Despite the ongoing attention on mortgage holders hit with higher interest rates, renters are the ones that are far worse off, according to new research.

According to research from RFI Global and DBM Atlas, Australian renters are struggling with rising rents and don’t have the savings buffer in place to support themselves like many homeowners do.

RFI Global Chief Product Officer Alex Boorman said renters have only been able to save roughly $5000, on average, since the start of Covid, compared to the $19,000 enjoyed by homeowners.

“These findings highlight the fact that renters are a segment facing financial stress due to lower savings buffers,” Mr Boorman said.

“While interest rate increases do not impact renters as directly as mortgage holders, there are indirect impacts to renters – in particular, rising rental costs as landlords ‘pass on’ rate hikes to their tenants.

“Renters are also facing cost-of-living pressures.”

RFI data shows that the primary concern for non-mortgage holders is inflation (75 per cent), followed by the rising cost of housing (62 per cent).

The proportion of non-mortgage holders concerned about cash rate increases has also increased over time, up to 42 per cent in March 2023.

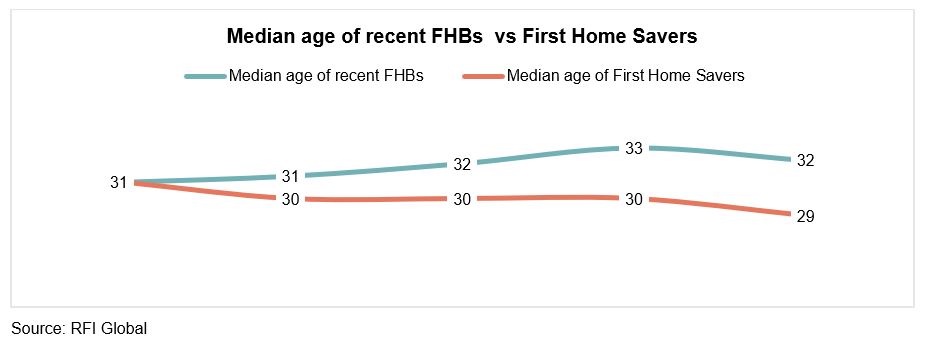

On the back of higher home prices, rising interest rates and the surging cost of living, the research found that Australians are taking out their first home loan later in life.

While the median age of consumers saving for a deposit has declined over time – creating more opportunities for disillusionment with the process.

Mr Boorman said during Covid there was a significant increase in younger consumers saving for a house deposit, in particular among savers under 25.

“Between March 2020 and August 2022, the proportion of savers under 25 who reported a house deposit as their primary savings goal almost doubled, from 18 per cent up to 30 per cent,” he said.

“However, in early 2023 we saw a reversal of this trend, with a significant decline in saving for a deposit among savers under 35.

“Looking at the big picture, this could reflect a sense among prospective buyers that affordability is slipping away from them and the barriers to entry are too high (unaffordable house prices, cost of living and interest rate hikes), as well as the renewed opportunity to use their disposable income on activities that weren’t available to them during the pandemic (travel, social activities, events etc).”

According to the research, the challenge of entering the property market comes in a number of forms, which are interconnected.

One-quarter of savings account holders indicate the top barrier to buying a home is affording the property in the first place, followed closely by saving for a deposit (24 per cent) and interest rates being too high (20 per cent).

The proportion of customers saving towards their first home, who see saving for a deposit and interest rates to be key barriers, increased significantly in the past three years since the initial onset of the pandemic in March 2020.

“When there is the perception that house prices are increasing faster than people can ever possibly hope to save, there is also the likelihood some will just give up on the dream of home ownership,” Mr Boorman said.

“Rising rates have negatively impacted affordability and put simply, people are no longer able to borrow as much as they could before.

“It’s an incredibly hard market to enter, and renters are understandably put off.”

The research found that first-home buyers are likely to turn to a broker for advice first when exploring their home borrowing capability (43 per cent), followed by friends/ family (25 per cent) and financial institution websites (24 per cent).

According to RFI Global data, challenges to housing market entry can be addressed in a number of ways – including, providing a lower minimum deposit requirement (63 per cent), lender-provided information on government grants buyers may be eligible for (42 per cent) and offering guidance to customers through the home buying journey or providing additional information about the market (35 per cent).

While they also found that lenders can better assist home buyers with sound advice, and guidance on financial position could benefit both a lender and their customer.