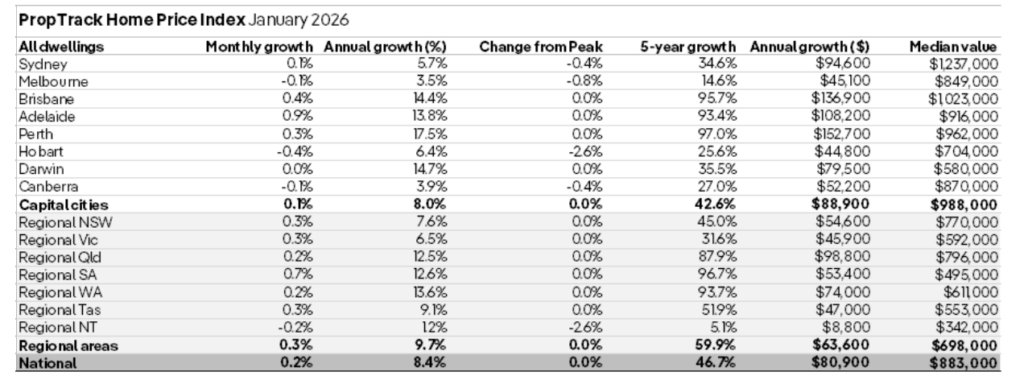

According to the latest PropTrack Home Price Index, national home prices increased by 0.2 per cent in January 2026, bringing the annual growth to 8.4 per cent.

However, the growth pattern shows significant variation between capital cities.

Sydney and Melbourne, Australia’s largest property markets, have experienced softening conditions in recent months.

While Sydney recorded a modest 0.1 per cent increase in January after a December decline, Melbourne posted its third consecutive month of falls, though prices remain only 0.8 per cent below their recent peak.

In contrast, smaller capitals continue to outperform their larger counterparts. Adelaide led the nation with a brisk 0.9 per cent increase in January, contributing to an impressive annual rise of 13.8 per cent.

Brisbane and Perth also maintained steady growth, recording increases of 0.4 per cent and 0.3 per cent respectively.

Regional areas outpaced the capitals in January, with prices rising 0.3 per cent compared to the combined capital cities’ 0.1 per cent increase.

Angus Moore, REA Group Senior Economist, attributed the divergent performance to supply factors.

“Ample choice for buyers in these cities throughout spring has likely contributed to the softer price growth,” he said regarding Sydney and Melbourne.

“In contrast, Brisbane, Perth and Adelaide have continued to see strong growth, outperforming the larger capitals amid very limited choice for buyers,” Mr Moore said.

Scott Kuru, co-founder and CEO of Freedom Property Investors, said the more affordable segments of the market are showing the strongest performance.

“We’ve noted annual growth of 15-17 per cent over the past year in affordable suburbs in Sydney’s west and Melbourne’s northern suburbs,” Mr Kuru said.

The market faces conflicting pressures heading into 2026.

While three rate cuts in 2025 supported price growth, inflation came in stronger than expected in the second half of the year, making a February rate hike increasingly likely.

Despite this potential headwind, structural factors continue to support the market.

“While the possibility of further hikes may weigh on the market, unemployment remains very low, which will support demand. At the same time, new housing supply remains limited, supporting home prices,” Mr Moore said.

First-home buyer activity is particularly strong in affordable areas, driven by government incentives.

“Affordable properties are being aggressively targeted by first-home buyers trying to take advantage of stamp duty holidays and incentives like the Federal government’s 5 per cent deposit guarantee and ‘Help-to-buy’ schemes,” Mr Kuru said.

Looking ahead, experts remain cautiously optimistic about the market’s trajectory.

“While conditions were softer in Sydney and Melbourne in recent months, home prices are still likely to head to new highs in 2026, but at a slower pace of growth than in 2025,” Mr Moore said.

“These monthly gains are small, but they could indicate the ‘slingshot effect’ is underway, setting up Australia’s big two property markets for a new home price boom,” Mr Kuru said.