Commercial investor activity on Sydney’s city fringe is tipped to hit record levels before the end of the year.

Knight Frank’s Sydney City Fringe Insight Report 2022 has shown office markets on the CBD outskirts have expanded rapidly in the past 18 months following a sharp pandemic-induced decline.

Gross regional product in the City of Sydney LGA totalled $131.2 billion in 2021, and has more than doubled over the past 20 years.

Office sales in the city fringe rebounded in 2021 to total $747 million, which is almost three times more than the fall in 2020 and 26 per cent higher than the average over the five years to 2019.

Knight Frank Associate Director Marco Mascitelli said suburbs such as Surry Hills, Eveleigh and Pyrmont proved particularly popular with investors.

“The city fringe is now seen as a natural extension to the CBD, but also a market growing organically in its own right with a distinctly different feel,” he said.

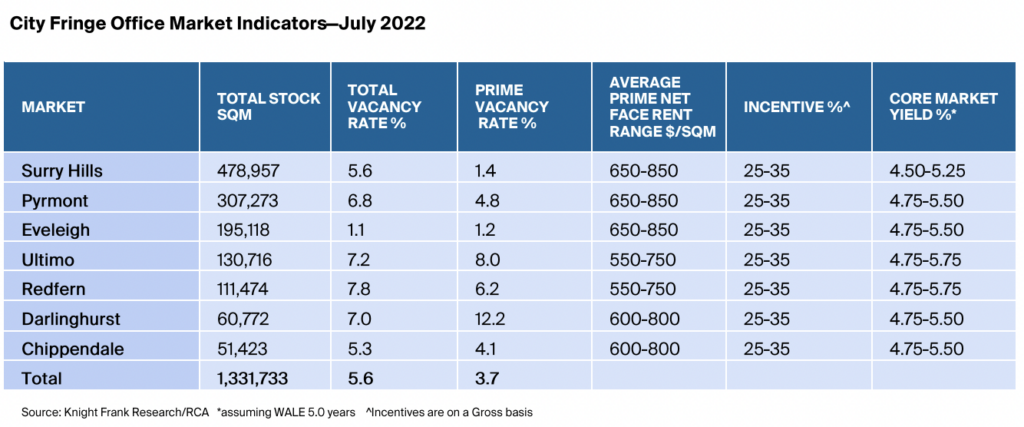

“The sub 2 per cent vacancy for prime space in Surry Hills and Eveleigh evidences the fringe market’s potential to catch up with more established precincts.

“A key finding of this report is the substantial growth of rents in the city fringe, with these rents coming closer to the major Sydney CBD precinct values and already outperforming inner city assets.”

In the past five years net effective rents in Pyrmont and Surry Hills have grown 60 per cent and 40 per cent respectively, compared to a 12 per cent rise in the CBD.

Net rents across the fringe markets range between $600sq m and $800sq m for prime space, while best-in-class assets can ask rents in excess of $1000sq m.

Knight Frank Joint Head of South Sydney Anthony Pirrottina said tech, creative and education industries had driven demand, with tech occupiers accounting for 35 per cent of deal activity each year for the past five years.

A recent example is AfterPay’s pre-commitment to 3700sq m at IP Generations Brewery Central Park development.

In contrast, tech occupiers have accounted for 18 per cent of deal activity in the CBD.

“The COVID-19 pandemic accelerated the trend of de-centralisation of office workspace, driven by staff wanting to work closer to where they live,” he said.

“This trend is particularly evident in locations such as Surry Hills, Redfern, Potts Point and Woolloomooloo, which are inner city areas that provide an opportunity to live, work and enjoy local amenity all within walking distance.

“As a result of this, we have seen office rental rates in the city fringe becoming more comparable to those in the CBD.

“The outperformance of the fringe markets can also be attributed to the growth of the technology sector, triggering increased demand for less traditional and more trendy office environments.”

Mr Pirrottina said the Central precinct, some 24ha bound by Pitt St, Cleveland St, Eddy Ave and Elizabeth St, would benefit from large-scale urban regeneration over the next decade.

“Tech businesses are drawn to these city fringe suburbs for the vibrant amenity, ability to help shape brand identity and appeal to potential new hires,” he said.

Demand for high-quality, prime office accommodation was tipped to hit record levels by the end of the year, with a number of major assets currently on the market gaining strong interest.

Prime grade space accounts for under 30 per cent of total fringe stock, compared to more than 60 per cent in the CBD.

Surry Hills is the largest fringe market, but has a prime composition of just 12 per cent.

“Looking ahead, despite the strong demand for prime stock and new development stock, the development pipeline in the fringe remains limited with only boutique size projects expected to be delivered in the coming years,” Mr Mascitelli said.

“This presents an opportunity for potential developers to enter the market given the limited competition for new space.”