While the Reserve Bank of Australia is widely expected to keep the cash rate on hold today, tomorrow marks a major shift for aspiring homeowners. The expanded First Home Guarantee (FHG) comes into effect, and fresh analysis from Domain reveals just how dramatically it could speed up the journey to a first home.

Domain’s research shows the program — which allows eligible buyers to purchase with a deposit as low as five per cent without paying Lender’s Mortgage Insurance (LMI) — could cut saving times by years across the country, particularly in markets where rising prices have kept first-home buyers on the sidelines.

“Until now, the biggest hurdle to homeownership has been saving a deposit,” said Domain’s Chief of Research and Economics, Dr Nicola Powell.

“The expanded First Home Guarantee is a real game-changer — helping buyers get into the market years sooner and saving thousands in Lender’s Mortgage Insurance. But it’s not a magic fix. Buyers will still face bigger mortgages and the risks that come with rising interest rates and potential property price drops.

“We also expect a fresh wave of demand, which could ramp up competition and push prices higher in more affordable areas, especially if supply doesn’t keep pace.”

How the numbers stack up

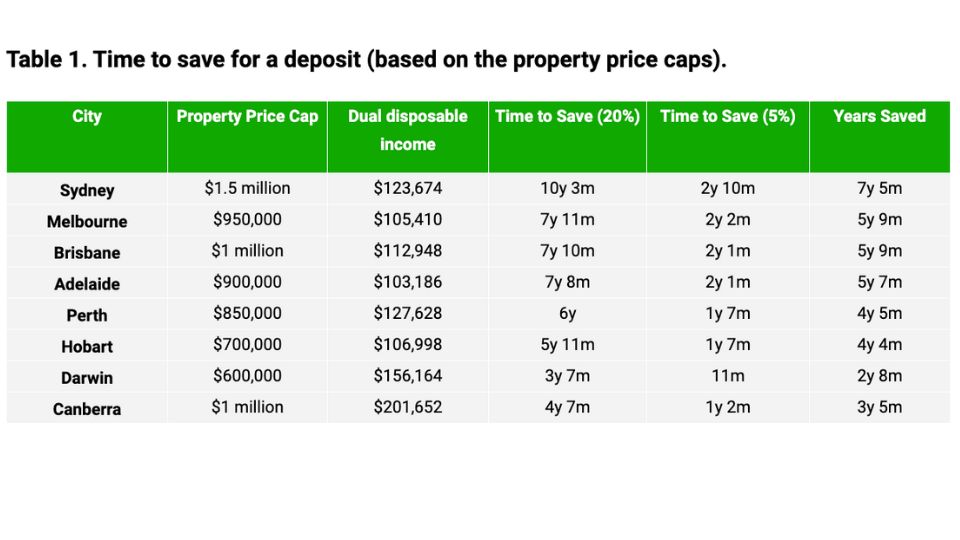

- Sydney: Households that once faced more than a decade to save a 20 per cent deposit will now need less than three years to save just five per cent.

- Melbourne, Brisbane and Adelaide: Saving times are expected to fall to just over two years, cutting more than five years from the typical deposit journey.

- Perth: Couples aiming for a five per cent deposit will see their saving period drop to 19 months, shaving about four and a half years off the wait.

The changes reflect new price caps under the expanded First Home Guarantee, designed to better match today’s housing market.

While the scheme will open doors faster, experts warn buyers to plan carefully; smaller deposits mean larger loans and greater exposure to interest rate movements.

The update is expected to fuel activity among entry-level buyers, especially in more affordable suburbs and regional markets.

But with supply still constrained, the added demand could keep upward pressure on prices.