Rent.com.au has reported its best operating performance to date, with the second quarter of 2019-20 financial year revealing a 19 per cent improvement on the period prior.

The renting website released its latest financial report last week, with CEO Greg Bader celebrating the results.

“To finish 2019 with a record-breaking EBITDA quarter is exceptionally pleasing, especially when you factor in that we usually experience a seasonal revenue drop in the December quarter,” Mr Bader said.

“Renter product revenue is very transactional and non-recurring in nature and as we expect, the last few weeks of the year sees people focused on the holiday season rather than moving house.

“We achieved a 19 per cent improvement in EBITDA compared to the previous quarter. With an average monthly EBITDA loss of $100k, this quarterly result is the closest the RENT Group has come to breakeven and is 54 per cent better than we achieved in the same quarter last year.”

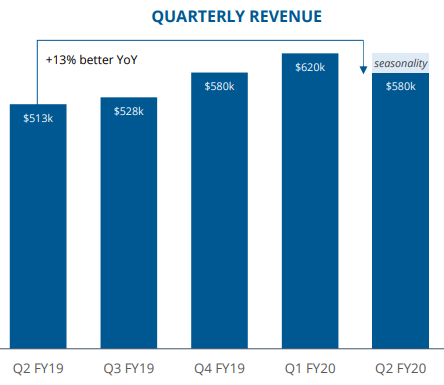

As expected, seasonality sees RENT’s revenue down compared to the previous quarter but up 13 per cent on the same quarter in the previous year.

“We have seen performance lift across most revenue lines over the last 12 months as we have optimised supplier agreements and enhanced the products with new features,” Mr Bader said.

“This constant improvement not only improves our core business, but also ensures we remain responsive to our customers’ needs.

“Our continued focus on reducing RENT’s reliance on paid marketing has resulted in growth of our organic user base to the point where we’re now getting more than 100,000 visitors to our blog alone each month and two-thirds of all site/app visits are now from organic (non-paid) sources.

“This is great for our brand and enhances our renter advocacy positioning in addition to the financial benefits. Compared to the same quarter last year (Q2 FY19) we spent 51 per cent less on marketing but had 20 per cent more unique visitors,” continued Mr Bader.

RentPay Update

Mr Bader said efforts in developing RentPay were continuing.

“Design and development of the customer front end has commenced. We have narrowed down our shortlist of potential fintech partners, and are now negotiating with a preferred partner who has the technical capability and appropriate licencing/compliance to help us deliver a game-changing solution to our renting customers,” Mr Bader said.

“On the cost side, we are conscious that we’re carrying additional costs within our business ahead of launching the new RentPay product and that this affects perception of how the rest of the Group is performing against its break-even target.

“As development of RentPay gathers pace it will bear a greater share of the Group’s costs as we redeploy more effort into building this new product.

“Rental payments are a $60 billion per year industry that is ripe for transformation and we need to invest in this as well as ensure we partner with competent, like-minded organisations if we are to fully seize this opportunity,” he continued.

“If we can scale to just 5 per cent market share for example (+/-115,000 renters), RentPay would be processing in the region of $200 million of rent per month and earning a recurring annuity income stream on top of current revenues associated with the moving period.”

Outlook

Mr Bader further noted the immediate period ahead was expected to be positive.

“January is always a good month for us from the perspective of visitors to our site and apps, Renter Resumes created and related activity, following the usual seasonal downturn in the December quarter,” he stated.

“January 2020 has started off with record numbers of Renter Resumes created and, while there’s always a slight lag before product sales come through, we’re starting to see this activity reflected in our revenue.

“We expect the new product initiatives that we’ve previously announced, such as the partnership with AGL (RentConnect), the new ‘Move Now, Pay Later’ feature of RentBond, and the new ‘Endorsements’ feature of RentCheck to start bearing fruit this quarter.

“Longer-term our focus remains on RentPay as the vehicle by which we position RENT within the tenancy period, thereby creating the default platform for the millions of renters across the country to use throughout their renting journey from search through to the tenancy period.

“We continue to manage the business efficiently whilst growing our product range and investing in our future. We are strongly supported by our core shareholder base of sophisticated investors who believe not only in the need for industry change, but most importantly, our capacity to lead it,” concluded Mr Bader.