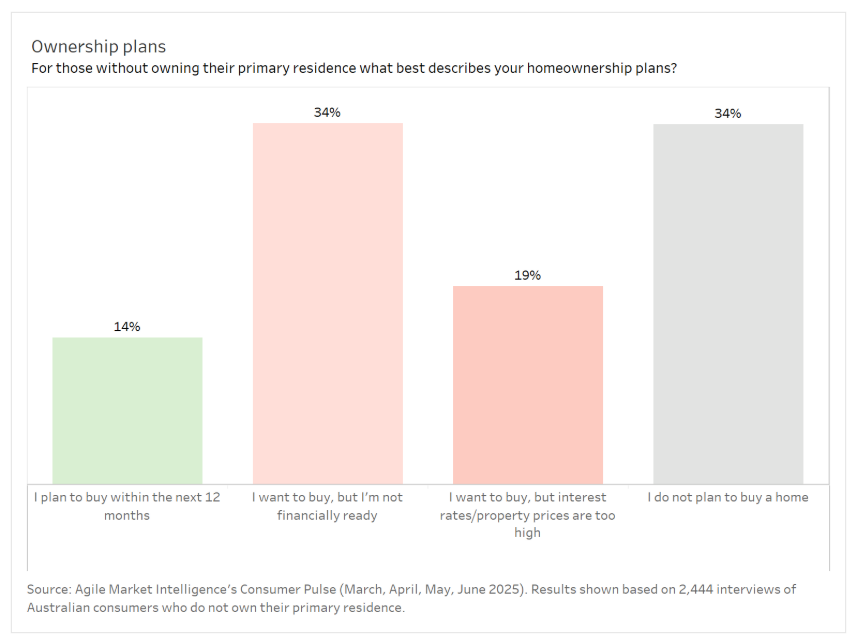

According to new research from Agile Market Intelligence’s Consumer Pulse survey, 34 per cent of Australians who don’t currently own a home have abandoned plans to purchase one, highlighting a significant shift in housing aspirations.

The survey, which collected responses from 2,444 Australian consumers between March and June 2025, found that financial barriers remain the biggest obstacle for potential buyers.

Over one-third (34 per cent) of non-homeowners want to buy but are not financially ready, with this figure rising to 44 per cent among young adults aged 18-34.

Only 14 per cent of non-homeowners nationwide plan to buy within the next 12 months.

Michael Johnson, Director at Agile Market Intelligence, pointed to a growing disconnect between housing aspirations and financial reality.

“We’re seeing a widening disconnect between aspiration and affordability,” Mr Johnson said.

People still want to own a home, but they’re frozen out by financial constraints that don’t appear to be easing.”

The research revealed significant differences across age groups, with older Australians more likely to have given up on homeownership entirely.

Among those aged 55 and over, 59 per cent of females and 67 per cent of males say they do not plan to buy.

This contrasts sharply with younger Australians, where only 19 per cent of women and 16 per cent of men aged 18-34 have abandoned homeownership plans.

However, the vast majority of these younger Australians still face significant financial barriers to entry.

State-by-state analysis shows South Australia and Western Australia leading the country in those not planning to buy, both at 41 per cent.

Queensland follows closely behind at 39 per cent.

Victoria has the highest proportion of those who want to buy but aren’t financially ready (40 per cent), while Western Australia has the highest percentage planning to buy within 12 months (18 per cent).

The research suggests that lower house prices alone aren’t enough to drive ownership aspirations, with broader economic factors playing a crucial role in shaping consumer outlooks.

“Affordability isn’t just about price. The cost of living, wage stagnation, and deposit hurdles all feed into whether someone believes buying a home is realistic in their state,” Mr Johnson noted.

The findings indicate a potential generational shift in property ownership patterns, with long-term renting becoming increasingly common for certain age groups.

“The sharp drop-off in buying intent among older demographics suggests we’re heading into a generational split in property ownership, with long-term renters becoming the norm for certain age groups,” Mr Johnson said.