Australia’s housing market is set for another year of solid growth, with property values expected to reach new records across every capital city by the end of 2026, according to new forecasts from Domain.

The research indicates that the next stage of the cycle will be shaped by easing interest rates, improved household earnings and a strong rise in activity from first-home buyers using the expanded First Home Guarantee Scheme.

Domain expects the lift in demand to be concentrated early in the year, with momentum moderating later in 2026 as long-delayed new supply begins to enter the market.

Record prices across the capitals

Sydney is tipped to record a 7 per cent rise in house prices, taking the median to about 1.92 million dollars and placing the 2 million dollar mark within sight.

Melbourne is expected to regain ground, with an estimated rise of roughly 87,000 dollars, lifting the median house price to 1.17 million dollars.

Canberra is forecast to move back towards its previous peaks, heading for about 1.18 million dollars.

Brisbane, Adelaide and Perth are predicted to see more moderate house price rises of around 4 to 5 per cent.

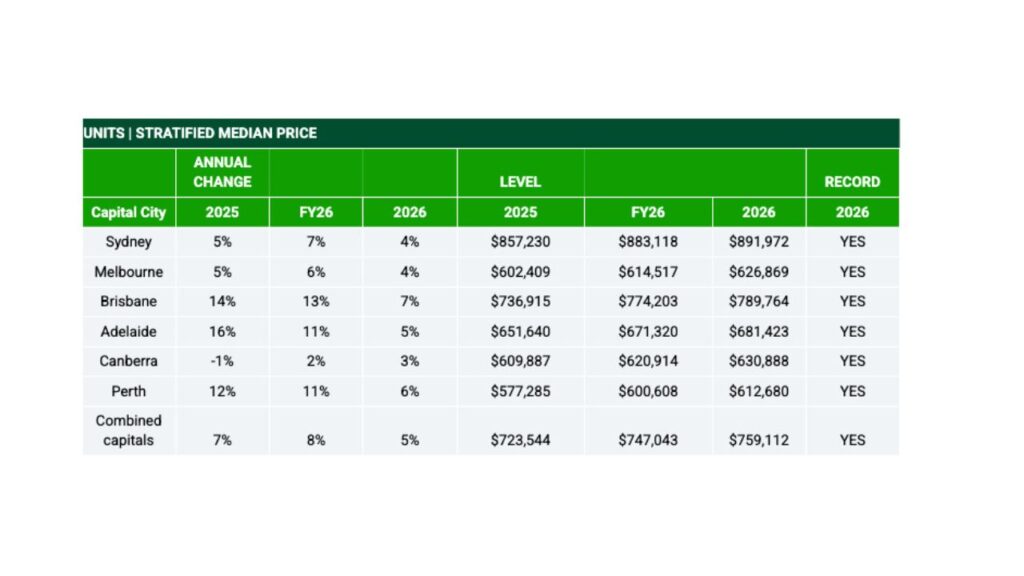

Units in these cities are projected to outpace houses as buyers look for more attainable options.

A wave of first-home buyers

The extension of the First Home Guarantee Scheme is shaping as one of the most influential forces in the year ahead.

Domain’s modelling suggests it may lift prices by as much as 6.6 per cent in its first year, as new entrants compete directly with investors in affordable segments.

The increase in activity is expected to mimic the effect of several interest rate cuts at once, adding pressure to prices through the early part of the year before settling as supply improves.

What it means for different buyers

Investors are likely to see the strongest conditions in the first half of the year, supported by firm rental yields and early capital gains.

Once new stock begins to arrive and buyer activity spreads out, the pace of growth is expected to soften.

Upgraders and downsizers will face different conditions.

Upgraders in Sydney and Melbourne may find competition more intense, while downsizers are set to benefit from higher sale prices and a broader selection of suitable homes, particularly in the unit sector.

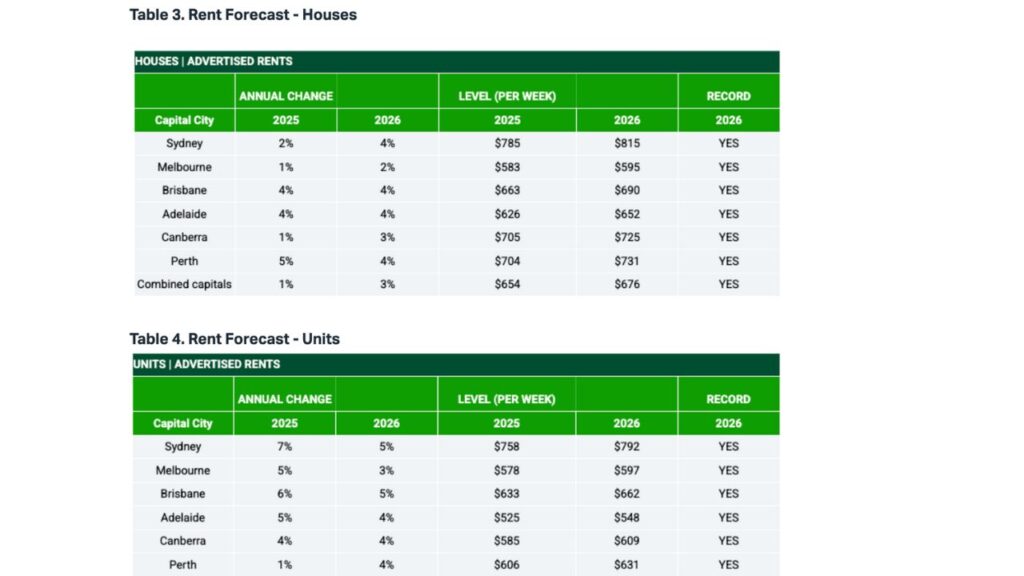

Renters are likely to see further increases.

After a short pause, rents are forecast to rise by about 3 per cent across the combined capitals, and up to 4 per cent in Brisbane, Adelaide and Perth, reflecting ongoing pressure on available homes.

Domain’s Chief of Research and Economics, Dr Nicola Powell, said buyers are continuing to search for relative affordability as the market progresses.

“Australia’s housing market is set for another strong year, with demand still high and buyers continuing to chase affordability, particularly in the unit market, which is expected to outperform in several cities,” she said.

“There are encouraging signs on the horizon, with new housing supply starting to come to market as building activity picks up. While prices and rents will remain elevated, slower population growth, rising incomes and a cautious RBA should help the market move toward more balanced conditions by the end of 2026.”

1Lateral Economics (2025), Home Guarantee Scheme Expansion: Implications for First Home Buyers and Lenders Mortgage Insurance, A Lateral Economics report for the Insurance Council of Australia, July. https://insurancecouncil.com.au/wp-content/uploads/2025/08/HGS-and-LMI-report-Lateral-Economics-final.pdf