Australia’s housing market is gaining ground once again, with all eight capital cities recording house price growth in the June 2025 quarter, the first time that’s happened in four years, according to Domain Group’s latest House Price Report.

The upward momentum comes despite the Reserve Bank of Australia’s decision to hold interest rates steady at 3.85% in July.

While some had anticipated a rate cut, renewed buyer confidence, ongoing affordability in certain segments, and persistently low housing supply are keeping prices on the rise.

“The housing market continues to outperform expectations, despite cost-of-living concerns and economic uncertainty,” said Domain’s Chief of Research and Economics, Dr Nicola Powell.

“But the road ahead may be uneven. Next month’s RBA decision will be one to watch; another rate cut could expand borrowing capacity, though regulators may tread carefully if investor activity accelerates.”

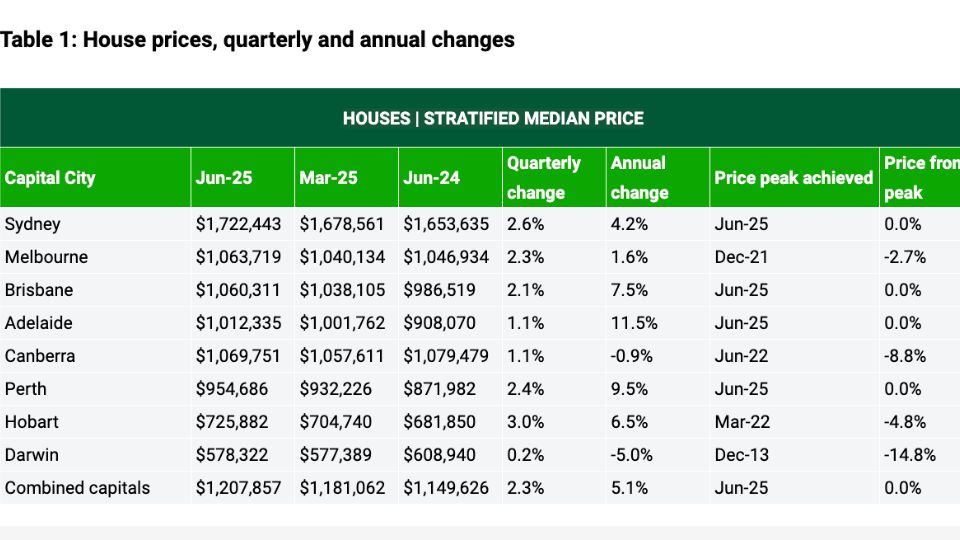

House prices hit new highs in four capitals

Sydney led the capitals with a 2.6% quarterly rise in median house prices, reaching a new high of $1,722,443, its strongest growth in two years.

Melbourne followed with a 2.3% rise to $1,063,719, its highest level since 2022 and now tracking toward record territory by mid-2026.

Brisbane, Adelaide, and Perth all posted fresh price peaks.

Perth’s median house price rose to $954,686, leaving it just $45,314 shy of crossing the symbolic $1 million threshold.

Perth remains one of the few capital cities where early movers can still buy below $1 million, a window that may close soon.

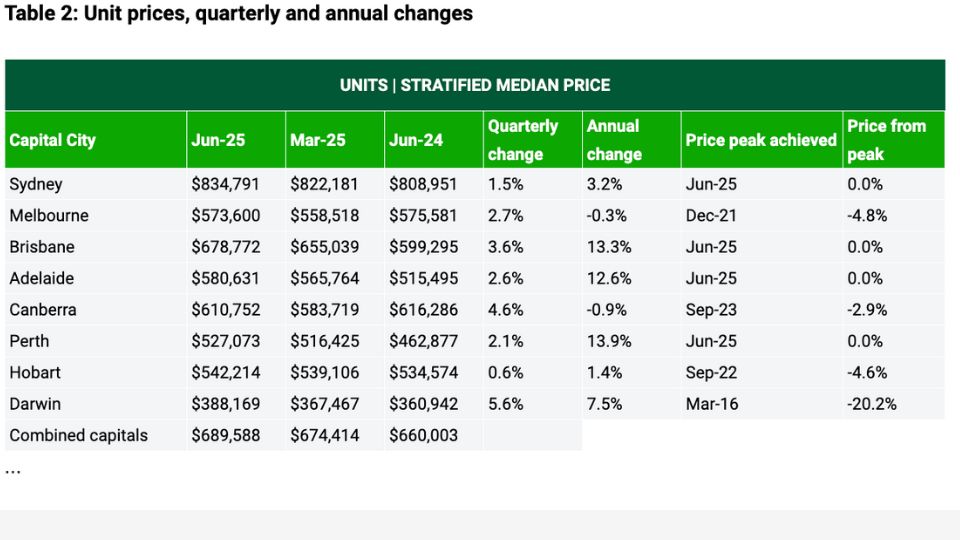

Unit prices rebound across the board

National unit prices also rebounded, recording their strongest quarterly growth in two years and climbing to a new high of $689,588.

Unit markets in Sydney, Brisbane, Adelaide, and Perth all reached record levels, as buyers turned to more affordable options.

Brisbane’s unit market is now in its longest-ever run of growth, while Adelaide has seen nine straight quarters of rising values.

Darwin led the capitals with unit prices up 5.6% to $388,169, reaching an eight-year high.

Canberra followed with a 4.6% increase to $610,752, marking its best quarter in nearly two years.

Supply remains the wildcard

While buyer activity has clearly returned, Dr Powell flagged limited housing supply as the biggest ongoing challenge.

“Supply remains the key wildcard. We’re still not building fast enough to meet population growth,” she said.

“Without a substantial boost in new housing, price pressures will remain, regardless of further rate cuts.”

As attention turns to the RBA’s August meeting, all eyes will be on whether the central bank maintains its cautious stance, or signals the start of a new easing cycle.

For now, the market appears to be moving ahead on momentum alone.