CoreLogic research analyst Cameron Kusher comments on data released by APRA earlier the week showing LVR lending is easing up with a further slowdown expected.

Data released by the Australian Prudential Regulation Authority (APRA) earlier this week has shown that high loan to value ratio (LVR) lending continues to fall indicating new buyers are in many instances using larger deposits. The latest authorised deposit-taking institution (ADI) property exposures data for the March 2017 quarter revealed the ongoing trend as a moderate pull-back in the share of new interest-only mortgage lending however, there will be a lot more work to do for lenders in this space.

The data showed that over the March 2017 quarter there was $89.257 billion in mortgage lending from the ADIs which was the lowest quarterly value of lending since the same quarter last year. Of course, part of this is seasonal due to the Christmas / New Year slowdown and lending over the quarter was 9.5% higher than the corresponding quarter last year. Over the quarter 65% of lending was to owner occupiers ($58.009 billion) with the remaining 35% ($31.248 billion) to investors. The value of lending to owner occupiers was 3.9% higher year-on-year while investor lending was 21.7% higher.

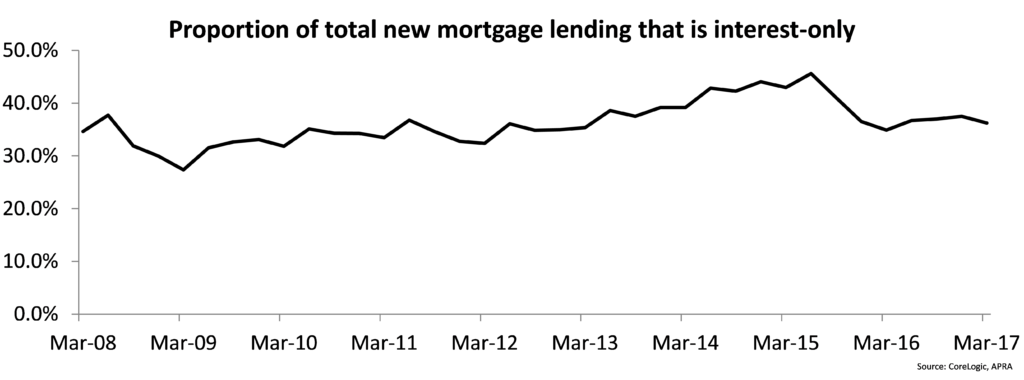

There is currently a big focus on interest-only lending with APRA recently announcing policy changes which limit the value of new interest-only lending to less than 30% of the flow of total new mortgage lending. Over the latest quarter, 36.2% of the value of total mortgage lending was for interest-only purposes signifying that further rationing of this type of lending is required. Although as a proportion of total lending interest-only lending has slowed, the value of this type of lending has increased by 13.8% from the same quarter last year. Importantly, interest-only lending peaked at 45.6% of the value of total new lending over the June 2015 quarter, so as a proportion of total lending it has already fallen substantially but has quite a way further to slow over the coming quarters as lenders work to meet the new 30% APRA benchmark by rationing the availability of this type of mortgage.

Low documentation ($377 million), non-standard ($142 million) and outside of serviceability loans ($1.461 billion) accounted for a cumulative 2.2% of new lending over the quarter. Although this was an historic low proportion, it should be noted that in value terms, low documentation (+42.5%) and non-standard (+21.6%) loans have increased over the year while outside of serviceability mortgages are -59.4% lower.

Over the quarter, $6.896 billion in new mortgages written had an LVR of greater than 90%. This represents the lowest value of new mortgage lending for LVRs above 90% since March 2011. It also indicates that 90% + LVR mortgages accounted for just 7.7% of all new mortgages over the quarter which was an historic low proportion. If you look at new mortgages with an LVR greater than 80%, they accounted for 22.0% of lending which is also an historic low. This indicates that borrowers are using either larger deposits upon entry to the market or using greater equity in their existing properties.

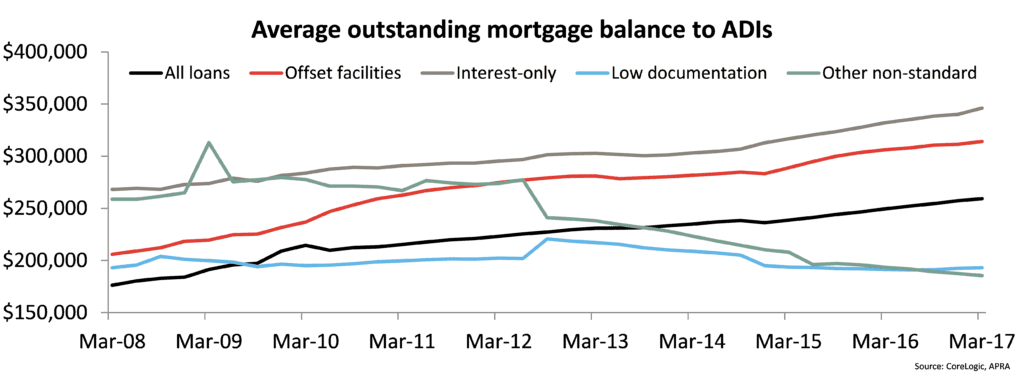

According to the data, the average outstanding mortgage balance was recorded at $259,400 at the end of March 2017 which was 0.8% higher over the quarter and 3.9% higher over the year. By loan type, the average outstanding balances were recorded at: $314,100 for loans with an offset facility, $346,100 for interest-only mortgages, $100,100 for reverse mortgages, $193,100 for low-documentation loans and $185,600 for other non-standard loans. Other non-standard loans were the only mortgage type to see a fall in outstanding balance over the year, -4.0% lower while the average outstanding balance for interest-only mortgages recorded the greatest rise, 4.2% higher.

The reduction in new lending to higher LVR borrowers is encouraging from a risk perspective with borrowers typically utilising larger deposits. While the proportion of lending for interest-only purposes has slowed, it has much further to fall over the coming quarters as lenders seek to reign interest-only lending in to less than 30% of the new flow of lending. With interest-only lending favoured by investors it may lead to a slowing in demand from this segment. Keep in mind that borrowers utilising interest-only mortgages are assessed on their ability to repay a principal and interest loan. Given this there is the possibility that the impact on investor demand may be minimal as they choose to just use a principal and interest loan rather than interest-only.

Investors face a broadening range of disincentives in the market, with mortgage rates for investment purposes up more than 25 basis points compared with their low point last year, record low rental yields and overall tighter credit policies from lenders. Additionally, there seems to be growing acceptance that the housing market is losing some momentum which is likely to further weigh on investor purchase decisions.