Last week, Australia’s neo banking market is significantly heated up with 86 400 officially opening its doors, and neo-rival Xinja receiving its full banking licence from APRA.

What are neo banks?

Neo banks are digital banks, controlled from your mobile phone typically with a customer service platform within the app. Already at large in the UK, Europe and US, Australia now has three banks offering live products with more to follow.

These digital start-ups face an uphill battle to wrestle market share from the big four banks. But are they just marketing hype, or are they putting good deals on the table?

Who are the neo banks?

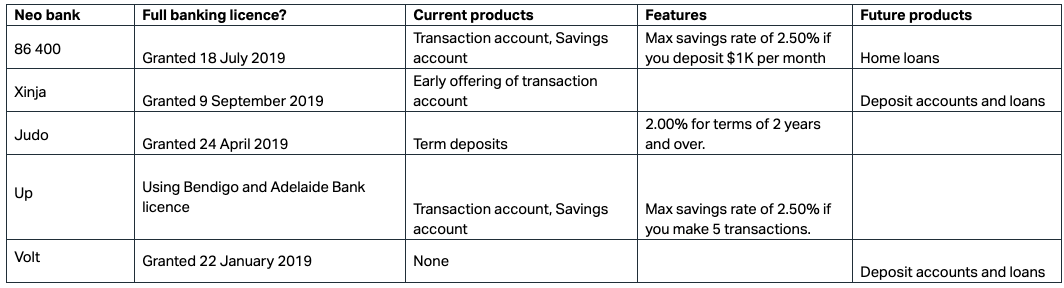

Here is a basic rundown of who’s who right now:

Most banks already offer a banking app. What’s the difference?

Neo banks say their advantage is that they have no cumbersome legacy technology, and as a result, they can offer faster, smarter, streamlined banking.

The neo banks also differentiate themselves in their marketing. They’re presenting themselves as the Uber of the banking world in the hope this will resonate with customers fed up with the incumbents.

Are they a threat to the big four banks?

The big four banks have deep pockets and they don’t like losing market share. The big banks are already investing heavily in retail banking technology. If the neo banks start gaining traction, the big four are likely to respond in spades to make sure they appeal to tech savvy Australians.

We’re in an age where people are taking to disrupters with huge enthusiasm in other industries. But Australians are notoriously loyal to their bank. More than three-quarters of our savings are with the big four and their subsidiaries. Neo-banks are unlikely to rock this boat any time soon.

Are they competitive?

Neo banks are going to have to be competitive on two fronts: technology and price.

So far, 86 400 and Up are both offering a maximum savings rate of 2.50 per cent, which is the equal highest rate on our database (My State and BOQ), while Judo Bank is offering term deposits of up to 2.00 per cent which is one of the most competitive rates on the market.

When it comes to transaction accounts, the neo banks will find it near-impossible to compete on cost. Up and 86 400 transaction accounts include some international fees and don’t waive all domestic ATM fees when a growing list of banks do.

Will neo banks live up to the hype?

There’s no question neo banks will help drive innovation in the sector. Neo banks don’t have cumbersome banking systems that have been known to slow the bigger banks down. They also don’t have branches which will help them save on costs.

In order to be successful, neo banks will have to patiently chip away at the market. But the big banks won’t go quietly into the night.