Commercial assets have been the battling rising interest rates in 2023, however, industrial assets have managed to see strong ongoing demand.

Ray White Commercial, Head of Research, Vanessa Rader said while total returns across commercial assets remain mostly positive in 2023, this has been propped up by stability in income returns, while capital returns have fallen into the negative for all asset types, with the exception of industrial.

“Industrial, despite seeing upward momentum from this record low cap rate, remains the most sought after asset class keeping yields averaging just 4.6 per cent this period,” Ms Rader said.

“Distribution/ logistic assets and industrial parks recorded the lowest cap rates at 4.5 per cent, with lack of stock and the stable income streams associated with these assets remaining attractive to investors.

“Sydney continues to attract the tightest yields at 4.4 per cent followed by Victoria and Queensland at 4.6 per cent and 4.8 per cent respectively.”

She said that while the sizable rental growth over the past few years has slowed, capital returns remain positive across most regions.

“Sydney is leading the charge, up 5.1 per cent in June 2023, while Melbourne is the only market to record an annual decline of 0.2 per cent,” Ms Rader said.

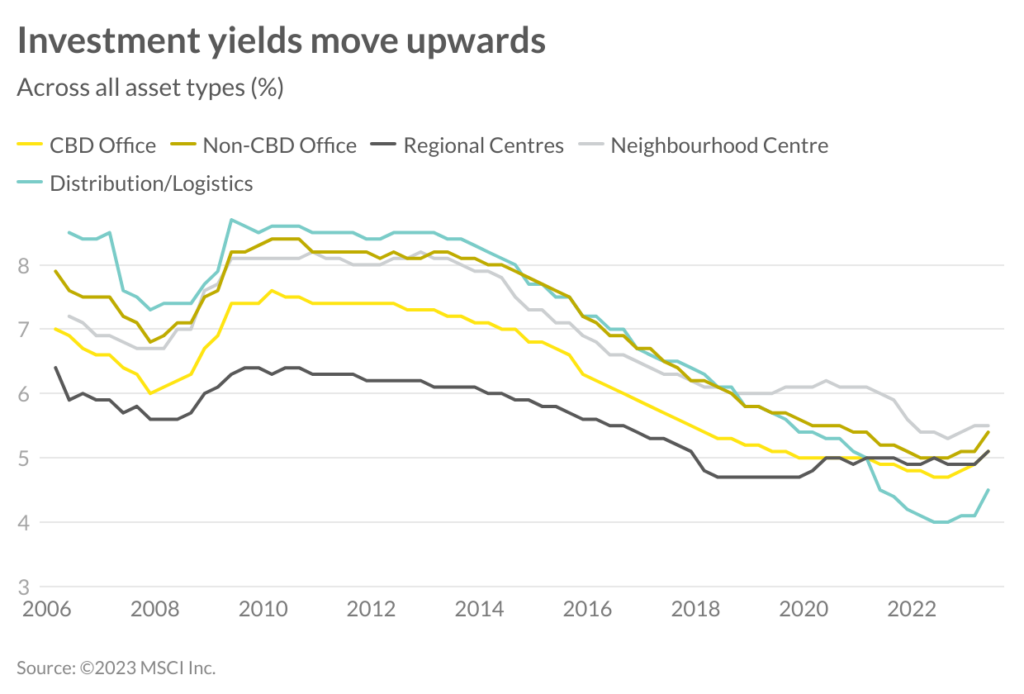

“Investment yields for industrial have seen the tightest rates on record, with some types featuring cap rates in the sub 4 per cent range, after historically being the highest yielding asset class of the traditional commercial investment classes.”

While industrial continues to lead the way, Ms Rader said that retail as an investment class has been through a prolonged difficult period.

“Competition from online trading has caused issues for brick-and-mortar retail which has kept returns below other commercial asset types,” she said.

“While returns did see some resurgence over the last few years, where sales activity peaked, these have again moved downwards despite the consistency of income return.”

She said that in June 2023, the average retail capital return fell to 2.7 per cent.

“No state has been immune to the changing fortune for retail with capital returns ranging from -0.7 per cent in Victoria to -6 per cent in Western Australia,” she said.

“All segments of retail have been impacted by these capital changes, from larger super and major regional centres (-1.9 per cent) through to neighbourhood (-4.4 per cent), however, income returns remained steady at 5.3 per cent and 5.2 per cent respectively.

“Larger retail centres have kept somewhat stable yields given the institutional nature of ownership, however, neighbourhood centres have seen some upward movement, with cap rates now averaging 5.5 per cent.”

According to Ms Rader, the office sector is also facing significant difficulties spurred on by work from home trends.

“Low unemployment and office supply are adding to the difficulty for this sector, which has been hampered by the high vacancy environment, resulting in strong incentives impacting effective rental rates,” she said.

“CBDs have seen greater change in total returns at -2.3 per cent while non-CBD sits at -1.3 per cent.

“Again some stability in income is keeping these rates elevated while capital losses average -6.5 per cent and -6.1 per cent respectively.

“Canberra, Sydney and Perth CBDs recorded some of the poorest results with capital returns recording -11.1 per cent, -7.2 per cent and -6.4 per cent respectively, while in non-CBD markets, Parramatta has been hard hit at -13.2 per cent.”

Ms Rader said office and its highly listed ownership, particularly in CBD markets, have yet to show sizable cap rate increases, with limited transactions keeping rates low.

“Sydney and Melbourne CBDs achieved the lowest rates at 5 per cent, while Perth CBD sat at 5.8 per cent,” she said.

“Across non-CBD markets most rates have moved back to early 2021 levels with Brisbane Fringe at 6.2 per cent and North Sydney at 5.2 per cent.”

Ms Rader said looking ahead the expectation of further cap rate growth across all asset types is anticipated, regardless of movements to interest rates.

“Investment into commercial property and the risks associated will see buyers more considered over the short term, keeping upward pressure on investment yields,” she said.