In a shock few experts saw coming, inflation has risen to almost 7 per cent in April, with higher petrol prices fuelling the increase.

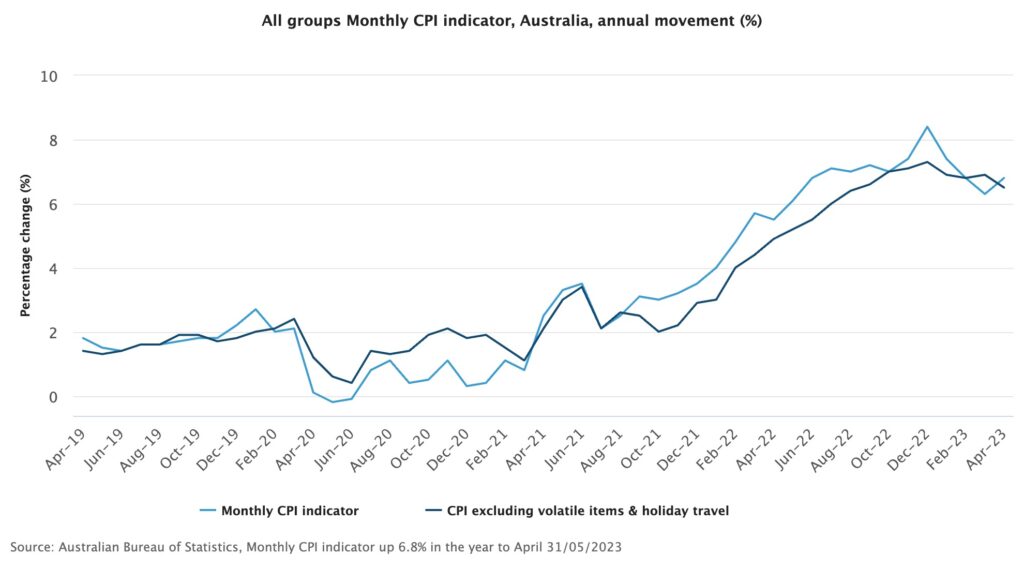

The Australian Bureau of Statistics (ABS) said the monthly Consumer Price Index (CPI) indicator, jumped to 6.8 per cent in the year to April, which is lower than the high of 8.4 per cent in December but, critically, up on the 6.3 per cent rise reported in March.

ABS Head of Prices Statistics Michelle Marquardt said automotive fuel was a “significant contributor” to the rise in inflation.

“The halving of the fuel excise tax in April 2022, which was fully unwound in October 2022, is impacting the annual movement for April 2023,” she said.

Ms Marquardt said when items with volatile price changes, such as fuel and fruit and vegetables, were removed, a better view of underlying inflation could be garnered.

“When excluding these volatile items, the annual movement of the monthly CPI indicator was 6.5 per cent in April, lower than 6.9 per cent recorded in March,” she said.

The most significant contributors to the annual increase in the monthly CPI indicator in April were housing (up 8.9 per cent), food and non-alcoholic beverages (up 7.9 per cent), transport (up 7.1 per cent) and recreation and culture (up 6.4 per cent).

The annual increase for the housing group in April of 8.9 per cent was lower than the increase in March of 9.5 per cent.

“Within the housing group, new dwelling prices rose 9.2 per cent, which is the lowest annual growth since February 2022 as building material prices continue to ease,” Ms Marquardt said.

“Rent prices rose further from an annual rise of 5.3 per cent in March to 6.1 per cent in April as the rental market remains tight.”

Price rises for food and non-alcoholic beverages remain high but have eased slightly from an annual increase of 8.1 per cent in March to 7.9 per cent in April.

The annual movement for transport rose to 7.1 per cent off the back of higher petrol prices compared to April last year.

“Automotive fuel prices were 9.5 per cent higher this month than they were in April 2022 when prices fell following the 22 cents per litre cut in the fuel excise introduced on 30 March 2022,” Ms Marquardt said.

“This contrasts to March 2023, which saw an annual fall in fuel prices of 8.2 per cent, compared to the high prices recorded in March 2022 related to the war in Ukraine.”

ANZ senior economist Adelaide Timbrell said the RBA could look to raise rates on Tuesday or in July, despite the ANZ recently tipping the cash rate would next rise in August.

“The risk around our forecast of a 4.1 per cent cash rate in August has been tilted toward earlier and/or more action from the RBA,” she said.

But the Real Estate Institute of Australia called for rates to hold when the RBA meets next week.

President Hayden Groves said the 11 interest rate increases since May 2022 were already squeezing household incomes and weighing on consumer spending.

“Despite the April figure, the CPI peaked late last year and the RBA needs to keep a pause on further rate rises at its meeting next week, allowing additional time to consider additional data showing the lagged impact of the previous eleven rate increases and assess the outlook for the economy,” Mr Groves said.

The inflation news came as RBA Governor Philip Lowe fronted the Senate Estimates hearing, where he suggested Australians get a housemate or stay living with their parents longer as a way of coping with the rental crisis.

According to the The Daily Telegraph, Dr Lowe told the hearing not enough homes were being built to keep up with population growth, which was tipped to rise 2 per cent as a result of international migration and the return of foreign students.

“Are there 2 per cent more houses? No,” he said.

“We need more people on average to live in each dwelling.”

Dr Lowe said one way to ease the rental crisis was for people to stay living with their mum and dad longer or to share a home.

“As rents go up, people decide not to move out of home, or you don’t have that home office, you get a flatmate,” Dr Lowe added.

“We do need people to economise on housing …. Kids don’t move out of home because the rent is too expensive, or you decide to get a flatmate or a housemate because that’s the price mechanism at work.”

Dr Lowe said the RBA tipped rental rates would rise about 10 per cent.

“It’s very tough,” he said.

“Some people are experiencing bigger increases than that (10 per cent figure). The bigger issue here is supply and demand. The vacancy rates are very low.”