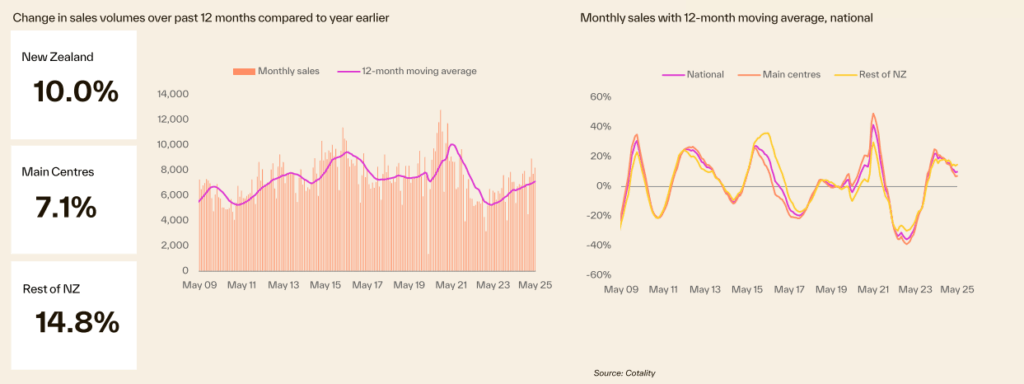

According to Cotality’s June Housing Chart Pack, sales volumes in May were 16 per cent higher than the same month last year, marking the 24th rise in the past 25 months.

The total number of sales reached 8,218, approximately 5 per cent above the 10-year May average.

Cotality Chief Property Economist Kelvin Davidson said the ongoing lift in sale volumes indicates improving market confidence.

“Property sales have been gradually trending upwards for around two years now, and activity is back at normal levels, or even slightly above,” Mr Davidson said.

It’s not a boom, but it’s clear that confidence is slowly returning, undoubtedly supported by falling mortgage rates.”

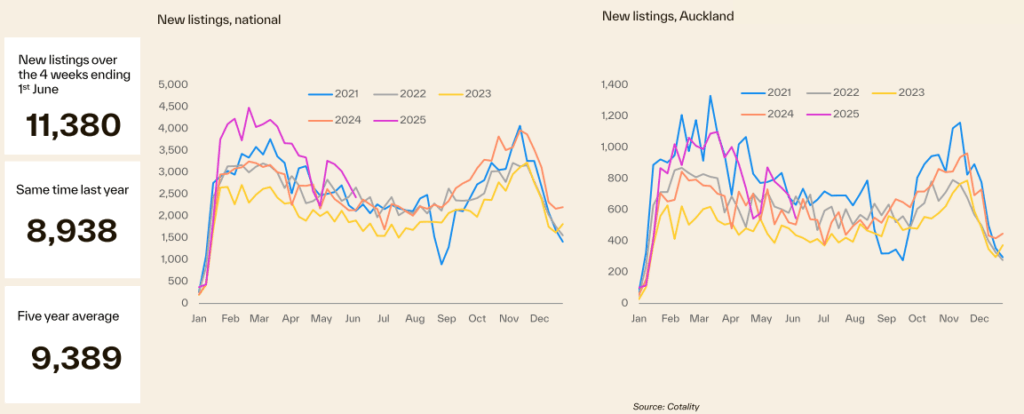

Despite the increased sales activity, for-sale listings remain high, with new listings continuing at a solid pace in recent weeks.

Mr Davidson said this abundance of available properties is giving buyers significant negotiating power in the current market.

“New listings have generally tracked in line with typical seasonal patterns this year, though April’s extended holiday break did cause a temporary dip,” he said.

“As the market now enters the traditional winter lull, listing activity is likely to remain muted until it picks up again in Spring.”

Mr Davidson said the stronger sales volumes have begun to slightly reduce total stock levels in recent weeks.

However, the total number of properties listed on the market is still 20 per cent above the five-year average.

Most areas across New Zealand are now showing a decline in total properties listed for sale compared to the same time in 2024, although Canterbury and Otago have not yet joined this trend.

The CoreLogic Home Value Index shows property values across New Zealand edged down by 0.1 per cent in May.

Over the three months to May, there was also a 0.1 per cent dip in median property values across the country.

New Zealand’s residential real estate market is currently valued at a combined $1.64 trillion, with total sales over the 12 months to May reaching 85,395.

The rental market is also experiencing subdued growth, with net migration having fallen significantly from its peak and the stock of available rental listings remaining elevated.

Gross rental yields now stand at 3.8 per cent, the highest level since 2015-16, offering some positive news for property investors in the current market.

The Official Cash Rate (OCR) has been reduced to 3.25 per cent following May’s 0.25 per cent cut, with inflation now back within the 1-3 per cent target range.

According to Reserve Bank figures, the average rate being paid on existing fixed loans is approximately 5.9 per cent, while prevailing rates are now about 1 percentage point lower.

“While we’re starting to see listings come down, they’re still well above average in many markets,” Mr Davidson said.

“That means price growth is likely to remain contained in the short term.”