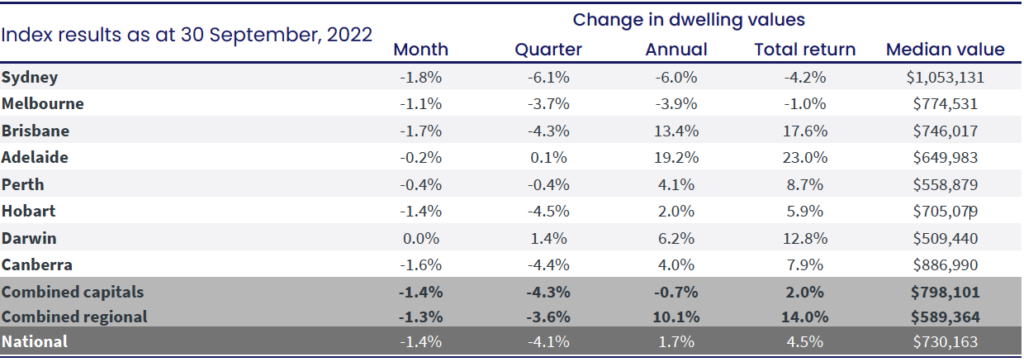

Across the combined capital cities, CoreLogic’s national home value index (HVI) recorded a 1.4 per cent decline in September, easing from a 1.6 per cent fall in August.

The result shows the declines in property values are losing some steam, but according to Core Logic Research Director Tim Lawless, it might be too early to predict that we’ve moved through the worst of the downturn.

Value decline has lost some pace in most cities

Housing value falls have accelerated in Adelaide and Perth this month; however, both cities continue to only record a mild reduction in values relative to the other capitals.

Sydney continues to record the largest falls, currently sitting 9 per cent below the January 2022 peak.

Darwin remains the only capital city where housing values have not yet trended lower, although properties remain 10.1 per cent below their 2014 peak.

Mr Lawless says that even though the declines have lost some pace, it’s probably too early to suggest the housing market has moved through the worst of the downturn.

“It’s possible we have seen the initial shock of a rapid rise in interest rates pass through the market, and most borrowers and prospective home buyers have now ‘priced in’ further rate hikes.

“However, if interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again.”

Spring vendors “wait and see”

While advertised stock levels across the country are also holding reasonably firm, the numbers show the traditional spring selling season is off to a slower start than usual; with the number of new listings added to capital city housing markets 12 per cent lower than last year.

Darwin and Canberra were the only exceptions to this, with both cities recording a higher-than-average flow of new listings over the past four weeks.

Mr Lawless says that it seemed as though prospective vendors are prepared to wait out the housing downturn rather than try to sell under more challenging conditions.

“We haven’t seen any evidence of distressed sales or panicked selling through the downturn to date; in fact, it has been the opposite, with the trend in newly listed properties continuing to diminish at a time when freshly advertised stock levels would normally be moving through a seasonal ramp up.”

“To date, the flow of new ‘for sale’ listings has actually trended lower as vendors retreat to the sidelines, a good indicator that homeowners are weathering the downturn,” Mr Lawless said.

But while the flow of new listings is seasonally low, total advertised inventory is holding firm in most regions, with advertised stock levels tracking 7 per cent higher than the same time last year.

Rental index rises also lose some steam

CoreLogic’s national rental index increased by 0.6 per cent in September, but that is the lowest monthly rise in rents since December 2021.

At the national level, rental growth moved through a peak in May 2022 with a 1.0% rise; since that time, the monthly pace of rental growth has been easing.

Mr Lawless says this slowdown in rental growth is “a little surprising”, given vacancy rates remain low, along with overseas migration once again on the increase.

“A gradual slowdown in rental growth in the face of such low vacancy rates could be an early sign that renters are reaching an affordability ceiling.

“Since the onset of COVID, capital city rents have risen 16.5 per cent, and regional rents are up 25.1 per cent.

“It’s likely renters will be progressively seeking rental options across the medium to high-density sector, where renting is cheaper, or maximising the number of people in the tenancy in an effort to spread higher rental costs across a larger household,” Mr Lawless said.