectables/art/gaming space.

But it may not be too long before we see brands building communities that benefit everyone in a similar way.

Even Martha Stewart has started dropping NFTs, which at the moment are just images, and of course, the value of those images is in both scarcity and the eye of the beholder.

But what if those images came with some type of access, where if you held enough of them in your digital wallet you’d also get 1:1 time with Martha Stewart in person to jam about home decor?

What if having one of Gary Vee’s NFTs in your crypto wallet gave you 1:1 access to Gary Vee?

This exciting time provides us with the potential to change the way we learn, attend conferences, get coached, socialise and work while jointly benefitting from the content and communities we create.

If you’ve gotten this far, congratulations – some of this stuff really is technical and hard. In closing I’d like to leave you with a few thoughts from George Mack (@george__mack on Twitter):

- If it’s a talking point on Reddit, you’re probably early. If it’s a talking point on LinkedIn, you’re probably late.

- If you’re mocked for doing something, it doesn’t mean it’s the future. But if nobody mocks you, it’s not the future.

- Don’t rely on algorithms. Have specific places you visit manually. If they’re predicting unpopular future topics, it’s unlikely the algorithm will be rewarding them.

So don’t forget to do your own research and watch this space!