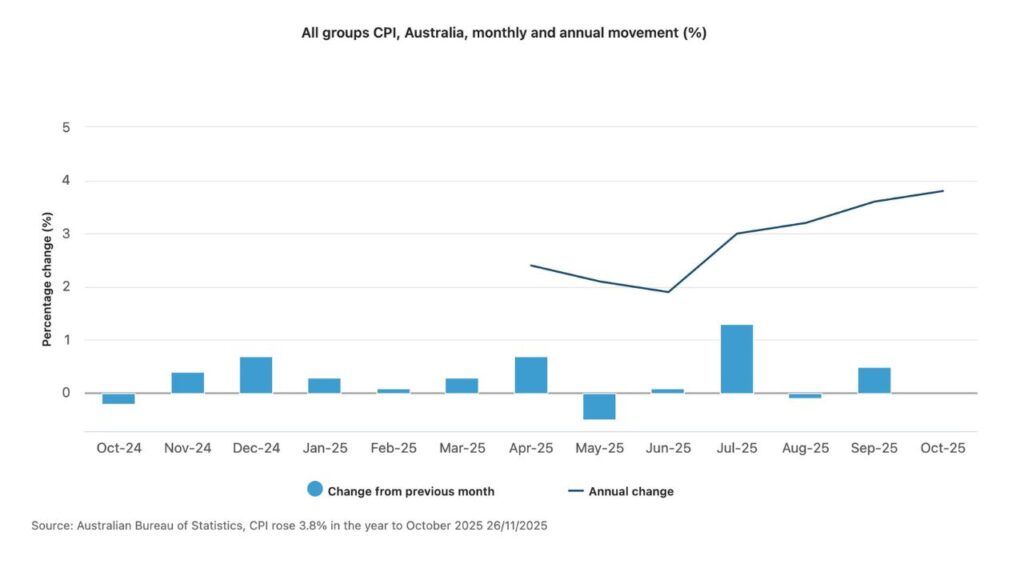

Australia’s inflation rate lifted again in October, with the Consumer Price Index (CPI) rising 3.8 per cent over the year, according to the Australian Bureau of Statistics’ (ABS) first full release of the complete Monthly CPI.

Michelle Marquardt, ABS head of prices statistics, said the move marks a significant shift in how inflation is reported.

“Today’s release marks the transition from the quarterly CPI to the complete Monthly CPI as Australia’s primary measure of headline inflation.

“The time series for the complete Monthly CPI goes back to April 2024, which is when the ABS began collecting prices for a number of Expenditure Classes more frequently,” she said.

The annual rise of 3.8 per cent to October is higher than the 3.6 per cent recorded to September.

Housing remained the biggest contributor at 5.9 per cent, followed by Food and non-alcoholic beverages and Recreation and culture, both up 3.2 per cent.

For property professionals, the most relevant movement was rents, which climbed 4.2 per cent over the year, continuing a trend of tight rental conditions in many markets.

New dwellings and electricity charges also added to housing inflation.

When smoothed for volatility, underlying inflation also edged higher.

“Trimmed mean inflation for the complete Monthly CPI was 3.3 per cent in the 12 months to October 2025, up from 3.2 per cent in the 12 months to September 2025,” Marquardt said.

Goods inflation rose 3.8 per cent, with electricity the standout at 37.1 per cent.

The ABS said this sharp rise reflects the end of State Government electricity rebates over the year, along with the timing of the Commonwealth’s Energy Bill Relief Fund payments.

Excluding these rebates, electricity prices rose 5.0 per cent due to annual retail price reviews in July.

Services inflation rose to 3.9 per cent, driven by rents, medical and hospital services (+5.1 per cent), and domestic holiday travel and accommodation (+7.1 per cent).

Food and non-alcoholic beverage costs remained steady at 3.2 per cent annually.

Meat and seafood rose 3.8 per cent, with beef and lamb both more than 10 per cent higher due to overseas demand.

Fruit and vegetables accelerated to 1.8 per cent annually, partly due to higher prices for strawberries, raspberries and apples in October.

Travel costs also moved higher. Holiday travel and accommodation increased 3.0 per cent over the year.

Ms Marquardt said domestic travel in particular saw a larger seasonal rise: “The monthly increase in Domestic travel of 5.9 per cent in October 2025 was higher than the 3.4 per cent rise in October 2024. The higher monthly increase this year was due to school holidays occurring in all states and territories in October along with major sporting events leading to higher demand for domestic travel.”

Domain’s Senior Economist, Dr Joel Bowman, said the latest inflation read adds pressure to the interest rate outlook.

“The latest CPI result has come in a touch higher than the market expected, driven mainly by rising housing costs as government electricity rebates rolled off.

“With inflation drifting up again over recent months, today’s figures make a December interest rate cut even less likely. That’s disappointing news for many mortgage holders heading into Christmas. On the other hand, holding rates steady will help cool some of the price momentum we’ve seen this year – welcome news for people trying to get into the market.

“We’re also seeing these cost pressures flow through to the price of building new homes, which has been rising since August. If this continues, it could slow the construction of new housing supply Australia urgently needs.

“Investor activity is another major driver of the current housing market lift. Persistently high inflation may strengthen conversations across the industry about potential macro-measures to rein this in; a move that would be welcomed by first-home buyers who are competing with investors in an already challenging market.”

Further, Oliver Hume Chief Economist, Matt Bell, believes 2026 is still going to be a good one for property.

“On the plus side, we do have continued strong underlying demand, rising consumer sentiment, households are in better and better shape, and we are still in the middle of a generational undersupply in new housing. These are all positive for further increases in property market activity and price.”

Details about the complete Monthly CPI are available here.