According to Cotality’s latest Million Dollar Market report, 34.1 per cent of the 4,844 markets analysed across the country recorded a median house or unit value of $1 million or more in September, up from 30.3 per cent this time last year.

The report found that properties with seven-figure price tags now account for 30.8 per cent of national sales over the year to September, more than double the 15.2 per cent they comprised in the same period in 2020.

Cotality Economist Kaytlin Ezzy said the million-dollar benchmark is losing relevance as membership in the seven-figure club reaches unprecedented levels.

“Five years ago, just 14 per cent of Australian suburbs were members of the million-dollar club, with the majority concentrated in Sydney’s prestigious Northern Beaches, Eastern Suburbs, and North Sydney and Hornsby regions,” Ms Ezzy said.

The expansion represents a 142.9 per cent increase in million-dollar markets over the past five years, coinciding with a national dwelling value increase of 46.8 per cent, or approximately $270,000 at the median level.

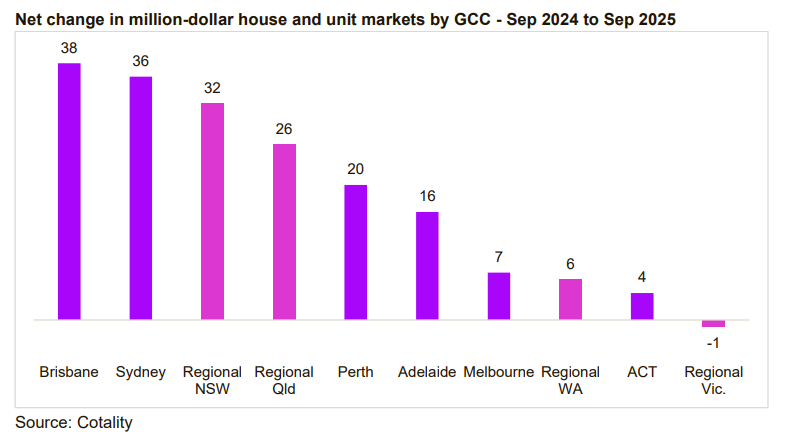

Brisbane led capital cities with the largest net change in million-dollar markets over the year, adding 38 new or returning markets to the club.

Sydney followed closely, where seven in ten markets now have a median house or unit value above $1 million, with a net increase of 36 markets.

The report highlighted that million-dollar suburbs are no longer confined to traditionally prestigious areas, with many new entrants located in suburban fringes.

“Some newly minted million-dollar markets include more mortgage belt suburbs like Sydney’s Penrith and Melbourne’s Taylors Lakes, along with Oxley in Brisbane’s Ipswich region and Upper Coomera in the Northern Gold Coast,” Ms Ezzy said.

Regional Victoria was the only area to record a net decline in million-dollar markets, with only 11 of 278 suburbs analysed having a median value at or above the $1 million mark, down one compared to last year.

The proliferation of million-dollar suburbs raises serious concerns about housing affordability, particularly for first-home buyers.

A household on the average income of $106,000 with a 20 per cent deposit would need to dedicate more than half of their pre-tax earnings to service a loan on a million-dollar property.

This financial burden increases to more than 60 per cent for those using the First Home Guarantee scheme’s 5 per cent deposit option, a repayment-to-income ratio that most lenders would not approve.

Despite the increasing prevalence of million-dollar properties, homeownership is becoming increasingly unattainable for younger generations, with the average age of first-home buyers continuing to rise and homeownership rates steadily declining.

With tight supply levels and additional demand from the expanded First Home Guarantee scheme, property values are expected to continue rising through 2025, likely pushing more suburbs across the seven-figure threshold.

“At their current quarterly rate of growth, over 80 markets are on track to join the million-dollar club by year’s end,” Ms Ezzy said.