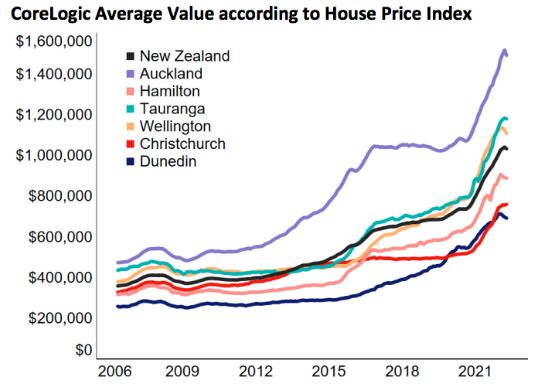

The New Zealand property market has recorded a modest fall in April, the first decline since the initial COVID-19 enforced lockdown in August 2020.

According to CoreLogic, property values declined 0.8 per cent in April led by a 1.6 per cent decrease in Auckland and 1.5 per cent drop in Wellington.

Price movements were mixed across the country with prices in Christchurch rising 0.5 per cent while Hamilton remained flat.

CoreLogic NZ Head of Research Nick Goodall said rising interest rates had made it harder for borrowers.

“Affordability remains a key constraint on the market as increasing interest rates impact the number of eligible borrowers and the amount they can borrow,” Mr Goodall said.

“This is on top of tighter credit availability by way of greater scrutiny on borrower expenses through the CCCFA changes as well as tighter loan-to-value ratio (LVR) restrictions continuing to bite.”

Growth in Christchurch, combined with value falls in Dunedin, has seen the average value of the two South Island cities drift further from each other.

Values have fallen 2.9 per cent in Dunedin over the past three months, which is the greatest quarterly decline in more than 13 years.

Similarly, the 2 per cent fall across the Wellington region in the past three months is also a record since the GFC. Both Lower and Upper Hutt are key contributors to the regional deterioration, with 3 per cent and 2.6 per cent drops over the month respectively.

Tauranga property values had previously defied the recent market softening but a fall of 0.3 per cent in April could be the first signs of the momentum running out.

The size and diversity of Auckland has led to some mixed results recently, with the drop of 1.6 per cent in April more than reversing the 1.4 per cent growth recorded in March.

Despite recent weakness, Mr Goodall said New Zealand employment was strong, which was a positive sign.

“Currently the labour market is tight, which likely means strong competition for people and should lead to higher wages,” he said.

Mr Goodall said home buyers were now carefully watching how much the Reserve Bank of New Zealand increased the cash rate.

“The trajectory of the OCR forecast is what is of most interest however and the forecast peak of more than 3 per cent is no doubt tempering some would-be-buyers to hold off in the environment of a falling market alongside rising interest rates,” he said.

“Outside of interest rates there appears to be a feeling that credit availability could be lifting out of the worst of times.

“High LVR lending has dropped well below the allowed speed limits and with preapprovals back on the table and anecdotes of banks more comfortable to open up again, we may see a little lift of ‘otherwise locked out buyers’, though this pool of buyers is likely to be relatively small.”

Mr Goodall said the property market is likely to continue to soften as the RBNZ continues to tighten.

“The slowdown/downturn appears to be entrenched, but will likely play out in a gradual manner, as long as the labour market remains tight,” he said.

“It should be noted that mortgage serviceability test rates have also increased with actual interest rates.

“While this likely contributed to the reduction in lending and transactions, it should serve to stress test that borrowers can withstand interest rate increases.”