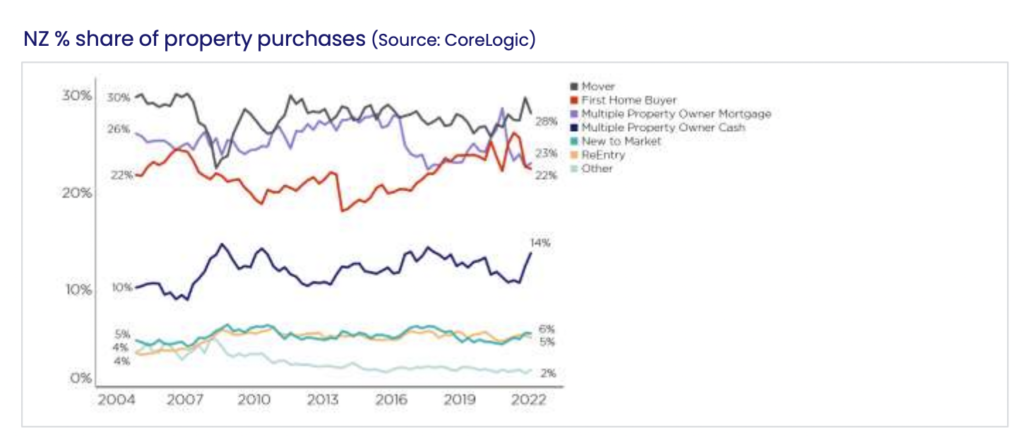

Cash buyers who own multiple properties are on the rise across New Zealand according to new data from CoreLogic.

The CoreLogic Buyer Classification data for May shows cash buyers who own multiple properties have equated for a steady increase in market share, rising from as low as 9 per cent in October 2021 to 14 per cent across April and May this year.

CoreLogic NZ Chief Property Economist Kelvin Davidson said buyers with a strong equity base were making the most of market conditions and better affordability.

“In an environment where credit is harder to secure and mortgage rates have risen sharply, as well as some potential ‘bargains’ starting to emerge, it stands to reason that people with larger equity bases and/or buying with cash would be enjoying the current conditions,” Mr Davidson said.

“It wouldn’t be a surprise to see continued (relative) strength in the market for buyers with a greater equity base behind them – they can take their time and negotiate hard.”

The proportion of first-home buyers entering the market continued to rise, up to 23 per cent from 22 per cent the prior month. However, their levels remain lower than in late 2021.

“The reasons for lower FHB market share this year are easy to find – such as stretched affordability, tight availability of low deposit mortgages, the CCCFA changes, and no doubt an active pull-back from the market by some would-be FHBs as they try to hunt out a bargain later down the track,” he said.

Owners looking to move or relocate softened in May, down to 27 per cent from April’s 29 per cent, making Q2 to date weaker than Q1 (30 per cent).

“Even though there is plenty more choice now available for would-be movers, some may have started to think twice about what higher mortgage rates might mean for their finances if they ‘traded up’ and took on more debt,” Mr Davidson said.

“There may also be concerns about whether or not they can sell their current property too.”

Homeowners with multiple mortgaged properties remained steady over the month at 23 per cent, following the cyclical peak of 29 per cent in the first quarter of 2021, which occurred prior to the 40 per cent deposit requirement and the removal of interest deductibility.

“While mortgaged multiple property owners’ (MPOs) share is lower than it used to be, it’s still worth noting that they haven’t deserted the property market altogether,” Mr Davidson said.

“Indeed, almost one in four buyers are still in this category, with some investors/MPOs clearly able to find enough convincing reasons to buy property, with higher yielding stock and/or newbuilds potentially a target.”

Mr Davidson said the amount of equity a property buyer currently has will be an important factor going forward.

“For those with more debt, the looming prospect of higher mortgage payments (about 48 per cent of NZ loans are currently fixed but due to reprice in the next 12 months) will be a concern,” he said.

“Mortgaged MPOs will at least be encouraged by the postponement of any official caps on debt to income ratios (DTIs), given that they borrow at high DTIs much more frequently than other groups.”