The federal government’s Home Guarantee Scheme will undergo major changes from 1 October 2025, expanding opportunities for first home buyers to enter the market, according to new data from Cotality’s September Monthly Housing Chart Pack.

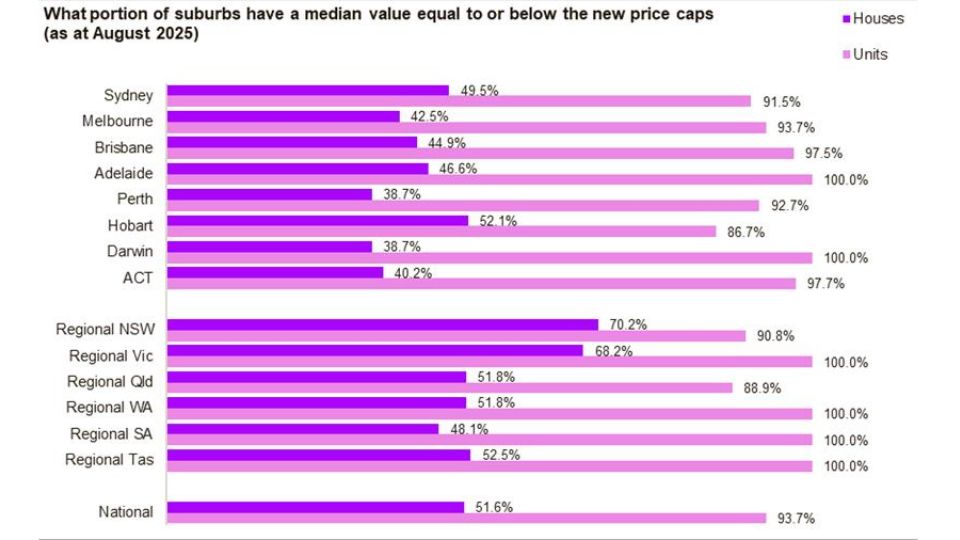

The scheme, which enables eligible buyers to purchase with a 5% deposit without paying lenders’ mortgage insurance, will remove income and place limits and lift property price caps across most regions. Under the revised settings, 63.1% of suburbs nationally now fall within the caps, up from just one-third previously. This includes 51.6% of house markets and 93.7% of unit markets.

Cotality Economist Kaytlin Ezzy said the changes reflect how rising property values had outpaced earlier thresholds.

“Since the caps were last revised in 2022, values across the mid-sized capitals have grown significantly, which has seen first home buyers reliant on the scheme to purchase a house essentially priced out. The new price caps are more in line with each region’s median values,” she said.

Examples of the increases include:

- Sydney, Illawarra, Newcastle and Lake Macquarie: caps lifted by $600,000 to $1.5 million.

- South East Queensland: cap increased by $300,000 to $1 million.

- Adelaide: cap increased by $300,000 to $900,000.

The adjustments mean options for buyers expand dramatically. In Adelaide, for instance, just 2.9% of suburbs previously qualified for the scheme; now 46.6% do.

In Brisbane, 97.5% of unit markets are under the new limit, compared with 36.9% before.

While the broader access may put upward pressure on prices, Ms Ezzy noted it levels the playing field for buyers without parental support.

“This will create a more equitable starting point and provide more options for those looking to get on the property ladder,” she said.

The report also flagged a lift in housing market momentum, with dwelling values up 1.8% in the three months to August, the strongest quarterly rise since mid-2024.

Annual growth rose to 4.1%, while national sales volumes climbed to 43,436 in August, above the five-year average. Listings also rose 9.4% during the month, setting the stage for a strong spring season.

Rental growth is also re-accelerating, with the 12-month change in capital city rents rising to 3.4% in August, up 70 basis points since June. Regional rents grew 5.8% annually, highlighting ongoing tightness in the rental market.