Since the start of the pandemic, Australian house prices have skyrocketed, rising by almost 24 per cent and remaining at record highs.

Until now, prices have continued to rise. According to Ray White Chief Economist, Nerida Conisbee, growth over the past three months has been higher than the previous three.

But while on most metrics, there is little evidence of a significant slowdown, in Ms Conisbee’s latest Ray White Now market report, she said we’re heading into a relatively uncertain 2022.

“Borders are reopening and the economy is bouncing back, but with it, rising inflation and the potential for an earlier than anticipated interest rate rise,” Ms Conisbee said.

“Regulators have started to step in to control credit growth and there may be more restrictions on the horizon.”

The market is still strong but with uncertainty rising, the start of finance restrictions now in place, and continued talk of interest rate rises, Ms Conisbee shares her seven key predictions for 2022.

More price growth

While the commentary around price falls is again ramping up, Ms Conisbee said the reality was that at this stage it’s looking unlikely prices would see a sharp decline in 2022.

“We’re heading into a period of strong economic growth, rather than a recession, and business and consumer confidence is high,” Ms Conisbee said.

“Nevertheless, it’s unlikely that we will continue to see the same rate of growth over the next two years that we have seen over the past two years.”

Barring an unforeseen event, there are three things that could slow the market, she said.

“The first is an increase in the number of properties for sale, the second is an interest rate rise and the third are heavy restrictions on finance,” Ms Conisbee said.

“The number of properties for sale has picked up over the past few months, primarily because lockdowns have now ended.

“Already this appears to be slowing the market – days on market have increased and we’ve seen a slight drop in average active bidders at auction.”

An interest rate rise may occur however it’s still too early to tell whether there will be one before the date expected by the RBA of 2024.

“The key indicator to watch is inflation – this is expected to be higher than usual in coming quarters but this is widely expected to be temporary. If that’s the case, then there won’t be an interest rate rise in 2022,” Ms Conisbee said.

“Finally, restrictions to finance have started however at this stage are relatively light touch. It’s likely that further restrictions will be put in place early next year, particularly if investor lending does not slow. Positively, APRA are moving carefully with regards to this.”

Regional shift to continue but at a less rapid rate

Since the start of the pandemic, we’ve seen the biggest move of Australians to regional areas ever recorded, the report said.

“The largest increases in population as a result of this shift were seen in regional Queensland, New South Wales and Victoria,” Ms Conisbee said.

“The shift was driven by strong mining and agricultural conditions, a lifestyle shift that came about from changes to the way people work, greater demand for second homes and the search for space.”

Many of these will change in 2022 and as a result, Ms Conisbee said it was unlikely we’d see the same strong conditions we saw over the past two years in regional areas continuing over the next two years, though the regional shift would continue.

Northern migration to continue

Freed from the constraints of an office commute, cashed up with high savings rates and able to access cheap finance, people and money flowed northwards, culminating in very strong conditions in South East Queensland, as well as Northern New South Wales.

“It’s likely that the northern migration will continue into 2022. Even with closed borders and extended lockdowns, we saw very high levels of movement of people from Sydney and Melbourne up to the Gold Coast, Sunshine Coast and Brisbane,” Ms Conisbee said.

“Open borders will enable people to move up there more easily. Add to this positivity off the back of employment growth and the Olympics, as well as tougher economic conditions in Melbourne particularly, and this part of Australia is looking particularly positive.”

Luxury property to continue to be a strong performer

Demand for luxury property hit record highs in 2021, said the report, driven by the same factors that drove the rest of the property market, as well as some sectors of the economy that benefited from the pandemic.

“It’s unlikely that any part of the residential property market will do better in 2022 than it did in 2021 and luxury property is no exception,” Ms Conisbee said.

“It’s however less likely to be influenced by restrictions to finance which is set to be the main driver of a slowdown in early 2022.”

Revitalisation of our CBDs

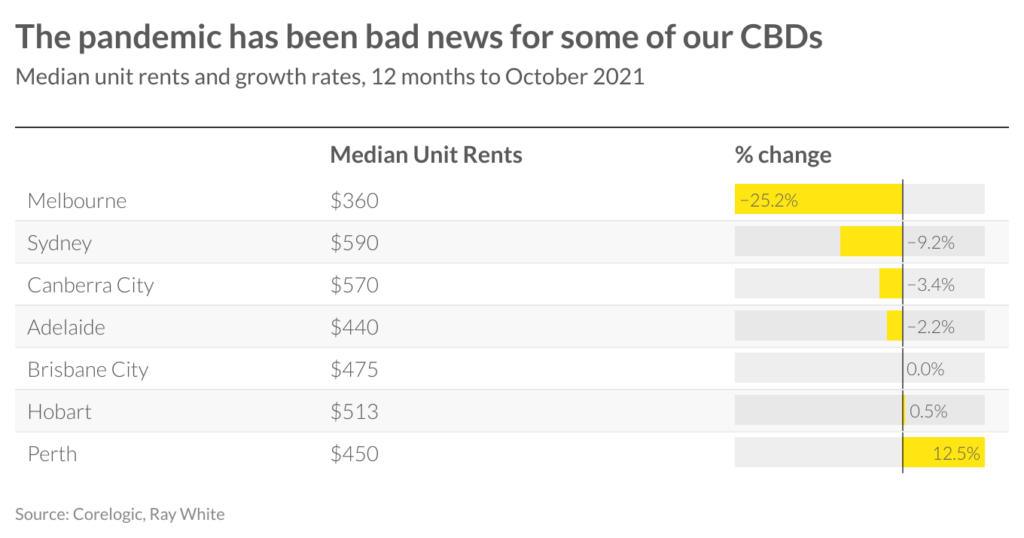

Property markets in our CBDs have been the hardest hit of all as a result of the pandemic.

“Office, retail and residential vacancies rose in many CBDs as office workers stayed home, overseas students were locked out of the country and some of our vibrant and exciting CBDs became ghost towns,” Ms Conisbee said.

“In 2022, we are going to see a return of our CBDs. Much of the return will be driven by market factors – office workers will return, retail and entertainment venues can now reopen and foreign students are coming back.

“It will however be helped along by a strong focus by local councils in getting activity back into our central areas.”

Rental acceleration to gather pace as borders reopen

Ms Conisbee said one of the more surprising impacts of the pandemic, given that we had seen more people leaving Australia than arriving, had been the sharp rise in rents in some locations.

“While international migration was paused during the pandemic, we did see high levels of interstate and intrastate migration to regional areas and to South East Queensland,” she said.

“Borders reopening will increase demand for rental housing. When people move to a country or region, most rent first.

“In addition, foreign students are returning which will also increase pressure on unit rents close to education facilities.

“As to how much, it will depend on the pace of international migration, as well as how interstate migration trends change.”

Construction costs to moderate as supply blockages become unstuck

Construction costs were a major component of high inflation in the September quarter, the report showed.

“While prices rose by 3 per cent overall, new dwelling purchases rose by 3.3 per cent with the higher than average increase driven by supply disruptions and a shortage of materials,” Ms Conisbee said.

“It’s likely that these higher costs will continue in the first half of 2022 and may also be exacerbated by high wages costs and stockpiling of materials.

“By the second half of the year, it’s likely that many of the supply disruptions will have flowed through and construction costs will start to moderate.”