The Labor Party has announced its intentions to introduce a new shared-equity housing scheme that could help shave up to $380,000 off the cost of a home.

Under the Help to Buy scheme, announced as a part of the Opposition’s election campaign, a Labor Government would take up to a 40 per cent equity stake in a home for qualified buyers, to help tackle ongoing housing affordability issues.

The program could see 10,000 places made available with homebuyers not required to pay any costs to the government, with all equity plus capital gains recouped when the property is sold.

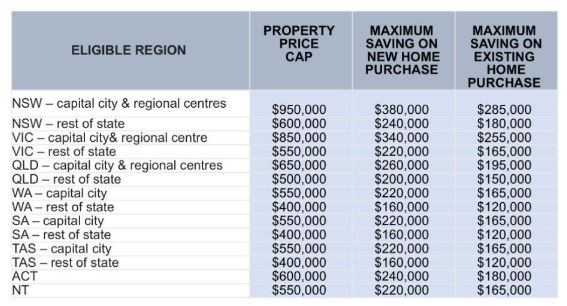

Under the plan, the Labor Government would provide eligible homebuyers with an equity contribution of up to 40 per cent of the purchase price of a new home and up to 30 per cent of the purchase price for an existing home.

The homebuyer would need to have a deposit of 2 per cent and qualify for a standard home loan with a participating lender to finance the remainder of the purchase.

In some parts of Australia, the cut to the cost of a mortgage could be as much as $380,000 under the proposed scheme.

“After nine long years in government, housing affordability has only got worse under the Liberal-National government,” Mr Albanese said.

“Help to Buy is part of Labor’s plan to tackle the housing crisis.”

This scheme is not just for first homebuyers, but those with a taxable income of up to $90,000 for individuals and up to $120,000 for couples.

Homebuyers must be Australian citizens and not currently own or have an interest in a residential dwelling.

Additionally, the homebuyer would not have to pay lenders’ mortgage insurance, and they could also buy an additional stake in the home during the period of the loan.

Real Estate Institute of Australia (REIA) President Hayden Groves said he welcomed the Labor proposal.

“We applaud the commitment to develop a National Housing and Homelessness Plan which is badly needed for all parties to come to the table and identify innovative solutions to unlock supply,” Mr Groves said.

“An evidence-based approach to a National Supply and Affordability Council with the right objective experts should provide a proper annual benchmark for Australia’s supply crunch.

“Only with dealing with supply will affordability barriers be overcome.

“Government initiatives that boost the demand side can potentially increase house prices and can make house prices more unaffordable.”

Chief Executive of the Property Council, Ken Morrison said, given the small number of places available, this was unlikely to be an issue.

“We welcome targeted measures that help people get into the housing market and we note that the proposed Help to Buy shared equity scheme is capped at 10,000 places a year and is therefore unlikely to distort housing markets or prices,” Mr Morrison said.

“We welcome measures to help people get into the housing market and Help to Buy would be an important addition to the housing affordability schemes already in place.”

Housing Industry Association (HIA) Managing Director Graham Wolfe said the proposed scheme would support home ownership.

“The proposed ‘Help to Buy’ shared equity scheme offers a sensible first step that mirrors existing schemes in Australian and overseas,” Mr Wolfe said.

“As a small and targeted government backed scheme it offers the chance for low and moderate income households to achieve their dream of home ownership.”

AMP Chief Economist Shane Oliver has previously stated that shared equity schemes are little more than a “band-aid solution” at best and potentially counterproductive.

“To the extent that it brings forward demand, there’s a risk this worsens the problem and benefits those already in the property market through higher prices,” Mr Oliver said.

Help to Buy would cost around $329 million based on forward estimates.