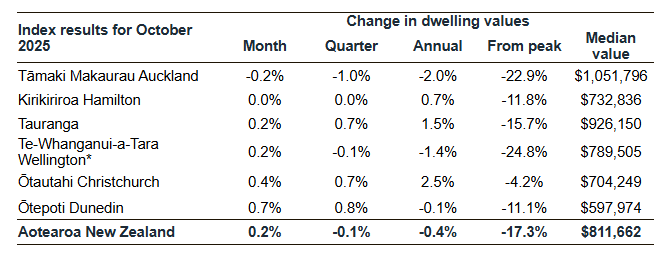

According to Cotality NZ’s latest Home Value Index, property values edged up by 0.2 per cent in October, following a 0.1 per cent increase in September.

This comes after five consecutive monthly falls between April and August, with the national median now sitting at $811,662.

Performance across major urban centres was mixed, with Auckland continuing to decline by 0.2 per cent while Christchurch and Dunedin showed stronger growth at 0.4 per cent and 0.7 per cent respectively. Hamilton remained flat, while Tauranga and Wellington both increased by 0.2 per cent.

Cotality NZ Chief Property Economist, Kelvin Davidson, suggests these modest increases could indicate the beginning of a market turnaround, though he advises caution.

“It’s a cliché, but upturns obviously have to start somewhere, and the recent emergence of small increases in property values would certainly be consistent with the falls in mortgage rates over the past year or so,” Mr Davidson said.

The recent announcement that loan-to-value ratio rules will ease from December 1 could provide additional market stimulus, potentially benefiting investors and first-home buyers.

“We’ve seen in the past that banks tend to act early on these rule changes, so the effects may start to show through even as soon as the release of October’s mortgage lending stats in late November,” Mr Davidson said.

Despite these positive signs, Auckland’s property market remains patchy, with varied performance across its sub-regions.

Franklin and North Shore saw slight increases, while Auckland City and Waitakere experienced more significant drops. Overall, Auckland values are down 2.0 per cent over the past 12 months and remain approximately 23 per cent below their previous peak.

Wellington also presented a mixed picture in October. Wellington City itself saw a 0.5 per cent increase, while Lower Hutt fell by 0.4 per cent and Porirua declined by 0.2 per cent.

The region’s values remain significantly below peak levels, with falls ranging from 23 per cent to 26 per cent across different areas.

The reduction in available property listings across major centres may be shifting some power away from buyers.

However, economic sentiment remains cautious, particularly in Auckland and Wellington, affecting market confidence.

Looking ahead, the Reserve Bank’s final Official Cash Rate decision for the year on November 26 is expected to result in a 0.25 per cent drop, potentially marking the end of the current cutting cycle.

Mr Davidson predicts a modest market improvement in 2026, with both sales activity and house prices likely to rise, though not dramatically.

“With mortgage rates already having fallen a long way, housing affordability more favourable, listings down a bit, and the economy set to improve, 2026 looks likely to see a rise in both property sales activity and house prices,” he said.

However, he suggests that significant price growth is unlikely, given increased housing stock relative to population and debt-to-income ratio caps now in effect.

“Prospective buyers, whether that’s owner-occupiers or investors, will also no doubt be pleased that values remain around 17 per cent below their early 2022 peak – with some likely to be viewing this as a strong opportunity to snap up ‘bargains’ at what might prove to be the low point for the market,” Mr Davidson said.