According to Cotality’s Housing Affordability Report, the national median dwelling value now sits at $860,529, requiring 45 per cent of median household income to service a new mortgage, despite recent interest rate cuts.

The report reveals it now takes nearly 12 years to save a standard 20 per cent deposit nationally, exceeding a decade in four major capital cities – Sydney, Adelaide, Brisbane, and Perth.

Tenants are facing similar pressures, now dedicating a record 33.4 per cent of their income to rent, significantly above the 20-year average.

Cotality Head of Research Eliza Owen said multiple factors have driven the deterioration in housing affordability over recent years.

“Australian home values have climbed roughly 47.3 per cent since March 2020, an extraordinary rise that added about $280,000 to the median dwelling value,” Ms Owen said.

This surge was fuelled by pandemic-era monetary stimulus and record-low interest rates that supercharged borrowing capacity and demand, even as housing supply lagged well behind household formation.”

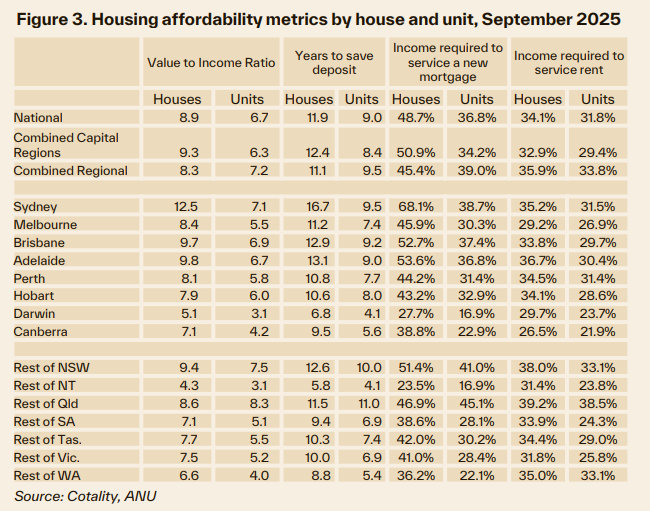

Houses have experienced sharper affordability declines than units, with the median house value now 8.9 times the average income, up from 6.6 times five years ago.

For units, the increase was smaller, rising from 6.0 to 6.7 times income.

Regional areas, once considered more affordable alternatives to capital cities, have seen affordability nearly match capitals on the value-to-income ratio (8.1 vs 8.2), erasing what was previously a significant advantage for buyers.

Sydney remains Australia’s most expensive and unaffordable city, where the median dwelling value is 10 times the median household income, requiring 54.5 per cent of income to service a new mortgage.

Adelaide has emerged as the second-least affordable city for purchasing, where home values have increased 77.2 per cent in five years against just 20.1 per cent growth in median household income. In Adelaide, it now takes a record 12.3 years to save a deposit.

Brisbane ranks as the third-least affordable housing market, while Perth, despite recording the most significant growth in housing values of any capital city over the past five years (83.9 per cent), still ranks fourth in terms of affordability challenges.

The Northern Territory offers the most affordable housing conditions, with Darwin and the rest of the NT being the only major regions where less than 30 per cent of income is required to service a new mortgage.

Rental affordability has deteriorated across most regions, with Regional Queensland experiencing the highest burden, where tenants now dedicate a record 39 per cent of income to rent.

The report highlights that temporary market corrections won’t solve the fundamental affordability crisis, as demonstrated by Melbourne’s recent experience, where prices are rising again following interest rate cuts.

Ms Owen said supply-side limitations have compounded demand pressures in the housing market.

“Construction sector insolvencies, rising material costs, and planning bottlenecks restricted new housing delivery. In short, the past five years combined extraordinary demand drivers with supply constraints, creating an extraordinary boom in both home values and rents,” she said.