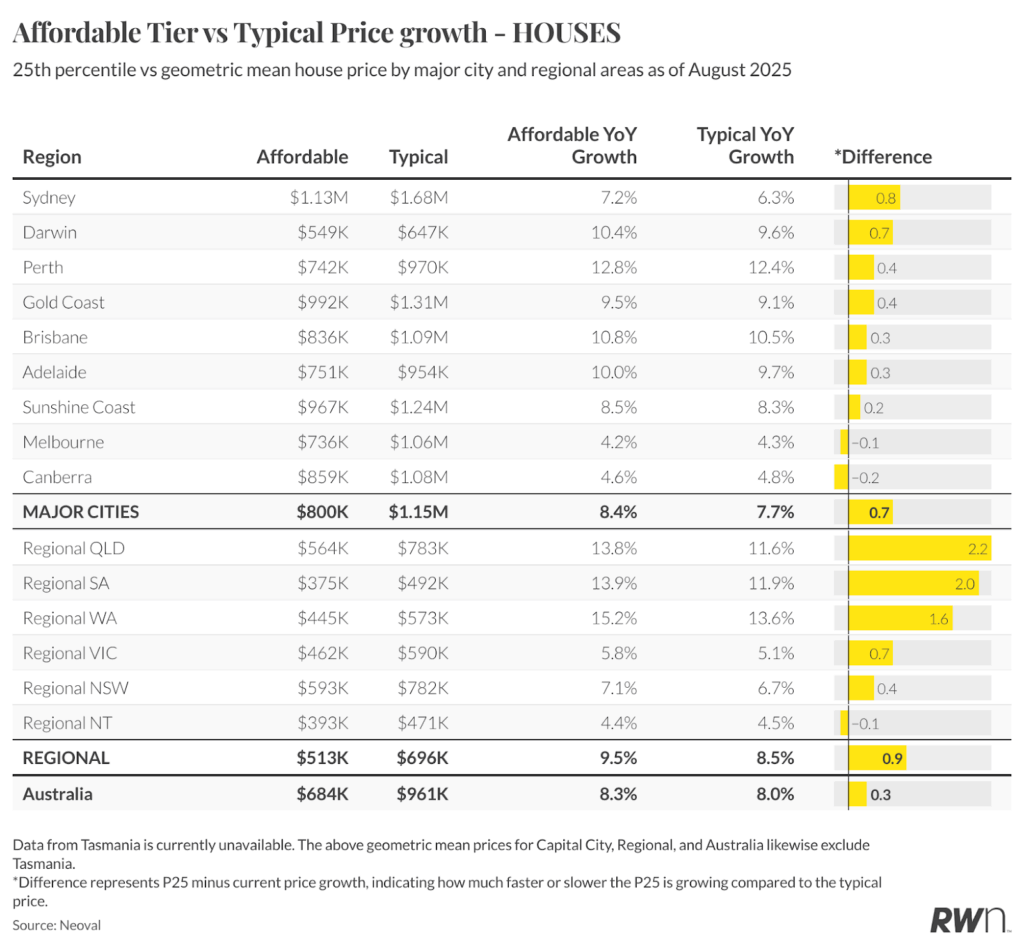

Ray White Group Chief Economist, Nerida Conisbee, said affordable houses nationally are growing at 8.3 per cent annually compared to 8 per cent for typical properties, while affordable units are surging at 7.1 per cent versus 6.3 per cent for the broader unit market.

“The story varies dramatically across cities, with some markets showing substantial affordable premiums whilst others display no discernible difference,” Ms Conisbee said.

“Sydney leads the affordable house outperformance with cheap properties at $1.13 million growing 7.2 per cent annually, nearly a full percentage point ahead of typical Sydney houses at 6.3 per cent.”

Ms Conisbee said this reflects the intense competition among cashed-up buyers seeking the most affordable entry point into Australia’s most expensive housing market.

The trend is even more pronounced in regional areas, according to the research.

“Regional Queensland affordable houses are surging 13.8 per cent annually compared to 11.6 per cent for typical properties – a remarkable 2.2 percentage point differential,” she said.

“Regional South Australia and Regional Western Australia show similar patterns with affordable houses growing 2.0 and 1.6 percentage points faster respectively than typical properties.”

The outperformance of affordable housing coincides with an unprecedented expansion of first home buyer support schemes, Ms Conisbee said.

“The federal government’s decision to bring forward and significantly expand the First Home Buyer Guarantee scheme to October 2025 – three months ahead of schedule – has removed key barriers for entry-level buyers,” she said.

The expanded scheme eliminates income caps entirely and dramatically raises property price thresholds to $1.5 million in Sydney (from $900,000), $950,000 in Melbourne (from $800,000), and $1 million in Brisbane (from $700,000).

“This allows first home buyers to purchase with just a 5 per cent deposit without paying lenders mortgage insurance, potentially saving tens of thousands of dollars in upfront costs,” Ms Conisbee said.

Treasury estimates suggest the uncapped scheme will issue an additional 20,000 guarantees in its first year, directly targeting the affordable segment where competition is most intense.

Not all markets are following the national pattern, Ms Conisbee said.

“Melbourne and Canberra stand out as exceptions to the affordable outperformance story,” she said.

“Melbourne affordable houses are growing at 4.2 per cent annually, actually lagging behind typical Melbourne properties at 4.3 per cent – the only major city where this occurs. Similarly, Canberra affordable houses trail typical properties by 0.2 percentage points.”

For units, both cities show identical growth rates between affordable and typical properties, with no discernible premium for cheaper stock.

“This divergence likely reflects superior supply responses in both markets, with Canberra’s apartment construction pipeline and Melbourne’s established development industry better positioned to respond to entry-level demand,” Ms Conisbee said.

The limited stock of affordable housing in most markets is intensifying competition among entry-level buyers, according to the research.

“With median house prices now approaching $1 million nationally, the pool of sub-$800,000 properties has shrunk dramatically, concentrating demand among remaining affordable options,” Ms Conisbee said.

Unit markets are showing even stronger affordable outperformance, with Perth leading at 16.5 per cent annual growth for affordable units compared to 14.5 per cent for typical apartments.

“Regional Queensland and Regional South Australia units both show 3.1 percentage point premiums for affordable stock, highlighting the acute shortage of entry-level apartments outside major cities,” she said.

Ms Conisbee said that the combination of government incentives, constrained supply, and demographic pressures from millennials entering peak home-buying years is creating a structural shift in how different price segments perform.

“This trend appears likely to persist while government support remains targeted at first home buyers and affordable housing supply constraints continue,” she said.