Housing affordability in Australia has reached its lowest point in decades, with new analysis from Domain showing that the very idea of an “affordable home” is now out of reach for many aspiring buyers.

The study, which examines ownership and affordability trends since the 1990s, found that entry-level homes have risen in price faster than premium properties across most major capitals since 2022.

In Sydney, houses in the 25th price percentile have grown 4.1 percentage points faster than those in the top quartile.

The gap is even wider in Melbourne (6.9 points), Brisbane (13.6), Adelaide (18.7) and Perth (19.8).

The affordability crunch extends beyond prices.

The time required to save for a deposit has stretched to record highs, with the median-income household now taking more than eight years to save a 20 per cent deposit, up from six years in the early 2000s.

Once that hurdle is cleared, repayments are consuming more household income than at any point in the past two decades.

A typical new mortgage now absorbs 54 per cent of disposable income.

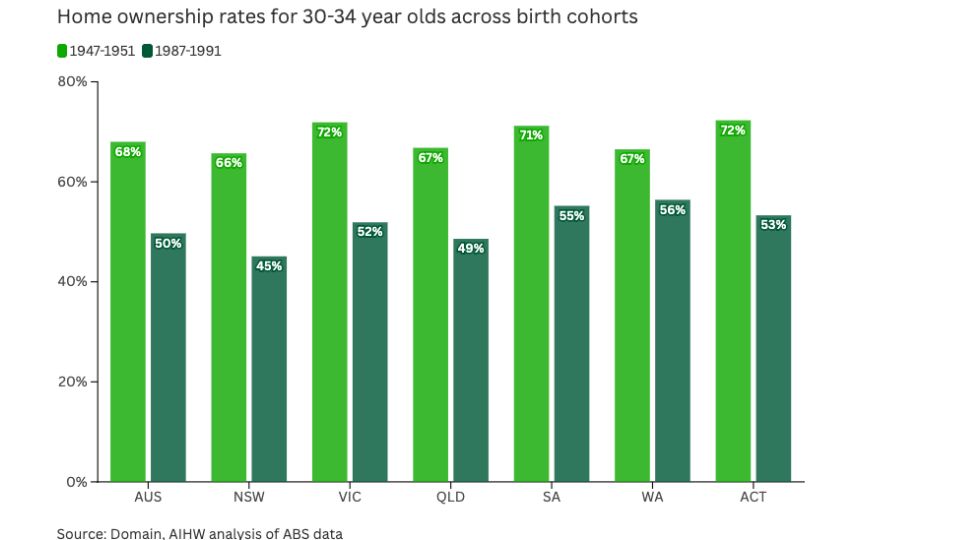

The report shows a widening generational divide.

“Nationally, over 68% of the population born between 1947-51 owned a home by the age of 30-34. Today only 50% of those aged 30-34 own a home. In New South Wales, the difference is even starker at only 45%,” said Dr Nicola Powell, Domain’s Chief of Research and Economics.

Dr Powell said urgent reform is required to address the crisis.

“More needs to be done to tackle this crisis in home ownership. A shift from stamp duty to a land tax should be the immediate first step – this would remove a major barrier for prospective buyers.”

The findings underline how affordability pressures are reshaping the housing market.

With entry-level properties rising more sharply than premium homes, savings timelines stretching longer, and mortgage stress at a 20-year high, younger Australians are carrying a disproportionate burden in the pursuit of home ownership.

View the full analysis here.