According to new PropTrack data, 55 of these high-performing suburbs are in regional markets compared to 43 in capital cities, demonstrating the strong investment potential outside metropolitan areas.

Queensland dominates the list with 45 suburbs, nearly half of all locations showing this remarkable growth pattern.

South Australia follows with 20 suburbs, while New South Wales has 18, and Victoria and Tasmania each contribute seven.

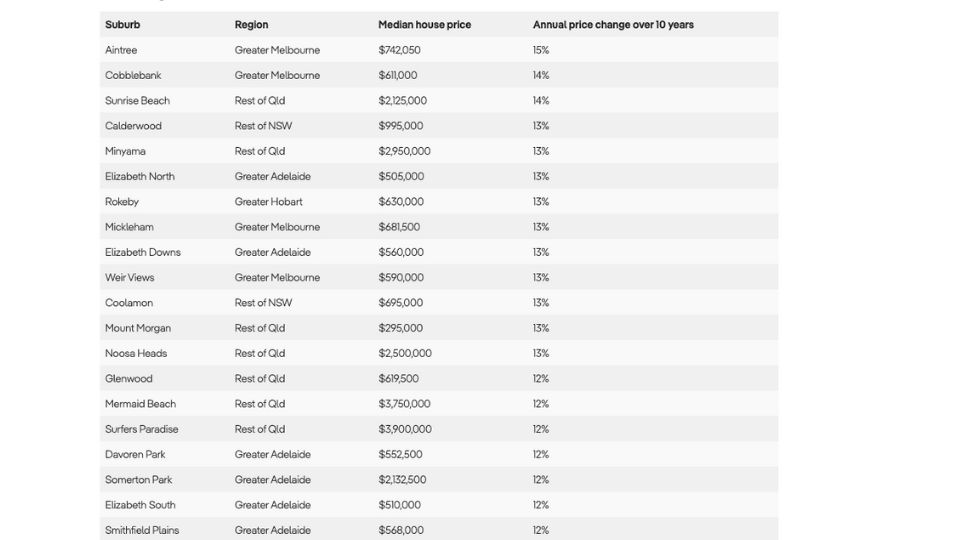

Melbourne’s western suburb of Aintree topped the list with the strongest performance, recording an impressive 15 per cent annual growth on average since 2015.

Cobblebank in Melbourne and Sunrise Beach on Queensland’s Sunshine Coast followed closely with 14 per cent annual growth each.

PropTrack’s analysis shows that affordability hasn’t been a barrier to strong growth, with nearly two-thirds of the suburbs on the list having median house prices below $1 million as of September 2025.

Southeast Queensland emerged as a particular hotspot, with 14 high-performing suburbs in greater Brisbane and 31 across the rest of the state.

The Sunshine Coast region contributed 13 suburbs to the list, while the Gold Coast added another 10.

Home prices have boomed across Southeast Queensland since the pandemic began, driven by people searching for greater lifestyle, more space and relative affordability compared to the southern capital cities.

The Ipswich region within Brisbane has been especially attractive to first-home buyers and investors, with 10 locations recording either 10 per cent or 11 per cent annual median house price growth since 2015.

Looking ahead, housing affordability remains a significant challenge despite this year’s three interest rate cuts.

Additional anticipated rate reductions are expected to further lower mortgage costs and increase borrowing power, potentially stimulating further growth in the housing market.

The early spring selling season has already shown strong buyer interest driving faster home sales amid limited housing stock across various markets.