The time taken to save a deposit to purchase an entry-level first home has dropped by as much as 13 months according to new figures from Domain.

In what is somewhat of a step back in time, the annual First Home Buyer Report shows the time it takes a couple to save a 20 per cent deposit for an entry-level home has dropped in each capital city, except for Adelaide.

First home buyers in Perth will save the deposit for an entry-level house one month faster than a year ago, while in Sydney and Canberra the time needed is 13 months lower.

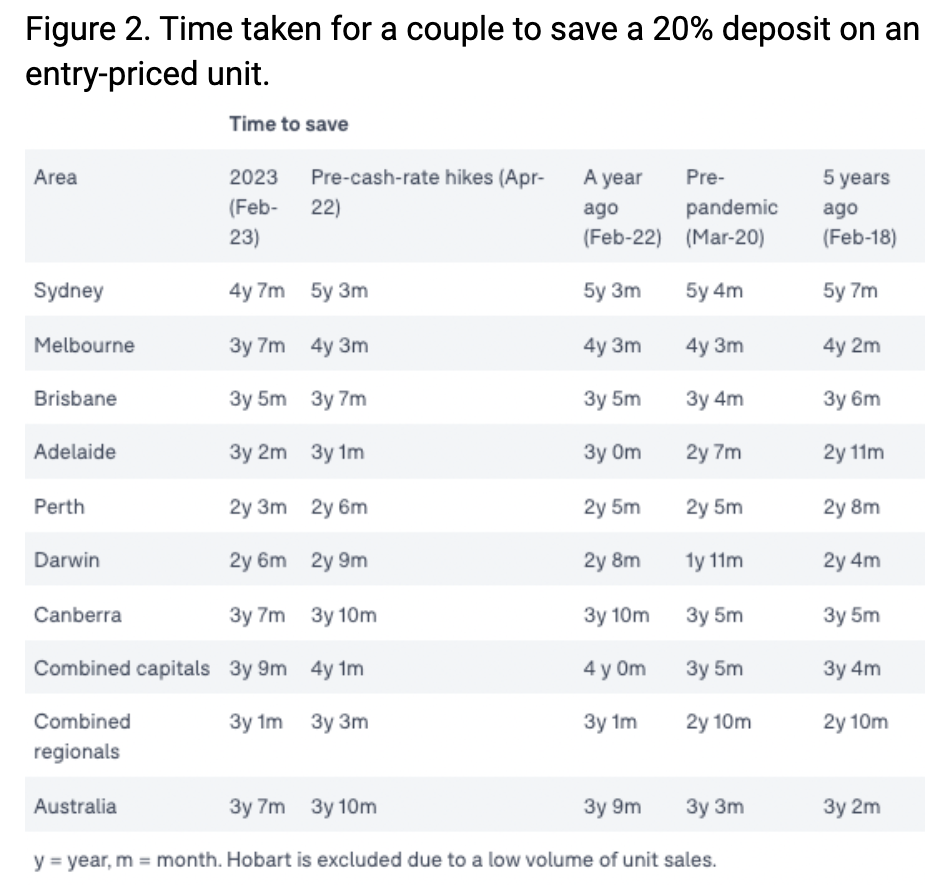

The time it takes to save for a unit is two months shorter in Perth and Darwin, and eight months fewer in Sydney and Melbourne.

“A time machine has been offered to first-home buyers across Australia, as falling property prices in certain cities, higher interest rates accrued on savings and wage growth have aligned to reduce the time to save for an entry-priced property deposit,” Domain Chief of Research and Economics Dr Nicola Powell said.

“Nationally, for a couple, it’s now become six months quicker for a first-home buyer to purchase an entry-priced house and two months quicker for an entry-priced unit since this time last year.”

Dr Powell said interest rate rises had helped flip the script on the time it takes to save a deposit.

“Previously, rock-bottom interest rates greatly benefited mortgage holders, making it cheaper to borrow and repay a home loan,” she said.

“However, it was a key driver of property price growth, making time to save a deposit longer.

“This narrative has flipped since the Reserve Bank of Australia embarked on one of the most aggressive rate hiking cycles in history, escalating the cash rate to over a decade high.

“Now in 2023, first-home buyers are facing less competition and softer prices, reshaping the affordability conversation.”

First-home buyers in Sydney still take the longest to save for an entry-prices house at six years and eight months.

To save a deposit for a unit it takes four years and seven months.

Darwin is the best city for first-home buyers looking for an entry-priced house, with the fastest savings time at three years and six months.

Darwin also saw the quickest time to save five years ago, providing a more stable environment to both save a deposit and keep up with the property market at the same time.

When it comes to saving for a unit, first-home buyers should look at Perth, where the time to save a deposit is just two years and three months.

Adelaide is the only capital to experience an increase in deposit saving time. It now takes an extra month to save a deposit for a house and two extra months for a unit.

The type of property first-home buyers select directly impacts how quickly they can enter the property market.

Across the combined capitals, purchasing an entry-priced unit could result in buying your first property one year and six months earlier than saving for an entry-priced house.

This is lower in regional Australia, taking an additional nine months.

The location first-home buyers choose can also directly affect the time it takes to purchase a home, with suburbs further away from the city usually more affordable.

In Sydney, the area with the shortest time to save for a deposit is Mount Druitt at five years and six months, while in Melbourne it’s Melton-Baccus Marsh at four years and seven months.

“It helps if a first-home buyer is flexible on the type of property and location they want,” Dr Powell said.

“A neighbouring suburb or a unit in your ideal area might offer much better value.

“The decentralisation of our workforce has supercharged affordability for some with remote working bringing increased flexibility and greater housing choice.

“In saying this, we know that not everyone is able to do this, with lower-income workers often needing to be close to their workplace as they are unable to work from home.”

But property prices aren’t the only way to consider housing affordability; mortgage serviceability is another aspect, as most first-home buyers take out a mortgage to buy a home.

The recommendation is that home owners dedicate less than 30 per cent of their income towards mortgage repayments to avoid ‘mortgage stress’.

Across the capital cities, the amount of income required to service a mortgage repayment on an entry-priced house has risen from 29.1 per cent in 2018 to 40.7 per cent today.

For units, across the combined capitals, this has increased to 27.3 per cent from 23.3 per cent in 2018.

In regional Australia, for a house, this has jumped to 28.2 per cent from 17.5 per cent in 2018, while for units, it has increased to 22.5 per cent from 15.5 per cent.

Kareene Koh, General Manager and CEO of Domain Home Loans, said rising mortgage rates had negatively impacted the costs associated with a home loan.

“The decline in prices has assisted buyers in shortening the time to save, but higher interest rates have seen the affordability of mortgage repayments deteriorate, adding a new level of complexity,” she said.

“It’s a difficult time for market entrants, but there’s still some good news. We’re seeing interest rates starting to stabilise providing a light at the end of the tunnel for the months to come.

“For first-home buyers, it’s important to be across the numbers and use things like a digital mortgage calculator tool, to work out what strategies might suit your budget best.

“Knowing your budget and familiarising yourself with the kinds of properties that sell below your maximum purchase price will ultimately be the key to determining where you can afford to buy.”