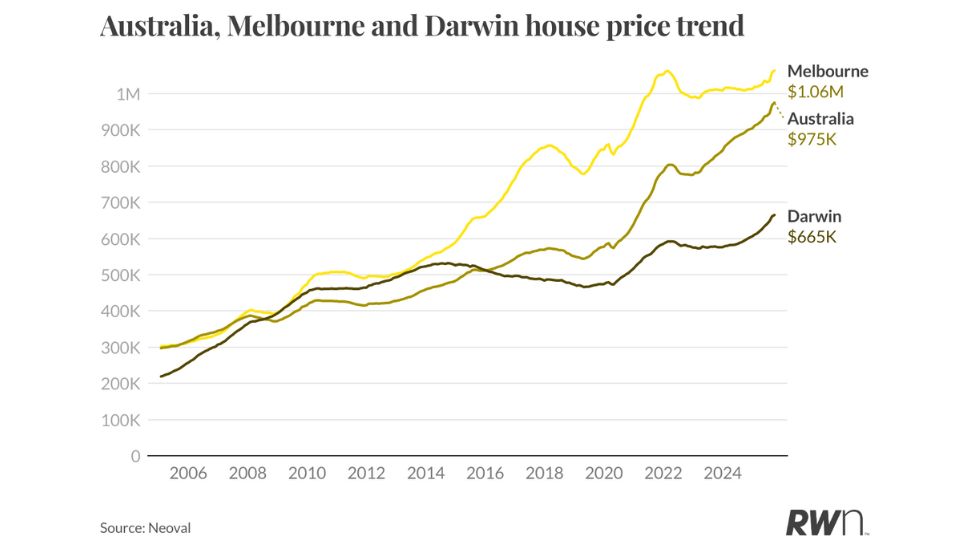

Melbourne house prices have climbed to a record high, while Darwin has emerged as one of Australia’s fastest-growing capital city markets, according to new Ray White data.

Both cities, late to join the recent housing upswing, are now firmly in recovery mode, with sellers responding to improving conditions by bringing more stock to market.

In Melbourne, house prices rose 3.1 per cent over the past three months and 5.3 per cent over the year, the strongest pace in more than two years.

The city’s median price has now edged just above its previous 2021–22 peak, marking a clear return to growth after a subdued 2023.

Darwin’s rebound has been even stronger, with prices up 3.9 per cent over the quarter and 11.1 per cent over the year.

The Northern Territory capital now sits alongside Perth, Adelaide and Brisbane among the country’s best-performing markets.

Tight supply and high rental yields are driving investor demand, with suburbs such as Moulden, Gray, Bakewell and Woodroffe recording annual growth of between 13 and 16 per cent.

In Melbourne, the best-performing areas include Wantirna, Chelsea Heights, Croydon Hills–Warranwood, Rowville and Dingley Village, all posting annual gains of around 7 per cent.

These established, family-oriented suburbs are benefiting from improving affordability and renewed buyer confidence as borrowing conditions ease.

Melbourne’s median house price now sits around $1.06 million, while Darwin’s stands at $665,000; still below its 2014 peak but rapidly regaining lost ground.

The narrowing gap between the two highlights how the national recovery is spreading to previously slower markets.

Listings data also show confidence returning, with Darwin up 62.6 per cent month-on-month and 16.8 per cent year-on-year, and Melbourne up 4.2 per cent over the month.

Rising supply alongside firmer prices suggests vendors are responding to demand rather than retreating from it.

Conditions are expected to remain supportive through the final quarter of the year.

A possible November rate cut would further strengthen sentiment and borrowing capacity, while continued population growth and limited new construction are likely to sustain upward pressure on prices.