Queensland’s housing shortage is continuing to push prices higher, with new figures from the Real Estate Institute of Queensland revealing that values rose across the board through the September 2025 quarter.

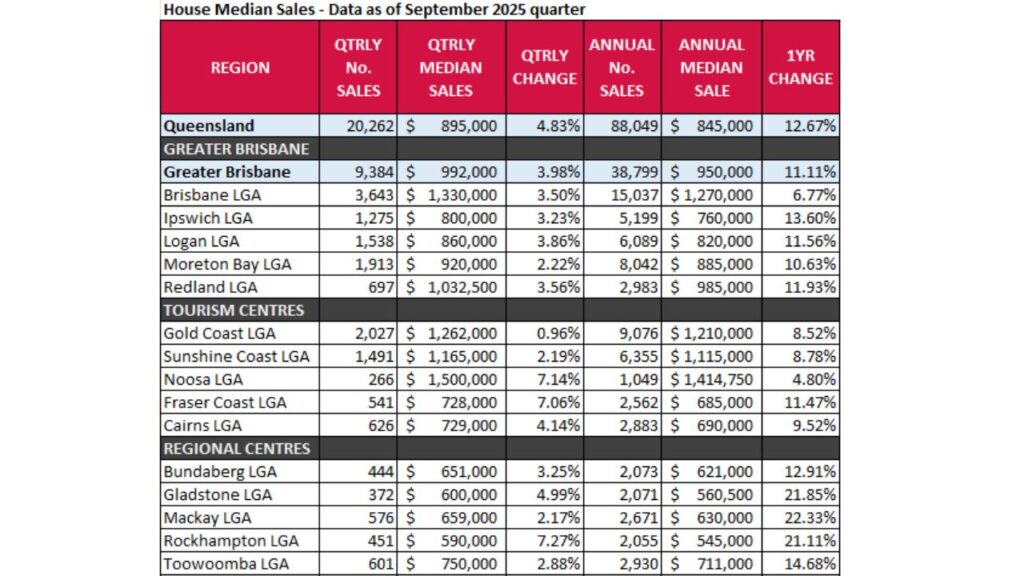

The latest median sales data, covering July to September, shows that the statewide median house price lifted 4.83 per cent over the quarter to $895,000.

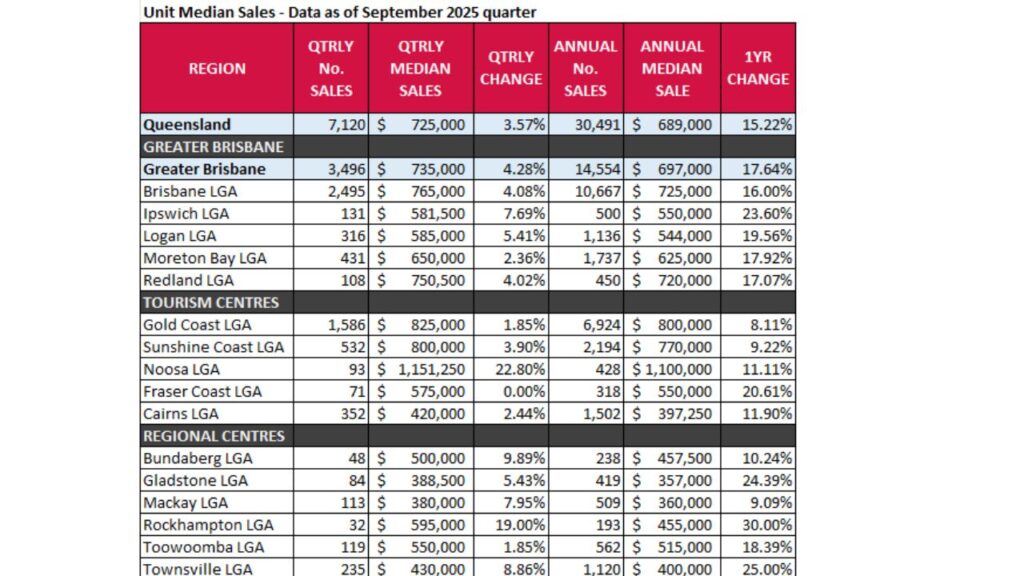

Prices are now 12.67 per cent higher than they were a year ago. Units also strengthened, with the median rising 3.57 per cent to $725,000 and annual growth reaching 15.22 per cent.

REIQ CEO Antonia Mercorella said the quarterly results point to the ongoing cost of Queensland’s thin housing pipeline.

“Across every corner of the state, prices are climbing in a concerning but classic supply story – when demand outstrips new housing delivery, prices inevitably move higher,” she said.

She noted that the pace of growth is particularly strong outside the south-east.

“The data shows that regional Queensland is driving some of the most dramatic price movements, while Greater Brisbane and its surrounding LGAs remain solid but less explosive.

“The particularly strong regional gains highlight that both investors and owner-occupiers are looking beyond the southeast corner for relative value and growth.”

Investor activity accelerates

The ABS’s latest lending figures show investors are becoming more active across Australia, with Queensland a major contributor.

Investor loans in the state rose 11.9 per cent over the quarter, and investors now make up around two in five new home loans.

Ms Mercorella said this trend needs to be viewed in the context of Queensland’s reliance on private investors to supply rental stock.

“In a state like Queensland that relies heavily on investors to provide rental properties, it’s important to remember that investor participation is essential to achieve a healthy rental market,” she said.

But if supply fails to keep pace, she warned that competition between buyers would remain intense.

“However, unless we see overall housing supply levels improve alongside returning investor confidence, it can lead to the inevitable clash between investors and prospective owner-occupiers – and that is why the real solution must lie in expanding supply.”

First home buyers look to new support

The Federal Government’s expanded First Home Guarantee began on 1 October, just after the end of the reporting period.

Ms Mercorella said the scheme may help shift the balance slightly, even though first home buyer loans slipped marginally during the quarter.

While some commentators have argued for introducing restrictions on investor lending, she said such steps may backfire.

“The focus should be squarely on unlocking more homes – not constricting one segment of the market. We need a balanced approach that supports both rental supply and pathways to ownership.”

She said the quarterly data underlines the need for sustained commitments from all levels of government.

“Queensland’s housing market remains remarkably resilient and fiercely competitive, but price growth without sufficient new supply only deepens affordability challenges,” she said.

“If we want a future where home ownership remains attainable, governments must stay firmly committed to driving new housing delivery and supporting first home buyers.”

House market: strong gains at both ends of the price range

The list of million-dollar-plus markets grew again this quarter, with the Redlands reaching a $1.03 million median.

Noosa climbed to $1.5 million, joining Brisbane ($1.33 million), the Gold Coast ($1.26 million) and the Sunshine Coast ($1.16 million).

Some of the strongest quarterly increases came from markets at opposite ends of the price spectrum.

Rockhampton rose 7.27 per cent to $590,000, while Noosa lifted 7.14 per cent to $1.5 million. Fraser Coast recorded 7.06 per cent growth.

Across the year, regional markets held their lead. Townsville was up 23.3 per cent, with Mackay at 22.33 per cent, Gladstone at 21.85 per cent and Rockhampton at 21.11 per cent.

Toowoomba (14.68 per cent) and Bundaberg (12.91 per cent) also posted strong yearly rises.

In Greater Brisbane, annual increases were led by Ipswich (13.6 per cent), Redland (11.93 per cent), Logan (11.56 per cent) and Moreton Bay (10.63 per cent).

Brisbane LGA posted a 6.77 per cent yearly rise, compared with 11.11 per cent for the broader metro area.

Unit market: demand intensifies, especially in regional cities

Units continued to draw buyers seeking relative affordability.

Noosa recorded a 22.8 per cent quarterly jump, taking the median to $1.15 million after dropping the same amount the previous quarter.

Rockhampton rose 19 per cent, though from a small sample of 32 sales.

Bundaberg (9.89 per cent), Townsville (8.86 per cent) and Mackay (7.95 per cent) all recorded notable quarterly lifts.

Fraser Coast recorded no movement for the quarter. Toowoomba (1.85 per cent) and the Gold Coast (1.85 per cent) saw smaller increases.

On an annual basis, Rockhampton led the state with a 30 per cent rise, followed by Townsville (25 per cent), Gladstone (24.39 per cent), Ipswich (23.6 per cent) and Fraser Coast (20.61 per cent).

Ipswich and Logan (19.56 per cent) remain among the strongest-performing non-regional markets.

Coastal markets continue to command a premium, with Noosa, the Gold Coast and the Sunshine Coast all sitting above Brisbane’s annual median.

Six unit markets are still below the $500,000 mark annually: Gladstone ($357,000), Mackay ($360,000), Cairns ($397,000), Townsville ($400,000), Rockhampton ($455,000) and Bundaberg ($457,000).

Days on market: sales remain swift

Buyers continue to move quickly. Houses across Queensland recorded a statewide median of 22 days on market, only one day more than a year ago.

Brisbane LGA and Greater Brisbane are at 22 and 21 days respectively. Rockhampton and Mackay remain among the fastest movers at 13 days. Noosa recorded the longest selling time at 49 days.

Units recorded a statewide median of 21 days, four days higher than last year. Brisbane and Greater Brisbane units sold in 17 days.

Rockhampton (13.5 days) and Toowoomba (13 days) were the fastest regional markets, while Noosa sat at 50 days. Townsville showed one of the sharpest improvements, down ten days to 18.