Record high inflation, rising interest rates and weak consumer sentiment are leading to falling home prices in the eastern states, with new data showing that one in two markets declined in value in 2022

According to CoreLogic’s Mapping the Market Report, 51.7 per cent of the 4,661 house and unit suburbs recorded lower prices over the past year.

The report also found the proportion of national house and unit markets recording a quarterly decline in values increased from 76.9 per cent in September to 80.7 per cent in December.

Price declines continue to be the most severe in the larger capital city markets, while house prices in Perth rose slightly and units also gained ground in Adelaide and Darwin.

CoreLogic Economist Kaytlin Ezzy said the degree of price declines varies between the capital cities and house and unit markets.

She said fewer than 10 per cent of house and unit markets recorded a decline in value in the December quarter 2021, serving as a stark reminder of how dramatically Australia’s housing market has moved since it peaked in early 2022.

“The market downswing doesn’t discriminate, with only a small proportion of suburban areas riding a wave of positive growth among the sea of declining values,” Ms Ezzy said.

“This has resulted in a reduction in the number of million-dollar suburbs, particularly in our most expensive housing market, Sydney, with the most resilient suburbs found in more affordable areas and within the unit sector.

“The downswing has meant buyers who were previously priced out of some markets might start to see opportunities appearing, particularly in cities where larger downturns have been recorded such as Sydney, Melbourne, Brisbane, Hobart and Canberra.

“However, it’s likely much of the benefits of falling values have been offset, with rising interest rates pushing serviceability buffers and mortgage repayments higher.”

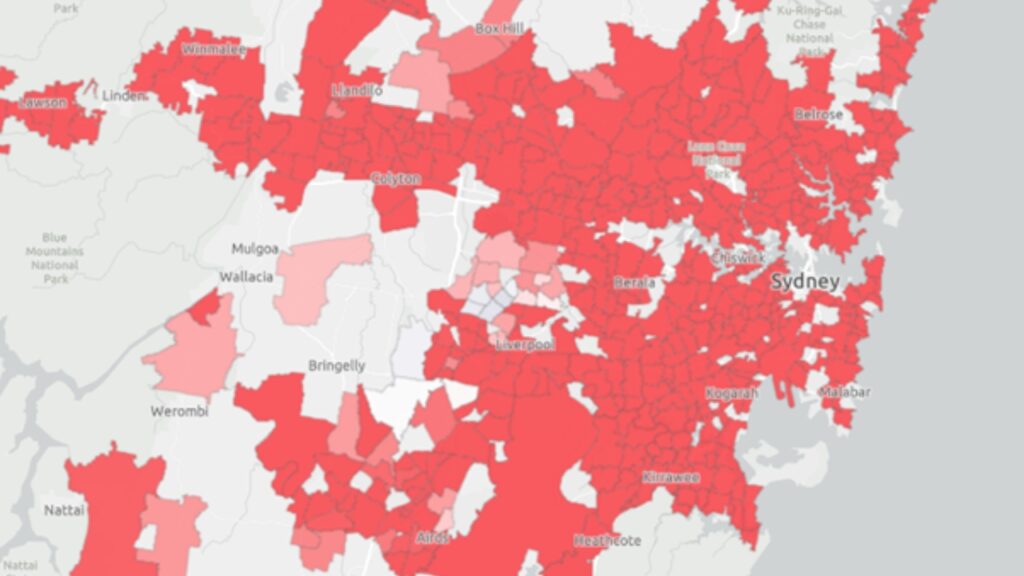

Sydney

Sydney experienced some of the largest price declines across the country last year, with only seven (1.3 per cent) of the 547 house suburbs recording an increase in values in 2022, with the majority concentrated in the city’s south east.

The broad-based and sustained downswing has seen the number of million-dollar house suburbs decline from 439 in March to 345 in December.

Annually, Sydney unit values fell 9.2 per cent taking the city’s median unit value to $772,807, according to CoreLogic.

Of the 292 suburbs analysed, 93.2 per cent (272) saw values fall over the quarter, while 95.2 per cent (278) recorded an annual fall in value. Annual falls range from 0.1 per cent in Mortlake to 23.8 per cent in Centennial Park in Sydney’s Eastern Suburbs.

Melbourne

Melbourne only fared slightly better, with six (1.6 per cent) of its 371 house suburbs recording a rise in values in the December quarter and all but eight (2.2 per cent) suburbs record a fall in their annual house value.

Annual value changes ranged from a 1.6 per cent rise in the western suburb of Darley to an 18 per cent drop in Highett in the city’s inner south region, CoreLogic reported.

The Melbourne unit market has seen values decline 5 per cent since a peak in April, with the inner city markets of East and West Melbourne, Southbank and Docklands recording annual increases of 12.9 per cent, 9.5 per cent, 9.2 per cent and 8.9 per cent, respectively.

Brisbane

After experiencing some of the strongest gains during the pandemic, Brisbane also saw values fall away substantially from their peak.

The portion of Brisbane suburbs recording a quarterly decline in house values remained fairly steady, with 94.4 per cent (302) of the 320 suburbs analysed falling in value, while the number of suburbs recording an annual decline increased from two in September to 160 (50 per cent) in December.

Selling conditions for Brisbane’s unit market continued to weaken through the December quarter with values falling 1.8 per cent.

Despite the significant growth seen over the past two years, 97.7 per cent of Brisbane’s unit suburbs have a current median value below $750,000.

Adelaide

Adelaide’s property market continues to be one of the most resilient in the country, with quarterly value falls across the housing market slightly increasing from -0.3 per cent in September to -1.4 per cent in December, with premium suburbs across Adelaide’s Central and Hills regions making up 11 of the 12 suburbs that saw values fall over the calendar year.

Adelaide’s unit market remains steady, with just one quarter (21) of the 85 unit markets analysed recording a decline in values.

Bucking the trend seen across the other capitals, house values across Perth rose 0.1 per cent over the December quarter, taking values 3.9 per cent higher over the year.

Perth

Perth remains the most affordable capital city for detached homes, with a median house value of $586,721.

Hobart

In Hobart, unit values fell 4.4 per cent over the December quarter and 7.9 per cent over the year, with all 10 markets analysed recording a quarterly drop in value.

Darwin

Across Darwin, the number of suburbs experiencing price declines increased, from 35.1 per cent in September to 84.2 per cent (32) in December.

Darwin’s unit market is the most affordable across the capitals, with a median value of $382,695, despite recording a 0.2 per cent rise in values over the three months to December.

Canberra

In Canberra, 100 per cent of the 83 suburbs analysed recorded a decline in house values over the December quarter.

The sustained downswing has seen the portion of house markets recording an annual decline grow from 27.1 per cent in September to 86.7 per cent in December.

The 2 per cent drop recorded over the December quarter saw Canberra’s unit values fall below $600,000 to $599,937.