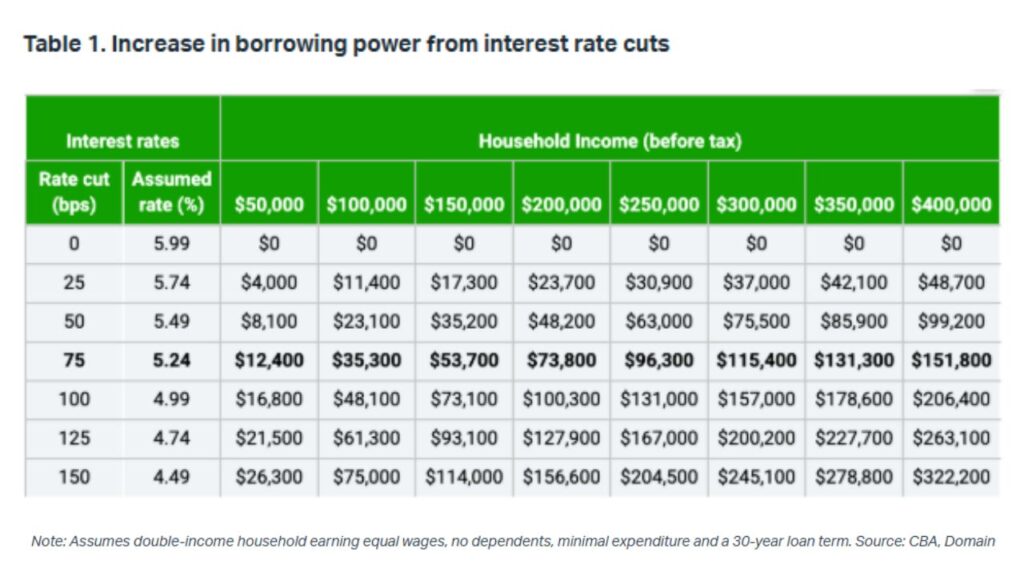

According to Domain Group’s latest analysis, a 25 basis point cut to 3.6 per cent at the August meeting would significantly increase borrowing power across all income brackets, from $4,000 for those earning $50,000 annually to nearly $49,000 for double-income households on $400,000.

Domain’s Chief of Research and Economics, Dr Nicola Powell, said the anticipated rate cut will have immediate benefits for current and prospective homeowners.

“A cut will hand would-be home buyers a boost in borrowing power, while easing the pressure for current homeowners,” Dr Powell said.

However, the increased borrowing capacity comes with a warning about the potential impact on an already tight housing market.

With more buyers able to borrow larger amounts while housing supply remains constrained, experts predict further price growth.

Domain’s forecasts suggest house prices could rise by 6 per cent and unit prices by 5 per cent by mid-2026, adding to affordability challenges despite the relief from lower interest rates.

The impact of rate cuts varies significantly across income brackets.

Domain’s modelling shows that if the RBA implements a total of 75 basis points in cuts from current levels, high-income households could see their borrowing capacity increase by more than $150,000.

For average income earners, even the expected initial 25 basis point cut would provide a meaningful boost to purchasing power, potentially allowing them to compete for properties that were previously out of reach.

The anticipated rate cut follows the RBA’s decision to hold rates steady in July, with economists now confident that inflation has moderated sufficiently for the central bank to begin easing monetary policy.

While buyers may benefit from improved affordability on paper, the limited housing stock available could mean increased competition at auctions and private sales, particularly in major cities where listings remain tight.

Dr Powell said that without addressing the supply side of the equation, rate cuts alone won’t solve housing affordability issues.

“With more money chasing too few homes, prices are set to rise again,” she said.

“Without urgent planning reform and faster approvals, demand will continue to outpace supply and price pressures are likely to continue.”

The potential rate cut is expected to trigger renewed buyer activity in the property market, with first-home buyers and upgraders likely to be particularly responsive to the improved borrowing conditions.

For existing homeowners with variable-rate mortgages, the cut would provide welcome relief after two years of rising interest rates that have stretched household budgets.

“Next week’s decision will be one to watch,” Dr Powell said.

“While lower rates will help many households manage their mortgage costs, the resulting boost to demand without corresponding supply increases means we’re likely to see continued upward pressure on property prices.”