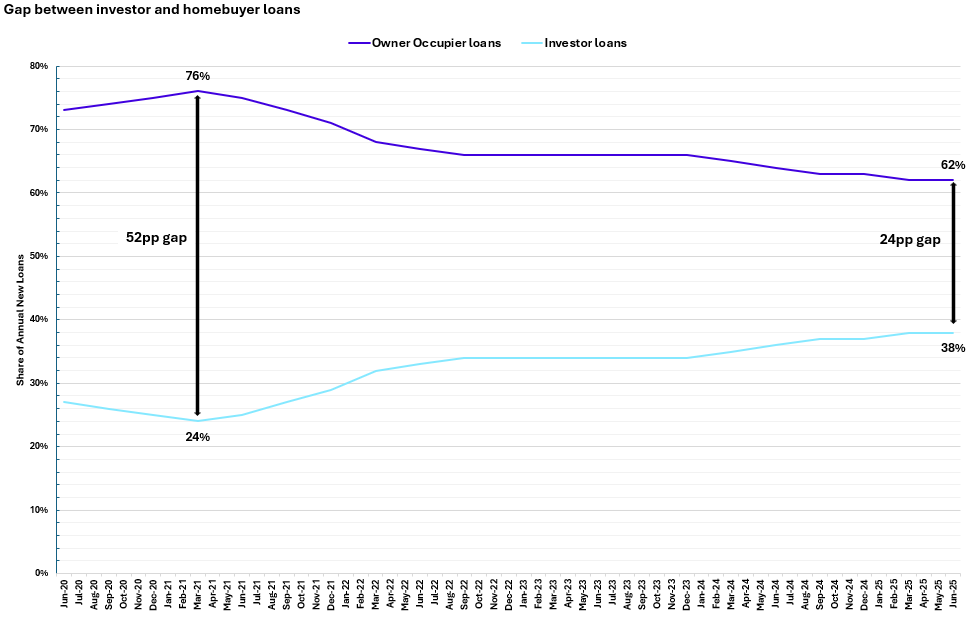

According to new analysis from Money.com.au, property investment loans now make up 38 per cent of all new lending, representing 196,699 loans in the year to June 2025.

Owner-occupier loans account for the remaining 62 per cent, with 324,972 loans.

The gap between investor lending and homebuyer loans has narrowed to just 24 percentage points, the closest it has been since the Australian Bureau of Statistics began tracking investor loans in 2019.

This marks a big change from just four years ago when property investors held their smallest share of new lending.

In the year to March 2021, investors accounted for only 24 per cent of loans compared to 76 per cent for owner-occupiers, creating a 52-percentage point gap that was more than double the current difference.

Money.com.au’s Mortgage Expert, Debbie Hays, describes this trend as a turning point in Australia’s property cycle with significant implications for the market.

“It means the homebuyer segment is becoming less the backbone of the market. Investors are now playing a much larger role in shaping house prices, affordability, supply and even influencing housing policy,” Ms Hays said.

The shift presents both opportunities and challenges for the housing market.

While it demonstrates strong confidence in property as an investment, it also intensifies competition for first-home buyers and owner-occupiers.

“Investors taking a larger share of the market is a double-edged sword. On one hand, it signals all-time high confidence in property as an asset class.

“On the other hand, it means first-home buyers and owner occupiers are competing with equity-rich buyers, which will inevitably push prices higher and widen the affordability gap,” Ms Hays said.

The data also reveals that the traditional gap between investor and owner-occupier loan sizes has virtually disappeared.

Investors now carry an average annual loan size of $667,512, almost identical to the $661,534 for owner-occupiers.

This surge in investor activity is expected to have significant implications for the rental market as well.

While more investors could potentially increase rental supply, the current imbalance between demand and supply suggests different outcomes.

Ms Hays said that the rental market will likely feel the effects of increased investor presence.

“More investors coming into the market can add to rental supply, since many of those properties end up in the rental pool. In theory, that should give renters more choice,” she said.

However, the reality may be more complex given current market conditions.

“But with demand for rentals already outstripping supply, a surge in investor activity can only fuel higher rents. Investors will look for higher rental yields to service their larger loans, and that translates into higher asking prices for tenants.”

The analysis is based on Australian Bureau of Statistics historical data of investor loans from 2019 to 2025, providing a comprehensive view of the changing dynamics in Australia’s property market.

“Investors are now playing a much larger role in shaping house prices, affordability, supply and even influencing housing policy. It wouldn’t surprise me if the government once again raised the prospect of negative gearing reforms to level the playing field,” Ms Hays said.