A new capital gains tax (CGT) reform proposal could reshape Australia’s housing investment landscape, with potential implications for developers, real estate professionals, and investors.

The McKell Institute, in a report co-authored by Professor Richard Holden and CEO Edward Cavanough, has urged the Albanese Government to overhaul CGT discounts to better incentivise new housing supply.

The plan, being submitted to next month’s federal productivity roundtable, comes as the national conversation intensifies around how to address Australia’s persistent housing shortfall.

The proposal: re-weighting CGT discounts

The McKell Institute’s proposal introduces a differentiated structure to capital gains tax discounts that aims to redirect investor interest towards new construction:

- Increase CGT discount on new attached dwellings (e.g. apartments, townhouses) to 70%

- Reduce CGT discount on existing detached homes to 35%

- Leave CGT discount on new detached dwellings unchanged at 50%

- Grandfather existing investments, preserving their current tax treatment. The new laws would only apply to new properties purchased.

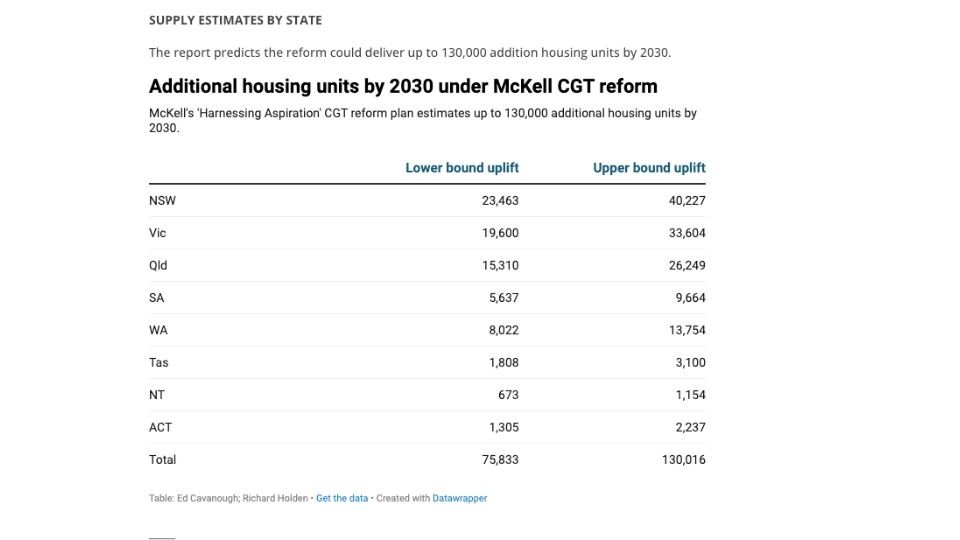

Modelling by the Institute suggests this approach could result in up to 130,000 additional homes by 2030, a projected 1.2% uplift in supply, enough to help bridge the gap between current output and the federal target of 1.2 million new homes by the end of the decade.

The release of the proposal coincides with preparations for Treasurer Jim Chalmers’ long-anticipated economic roundtable in Canberra next month, aimed at building consensus on long-term reform.

Mr Chalmers has said the government is “not looking at” CGT changes currently, but acknowledged there is growing “appetite” for fresh policy ideas.

Notably, internal pressure is mounting within Labor, with the grassroots group Labor for Housing also backing a reduction in CGT concessions as a way to boost new supply.

“The CGT discount is neither good nor evil, but it should be better calibrated to achieve our social aims,” Mr Cavanough said.

“We have to stop seeing capital gains tax reform as a political no-go zone and start seeing it as a practical lever to fix the supply side of the housing crisis.”

Currently, investors who hold a property for more than 12 months pay tax on only 50% of their capital gain.

The proposed changes would increase this discount for new builds, particularly medium-density housing, while reducing it for existing stock, especially older standalone homes.

Government figures show that more than half the CGT discount benefit goes to the wealthiest 10% of Australians, adding weight to the argument that current settings entrench inequality rather than boost supply.

Importantly, the sale of a principal place of residence remains CGT-exempt, and the proposed changes would not affect owner-occupiers.

If adopted, the reforms could bring a significant shift in market behaviour. Key takeaways for industry include:

- Increased investor demand for off-the-plan and newly constructed dwellings, particularly in urban infill areas and medium-density projects.

- Potential cooling in investor interest for existing detached housing, where reduced CGT incentives may impact pricing and resale strategies.

- Policy-driven tailwinds for apartment and townhouse developments, especially in metro markets aligned with state and local densification plans.

Professor Holden noted that investors’ desire to secure their financial future isn’t the issue, “but this desire should be harnessed to achieve national objectives on housing supply.”

The federal government’s 1.2 million homes by 2030 target translates to approximately 220,000 dwellings per year.

Yet with only around 160,000 new homes built annually, that pace has been met just once since 2023.

Treasury itself has expressed scepticism that the target will be met under current policy settings.

Without intervention, the gap is expected to widen, fuelled by labour shortages, elevated construction costs, and mismatched planning frameworks.

The capital gains tax proposal will be tabled at the roundtable, where Mr Chalmers has committed to “listening respectfully” to ideas, despite previously ruling out immediate CGT changes.

Whether the reform gains traction remains to be seen, but for property professionals, the signals are clear: tax settings are firmly back in the frame as a lever for reshaping investor demand and accelerating housing construction.