In less than 25 years, a whole new industry has been created. Property Portals, these digital platforms that span the globe, aggregate property listings that serve as the primary advertising for the real estate industry.

To the consumer, this industry provides the most convenient method for searching properties for sale or rent, whether residential, commercial or industrial. Hundreds of millions of consumers every day.

In aggregate this industry of publicly traded and private companies approaches a collective market cap of something like $100+ billion across every corner of the globe.

The largest of the players would be Zillow with a market cap just nudging $10bn as it begins to eke out a decent (adjusted) EBIDTA which rose to 22% from just 2% the year prior on revenues of $1.1bn. This profitability, however, looks paltry as compared to the profit powerhouse of Rightmove in the UK which consistently exceeds 70% EBIDTA margins on revenues of $340m which is why it supports a market cap of $5bn.

The list goes on through the likes of the REA Group, ImmobilienScout24, VivaReal, Schibsted and many hundreds of others (including in NZ Trade Me and Realestate.co.nz). Suffice to say this business model of aggregating listings of real estate companies for consumer search supported by premium advertising and listings subscriptions makes for a very lucrative business, one that the incumbents will defend through constant innovation, as well as acquisition. However no industry is ever safe from disruption, especially digital platforms.

Whilst I don’t contend that the demise of these property portals is imminent, I do foresee a risk. A risk every bit as real as the global newspaper industry which became the victims of the property portal success as through the 90’s into the new century their real estate advertising goldmine, began to crumble and today has all but disappeared.

SO WHAT IS THIS RISK AND WHERE WILL IT LIKELY COME FROM?

To understand the risk you need to simply look at the portals’ role. They are an aggregator of both sides of the market in which they operate. They aggregated advertised listings and they aggregate a consumer audience. Their global success has been the ‘winner takes all’ model as the aggregation of the largest audience (although in most countries there is a #1 and a #2 leaving the rest in their wake), audience advantage guarantees dominance in listings, so begets the audience.

But stop for a minute and reflect as to the future of search, after all this is what a property portal is a search engine. The technology revolution for search is voice. The improvements of the past couple of years have been incredible and the next few years will take us forward beyond our current estimation. The reason why is the accelerated adoption of ‘home’ devices. The Amazon Echo, The Google Home and the Apple HomePod. For a moment ignore the latter and concentrate on the first two. They are the global powerhouses of search and artificial intelligence, coupled with the global reach that would surpass the local audience of any property portal.

So imagine a future state. You’re on the couch and with your Google Home you ask “Hey Google – what properties might I like to see this weekend” – the screen of your choice (TV/ Tablet / Glasses) then starts to display homes for sale open this weekend.

Let’s look at the mechanics of this scenario. Google Home is paired to your Google account so it knows so much about you – where you live, where you work, where the kids go to school, how far you drive on weekday and weekends, where your relative lives and your friends. Google knows what your style preferences are and what you have bought in the past few years to renovate or decorate your home, it also knows details of your finances and likely as not your mortgage.

So when you ask Google to show you what properties you would want to see this weekend, you don’t need Zillow / Rightmove / REA as intermediaries or their ‘simple’ search filters – location / beds / price.

Google has the listings inventory of every real estate company in every country, they have collated it for years in search logs. They have deep attribute knowledge of every house that has been advertised for over 15 years at least; they also every house’s estimated valuation. It knows the level of your interest in types of houses and more important the best match of you to your future house. So Google will deliver a portfolio that is personalised to a very fine degree for your review. However, it will never stop learning leveraging its vast AI capability to do this. Every comment you make when you see a property in this portfolio will be a key signal to adapt the portfolio to better meet your needs by style, condition, location and attributes. Every comment is also a signal which helps other Google customers who benefit from your comments. Should a new property hit the market via the local agency that is the perfect match, it will add this to the morning update it provides before you leave the house in the morning, and schedule a catch up with the local agent optimising you and your partner’s diaries.

This capability is real and achievable not just by Google but also by Amazon as they have a significant advantage in consumer engagement in a retail sense and richer installed base of Echos. Already more than 1 in 10 US homes has a voice-activated home device and that number will only accelerate this year.

What is the goldmine for these two behemoths? Well, Amazon for one has made that clear just this week – they are after the mortgage market. Real estate is at its heart actually just a vehicle for the far more lucrative finance industry as the largest consumer asset base globally. As for Google, well as an advertising company I think they can come up with ways to monetise the connection between the agent and the buyer that will boost Google’s stock by a healthy $100bn or more!

HOW DO PROPERTY PORTALS DEFEND AGAINST THIS FUTURE THREAT?

The smart ones recognise it and are heading down ancillary market routes. Zillow has been after mortgage origination for years, they have recently tested the iBuyer market, but I think the larger bet which has been on their radar for a number of years signalled by their Premier Agent platform is to become Zillow Realty as a broker of scale supporting hundreds of thousands of agents with an infrastructure to allow them to be truly independent contractors with no franchise aside from the Zillow brand. Interestingly Zoopla in the UK has already started earning more revenue from their uSwitch business than the portal space, they can see that the business model of a property portal may just have been an opportunistic industry that is surpassed by the next tech revolution.

The smart ones recognise it and are heading down ancillary market routes. Zillow has been after mortgage origination for years, they have recently tested the iBuyer market, but I think the larger bet which has been on their radar for a number of years signalled by their Premier Agent platform is to become Zillow Realty as a broker of scale supporting hundreds of thousands of agents with an infrastructure to allow them to be truly independent contractors with no franchise aside from the Zillow brand. Interestingly Zoopla in the UK has already started earning more revenue from their uSwitch business than the portal space, they can see that the business model of a property portal may just have been an opportunistic industry that is surpassed by the next tech revolution.

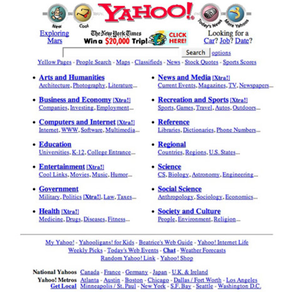

Interestingly for those that have the memory of the early internet period, there will be a familiar ring to the word portal, after all there was a time in the late 90’s when the river of gold of the early web day flowed from everywhere to Yahoo. Every pre-dot com startup gave up huge equity and most of their revenue to Yahoo to be the access point for their category of product or service as everything for the consumer started at Yahoo – how that once invincible portal has deflated over the past 20 years to a shadow of its former self, valued in ’98 at over $110bn and recently selling to Verizon for $4.5bn. An object lesson for today’s property portals perhaps?

The above article was written by Alistair Helm, and is republished with his approval. The article was originally published on Properazzi.