While office vacancy rates are rising in Sydney and Melbourne, demand has lifted Queensland and Western Australia according to an expert.

A heavy pipeline of new supply is also impacting vacancy rates right across the country.

Ray White Commercial Head of Research Vanessa Rader said when considering the change in occupied stock or net absorption, it’s clear that there has been a swing towards both Queensland and Western Australian markets.

“Brisbane CBD has come out on top recording 71,000sq m of new activity over the year, after a number of difficult years for the CBD,” Ms Rader said.

“Further adding to the Queensland story has been the reduction in ‘For Lease’ signs across the Brisbane fringe, taking up 45,573sq m, and Gold Coast 12,132sq m.

Ms Rader said the rapid population growth in Western Australia had also spurred the need for office space.

“The Perth CBD has recorded 29,379sq m of new tenancies this past 12 months, while West Perth has been a quiet performer, increasing its occupancy by 16,607sq m,” she said.

While the smaller markets have been seeing strong demand, both Melbourne and Sydney continue to struggle to attract people back to the office.

Melbourne CBD has fared the worst, losing 83,000sq m of occupants over the past 12 months, Sydney CBD is not far behind, down 59,911sq m.

She said office occupancy levels have taken a dive in many East Coast markets as employers grapple with hybrid working styles becoming the new norm, while high supply continues to hamper some markets.

Ms Rader said that while demand has been mixed, it’s also important to factor in the pipeline of new supply coming online.

“The continued movement in stock levels plays a pivotal role in the health of an office market, impacting the overall vacancy level and in turn impacting rents, incentives and values of assets,” she said.

“For most markets, these strong levels of absorption have been overshadowed by a strong supply pipeline, adding office stock into the market and keeping vacancy levels elevated.

“There has been much discussion on the volume of new stock completed and still in the pipeline for the Sydney and Melbourne CBDs, hampering their improvement, however, this development of new stock is not restricted to these states. “

She said while Brisbane CBD has been one of the only markets to see vacancy declines, it has enjoyed a combination of both strong take-up and limited net supply additions of close to 19,000sq m.

“With more than 150,000sq m expected to be added to this market over the next few years, a prolonged high vacancy is anticipated,” Ms Rader said.

“For markets such as Brisbane fringe and Perth CBD, impressive absorption of stock has been overshadowed by high new supply completions, resulting in the upward movement in vacancies.”

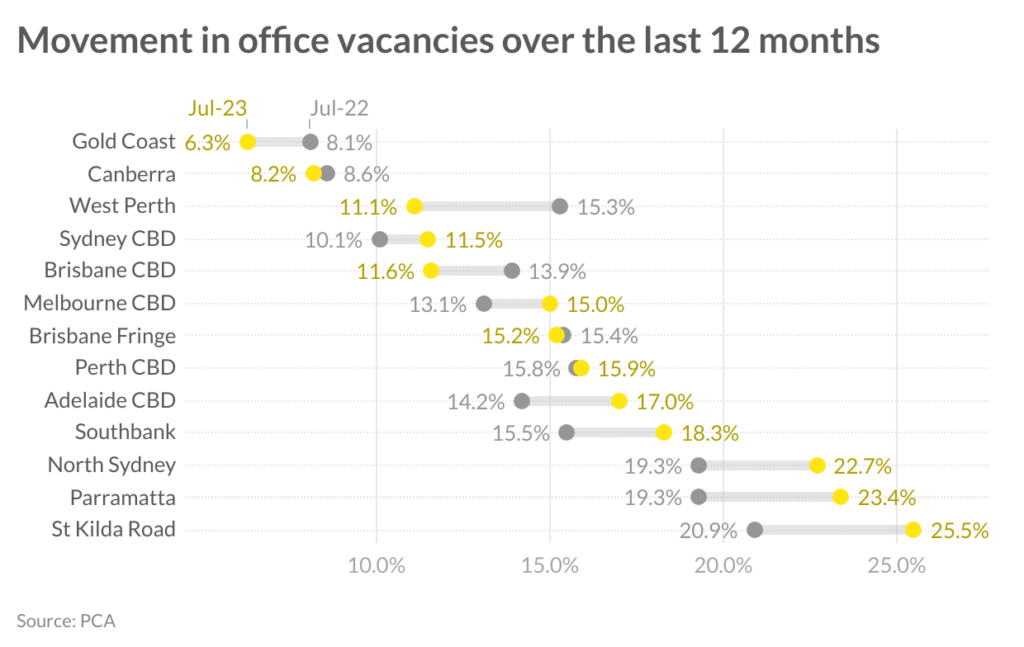

According to Ms Rader, markets such as Gold Coast and Canberra have had limited change to stock levels, resulting in vacancies falling to 6.3 per cent and 8.2 per cent respectively – the lowest vacancy markets in the six months to July 2023.

West Perth has also benefitted from both space contraction and new tenancies, reducing vacancy to 11.1 per cent, which is an eight-year low.

She said while both Sydney and Melbourne CBDs have had net supply additions, they have only been small, at 16,093sq m and 15,182sq m, compared to the negative take-up recorded.

This has seen both cities face vacancy rates increasing to 11.5 per cent and 15 per cent.

While many of the suburban markets such as Parramatta, Macquarie Park and North Sydney, have seen new office completions further hindered their recovery and added to the divide between prime and secondary assets.