Australia’s housing market is forecast to reach new price highs in 2026, though the pace of growth is expected to ease as affordability pressures and stable interest rates begin to weigh more heavily on buyers.

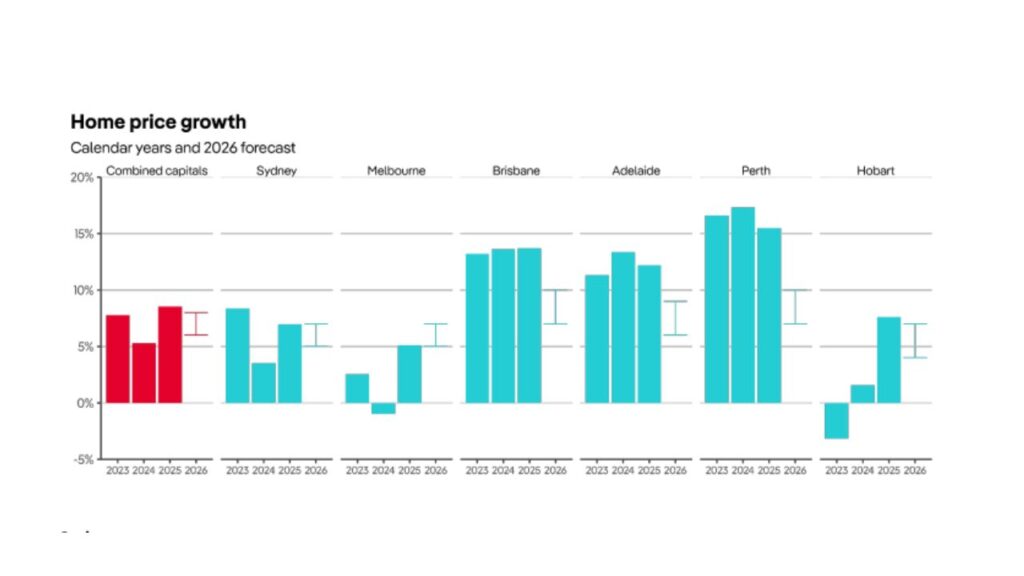

According to the realestate.com.au Property Outlook Report, home prices across the combined capital cities are expected to increase by 6 to 8 per cent in 2026, a slower rate than seen in 2025 and broadly in line with the long-term average of the past three decades.

While price growth is moderating, the report makes clear that the underlying forces supporting the market remain firmly in place.

Housing supply continues to lag population growth, listings remain historically low in many markets, and borrowing capacity has improved following three cash rate cuts in 2025.

At the same time, affordability constraints are becoming harder to ignore.

REA Group economists Angus Moore, Eleanor Creagh and Anne Flaherty noted that stretched household budgets, an extended pause in interest rates and high deposit hurdles are likely to temper buyer demand through 2026, preventing any return to the rapid price gains seen in previous boom cycles.

Demand is expected to be supported by population growth, rising incomes and investor activity, as well as government initiatives such as the expanded 5 per cent Deposit Scheme and the Help to Buy shared equity scheme, which are designed to assist first-home buyers.

However, with interest rates now expected to remain on hold for an extended period, repayment burdens are likely to limit how far demand can push prices higher.

On the supply side, new housing delivery continues to fall short of demand.

Total listings volumes remain low relative to historical levels, particularly outside Sydney and Melbourne, placing a floor under prices despite slowing momentum.

The report forecasts that Sydney and Melbourne will record more modest gains in 2026, with prices expected to rise by 5 to 7 per cent in each city.

Sydney’s median home value stood at $1.239 million in November 2025, while Melbourne’s was $852,000.

In contrast, Brisbane, Adelaide and Perth are expected to continue outperforming the larger capitals, though the gap is likely to narrow.

Brisbane home prices are forecast to rise by 7 to 10 per cent, Adelaide by 6 to 9 per cent, and Perth by 7 to 10 per cent, reflecting ongoing supply shortages and strong population growth, albeit at a more measured pace than in recent years.

Perth, which recorded annual price growth of 15.5 per cent in November 2025, is expected to remain one of the strongest-performing markets, supported by very tight rental conditions and an undersupply of new housing. However, declining affordability is expected to gradually curb growth.

Melbourne is still recovering from several years of underperformance relative to other capitals.

Higher stock levels following a busy spring selling season are likely to give buyers more choice and keep competition contained, limiting price growth despite improving conditions.

Hobart is expected to experience a year of consolidation rather than a renewed upswing, with prices forecast to grow by 4 to 7 per cent.

The city has yet to recover its 2022 peak, and slower population growth combined with affordability constraints is expected to keep gains steady rather than sharp.

Overall, the report suggests that while price growth in 2026 is set to continue, the market is entering a more restrained phase.

Strong fundamentals remain in place, but affordability is increasingly acting as a ceiling on how far and how fast prices can climb.