For most real estate principals, the rent roll is a necessary compromise. It ties up staff, generates relentless email traffic and sits under a thicket of compliance rules.

Yet it is hard to walk away, because every management is also a relationship with a landlord, and perhaps one day, a listing.

Sydney-based firm Crossub has built an entire business around that tension.

The company runs as a white-label property-management support partner, taking on the back-office workload while leaving agencies firmly in charge of their clients and brand.

“Agents are sick of the management on the properties because they’re not really making much from it,” says co-founder Geng Xu.

“They want the landlord database, they want to sell the properties, not be buried in emails and routine inspections.”

Geng and his co-founder, Haoyue Guan, have built Crossub over just three years, growing it to more than 4000 managed properties in New South Wales, expanding into Victoria and Queensland, and preparing to turn on a portfolio of 600 homes in Oxford in the United Kingdom.

Until now, that growth has come without a traditional marketing push; most clients find their way to the business through referrals.

Ask any property manager about their day, and the word that usually comes up is “emails”.

Rent arrears, maintenance requests, tenancy applications, inspection notices, complaints, questions: much of the job is triaging and replying.

AI as the Operating Backbone, Not Just an Inbox Tool

Crossub manages around 4,000 properties across New South Wales, a scale that naturally generates thousands of daily tasks — from maintenance and leasing to inspections and compliance.

In a traditional office, handling this volume would require a large team working across multiple disconnected systems.

But at Crossub, technology is the core operating system, and it goes far beyond email.

“Our AI isn’t just reading emails,” says Geng. “It’s the infrastructure behind every major function in the business.”

Incoming emails are routed through an AI engine that reads the message, references previous conversations, and pulls in related data from the property database to determine the appropriate workflow – whether leasing, maintenance, inspection, or another area.

From there, the system assigns tasks, drafts responses, or updates relevant records – all before a human ever needs to step in.

While the inbox may be the most visible entry point, the same AI engine powers every department, driving communication between systems that would otherwise remain siloed.

“One of the biggest challenges in property management outsourcing is communication breakdown – tasks falling through the cracks, delays, or inaccurate updates,” Geng explains.

“We built our system to eliminate that.”

Each department – maintenance, leasing, inspections – is connected through the same AI-driven workflow system.

That means when a tenant reports an issue, the AI not only logs the job and assigns it, but also updates the relevant inspection timeline, notifies the contractor, and prepares pre-filled reports for the agency; all without delay or duplication.

Importantly, the AI also keeps agents informed in real-time, but only with relevant updates.

“We don’t bombard agents with unnecessary notifications,” says Geng. “But when they want to check on something — a maintenance job, a leasing approval, a bond lodgement — the answer is available instantly, with full context.”

The result is a scalable, high-efficiency property management model, where decisions are faster, handover points are automated, and service quality remains consistent even as the portfolio grows.

“What we’ve built is not just automation,” Geng says.

“It’s an intelligent operating system designed to solve property management at scale.”

Inspectors like Uber drivers, trades on tap

Behind the digital layer sits a more traditional physical one.

Crossub still needs people to open front doors, walk through properties and check whether a leaking tap has been fixed.

Rather than hiring a large permanent team, the company treats inspections a little like a ride-share model.

All inspection work is carried out by people who hold the appropriate real estate qualifications, a requirement Crossub applies across its entire team.

That extends to the contractors who take on inspection jobs through the platform, ensuring that every property visited is handled by someone with the necessary licence and experience.

“Our inspectors are like Uber drivers,” Geng says.

“Any PM who holds a license working in an agency can register on our system.”

When Crossub has an open home, ingoing, outgoing or routine inspection to be done, it appears as an order in the app.

Registered inspectors can claim jobs and are paid per property, often around $150 per inspection.

The firm adopts a similar approach to maintenance. Before opening in a new market, Crossub spends time building a local contractor network – electricians, plumbers, cleaners, handymen and others – so that work can be handled quickly and close to the property.

Tenants interact through their own Crossub app.

From there, they can lodge maintenance requests, receive and respond to rent review notices, see upcoming routine inspections and adjust appointment times.

They can also view invoices and key property details.

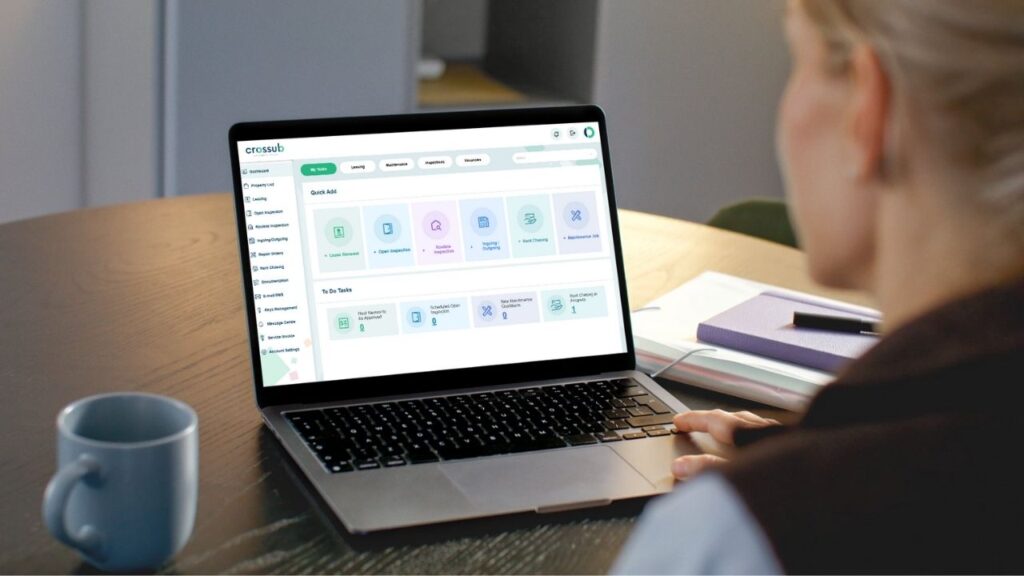

Agents and principals have their own interface, with a dashboard showing tasks in progress, overdue items, inspection counts, maintenance jobs approved or awaiting approval, and leasing activity.

A monthly report summarises what has been completed on the portfolio, although Geng says many clients prefer to check the live dashboard.

“We are not just an online platform,” he says.

“We found that online-only tools do not support agents enough. A lot of agencies use existing PM software, but they still suffer from labour costs and time spent. We support them with both systems and people.”

Crossub’s pricing is straightforward. Rather than charge a flat subscription, the company takes a share of the management fee.

“We charge 30 per cent of what the agent charges,” Geng says. “If the agent charges 5 per cent, we charge 30 per cent of that 5 per cent. If they charge 6 per cent, we charge 30 per cent of the 6 per cent.”

At face value, that split can give principals pause. If a firm is keeping only 70 per cent of its management fee, does the arrangement still stack up?

Geng’s argument is that the alternative is far more expensive.

Senior property managers are commanding salaries of $120,000 to $130,000 or more in many markets.

By contrast, an agency can pass almost all of the mechanical workload to Crossub, keep the landlord relationship, and retain the bulk of the fee.

Protecting the Agent–Landlord Relationship

Outsourcing the operational side of property management naturally raises a question: what happens to the relationship between the agent and the landlord?

At Crossub, that relationship is strictly off-limits.

“We have a clear and firm policy: our staff do not contact landlords directly under any circumstance,” Geng says.

“That’s a boundary we maintain out of respect for the agent’s role and their client relationships.”

Instead, Crossub operates fully in the background, often under a white-label structure, so landlords remain unaware of the outsourcing.

All landlord-facing communication continues to come from the agency.

“This approach allows agents to retain full ownership of their client relationships, while we provide the operational support behind the scenes,” Geng adds.

“We also invest in training our team to understand the importance of these boundaries, not just as a rule, but as a core part of how we protect our clients’ trust.”

From Solo Agents to Global Growth – Unlocking Scale Without Borders

Crossub’s client base spans the entire real estate landscape, from solo agents and boutique independents to large franchise groups and global brands.

But regardless of size, the common thread is growth: Crossub gives agencies the ability to scale their property management portfolios without being held back by staffing, geography, or infrastructure.

“The reason we’re called Crossub is short for ‘Cross Suburbs’,” explains Geng.

“Our vision is to empower agencies to grow beyond their local postcodes. You no longer need a physical team in every suburb or city to manage properties – we do that for you.”

For example, a Sydney-based sales agent can now sell a property in Melbourne to an investor, and still retain the management through Crossub.

In the past, that property would’ve been handed off to a local Melbourne agency.

Now, Crossub enables the original agent to stay in control, while we deliver the on-the-ground service, wherever the property is.

This model appeals to a wide range of agency types:

- New and small agencies often start with just a handful of managements linked to their sales pipeline.

“One sales team joined us in March with three properties. By November, they had 130. They can win the listings — we manage them.” - Mid-sized agencies use Crossub to avoid the cost of a full-time senior PM while still growing their rent roll.

“They keep 70% of the management fee and give us 30%. For them, it’s a scalable solution without needing to hire a $120K PM.” - Large franchise groups and corporates often engage Crossub as overflow or contingency.

“If a property manager resigns, we step in temporarily. Once they rehire, they take it back. We’re the safety net.”

Importantly, Crossub’s model is flexible and commitment-free.

Agencies can onboard with just one property, and there are no lock-in contracts or exit fees.

It’s designed for modern real estate businesses that need agility and national reach, without operational headaches.

For more information, visit crossub.com.au