New research has identified the best major regional locations for average annual house price growth over the past two decades.

The in-depth analysis by property market research firm and buyer’s agency Propertyology found that, contrary to popular opinion, many towns across the country produced median house price growth as robust as capital cities over the 20-year period.

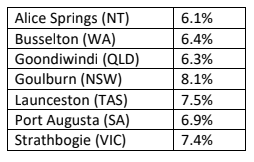

Alice Springs in the Northern Territory topped the list, followed by Busselton in Western Australia, and Goondiwindi in Queensland.

Propertyology Head of Research Simon Pressley said higher returns on investment had been produced in dozens of towns with populations below 50,000 than in a number of capital cities over the period.

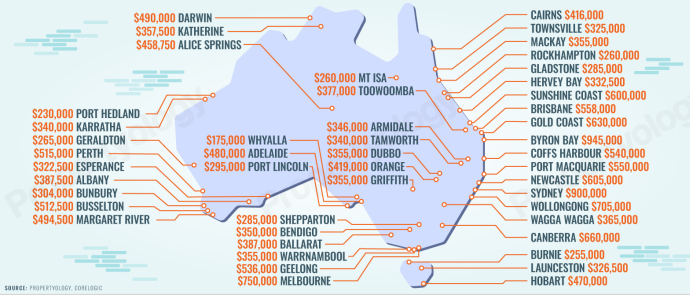

“A regional town with a population of only 23,000 has Australia’s third-highest median house price,” he said.

“Other towns with populations as small as 7,000 people have also proven to be far less volatile than Australia’s biggest cities over the past two decades.

“These facts are just a few examples to highlight the gross inaccuracies with people’s perceptions about Australian locations with smallish population sizes – the lifestyle, the real estate opportunities, the risks.”

Mr Pressley said one-third of Australia’s total population live outside of a capital city.

“Those eight million-plus people are close to double the population size of New Zealand or Ireland and it represents about two-thirds of the

population of each country in Scandinavia,” he explained.

The research found the top performers for average annual median house price growth over the past 20 years were:

The research also identified key characteristics of regions with populations above 10,000 as well as their property market performance compared to their respective capital cities over the past two decades.

Mr Pressley said every one of the regional areas analysed in the study produced strong average annual price growth over the period because of a number of economic and market fundamentals, including housing affordability.

“For example, just two hours north of Melbourne is the municipality of Strathbogie, with a population of 10,700 people,” he said.

“In addition to having a really cool name, Strathbogie’s 7.4 per cent average annual capital growth rate and its five per cent rental yield are both superior to Adelaide, Brisbane, Perth and Sydney.

“Likewise, the absolutely beautiful regional city of Armidale, in the New South Wales region of New England, officially boasts Australia’s highest ratio of residents employed within the education sector.

“The median house price in the picturesque university city is still a very affordable $340,000 yet it has tripled over the past 20 years.

In addition to that impressive capital growth, the 5.2 per cent median rental yield is outstanding.”

Strong and stable

Mr Pressley said a common misconception about regional locations was that they were somehow riskier than capital cities, however the study proves that not to be the case for many locations.

Regional towns with diverse economies have proven histories of property price growth, often superior to capital cities, he said.

“Let’s start with the median house price in townships such as Lismore (population 44,000), Esperance (population 14,300) and Dubbo (population 53,000), which have produced price growth in 17 out of the last 20 calendar years, whereas Perth (population 1.96 million) has produced six years of price declines.

“You tell me, does small actually mean more volatile?

“While big city investors struggle with eye-watering mortgages and massive holes in their annual cash flow, myriad smaller locations provide investors with cash in their pockets each year along with the capital growth.”

Mr Pressley said Propertyology’s studies of Australian real estate history show the most volatile property markets are often the expensive ones, or ones which lack economic diversity, and/or locations with a big

construction industry workforce that have a tendency to be overstimulated during the good years to create oversupply problems.

Over the past 20 years, the research found that the annual median house price declined in big cities like Sydney (five times) and Perth (six-times), however, smaller locations such as Warrnambool (VIC), Mount Gambier (SA), Warwick (QLD), Narrabri (NSW), Esperance (WA) and Alice Springs (NT) recorded fewer annual instances of price declines.

Locations with more affordable housing also reduced the property investment risk, Mr Pressley said.

“Locations with a significantly more affordable buy-in price mean that property investors require smaller deposits,” Mr Pressley said.

“This means that buyers are able to enter property markets sooner and can expand their portfolios more quickly.

“Logic also suggests that the starting price has a lower height to fall from. The second line of defence is the value and reliability of the income which the asset produces – this determines how much the owner needs to contribute of their own money each year.”

Mr Pressley said an increasing number of Australians are relocating away from big cities to regional locations, which is another positive for future property market performance.

“As proof that Propertyology is just as objective about regional towns as we are about capital cities, we have already invested in 15 individual Australian towns. Who else has done that?” he said.

“Investing is a financial decision with the best decisional structure beginning with an objective analysis of 100 per cent of the options.”

“With Australia’s eight capital cities included, there are 185 individual towns that have a population of 10,000 or more. Any investor who focuses on their hometown is giving themselves a one in 185 chance of making the best decision. Is that smart decision-making?”